Hmmm... the page you're looking for isn't here. Try searching above.

Hmmm... the page you're looking for isn't here. Try searching above.

Israel strikes Rafah after Hamas says it agreed to ceasefire deal

Miss USA: 'I have made the very tough decision to resign'

Elizabeth Holmes due for release from prison 2 years earlier than expected

'Keep your mouth shut': Heat president blasts star's comment

Return to the '70s? Today's housing market has echoes of dark era.

Stories for you

- StyleYahoo Celebrity

Met Gala 2024 live updates: See what stars are wearing on the red carpet

Zendaya, Jennifer Lopez and more stars are attending fashion's biggest night.

1 min read - PoliticsYahoo News

Trump trial live updates: Judge finds Trump violated gag order again and threatens jail time, while jury sees paper trail in hush money case

The former president’s criminal hush money trial resumes Monday in Manhattan, where the prosecution will continue presenting its case.

1 min read - USYahoo News

64 arrested at UC San Diego, Ole Miss launches investigation into racist video: All the updates you need to know about college campus protests

Columbia canceled its main commencement ceremony, the University of Mississippi launched a student conduct investigation and Princeton students announced a hunger strike.

4 min read - EntertainmentYahoo Music

Quiz: Kendrick Lamar and Drake latest diss tracks go to the next level. How much do you know about the two rappers' history?

The back-and-forth has kept fans of both Lamar and Drake on the edge of their seats.

1 min read - News

Apple iPad event 2024: Watch Apple unveil new iPads right here

We’re still well over a month out from WWDC, but Apple went ahead and snuck in another event. Tomorrow, May 7 at 7 a.m. PT/10 a.m. ET, the company is set to unveil the latest additions to the iPad line. According to the rumor mill, that list includes: a new iPad Pro, iPad Air, Apple Pencil and a keyboard case.

- TechnologyEngadget

How to watch Apple's iPad launch event on Tuesday

Apple is about to announce new iPad models at an event on May 7. The company is expected to tease an OLED iPad Pro and a new iPad Air, among other items.

2 min read - BusinessEngadget

What to expect at Google I/O 2024: Gemini, Android 15 and more

Google's I/O developer conference is right around the corner. Here's what we're expecting to see, including Android 15 details and a whole bunch of AI news.

4 min read - EntertainmentYahoo Celebrity

Dwayne Johnson is difficult to work with, report claims. The star has 'mountains of public goodwill' to offset negativity, expert says.

Once named the “Most Likable Person in the World,” the actor is under fire in a new report, accused of showing up to work late on the film “Red One,” irritating the crew and causing the budget to balloon.

6 min read - LifestyleYahoo Life Shopping

This is the best vitamin C serum of 2024 — it's potent, innovative and long lasting

We tried more than a dozen brands. Here's why Drunk Elephant's C-Firma serum is a better anti-aging vitamin C product than all the rest.

4 min read - StyleYahoo Life Shopping

The 12 best sandals for women in 2024

From comfy Clarks to iconic Birkenstocks to trendy Freedom Moses, these are the best sandals for women, according to experts.

5 min read - LifestyleYahoo Life Shopping

12 best knives and knife sets in 2024, tested by top chefs

Including the best steak knives, paring knives, bread knives and knife sets for prepping, dining and gifting.

5 min read - LifestyleYahoo Life Shopping

The 17 best wireless bras to shop for 2024, tested and reviewed by bra experts

From wire-free T-shirt bras to super-soft bralettes, our team of experts say these are the best wireless bras around.

6 min read - StyleYahoo Life Shopping

The best swimsuit brands for women over 50, according to style experts

Check out these confidence boosting swimsuits, packed with strategically placed ruching and underwire galore.

7 min read - LifestyleYahoo Life

The best grills for 2024, according to BBQ champions and grill masters

Weber, Char-Broil, Traeger and more: Get fired up with top-rated picks for every budget, space and cooking style.

4 min read - LifestyleYahoo Life Shopping

The best hyaluronic acid serums of 2024 will make you believe the anti-aging hype

Hyaluronic acid heroes like Glow Recipe, Caudalie, The Inkey List, Peach & Lily and Naturium will make your skin dewy and plump.

4 min read - HealthYahoo Life

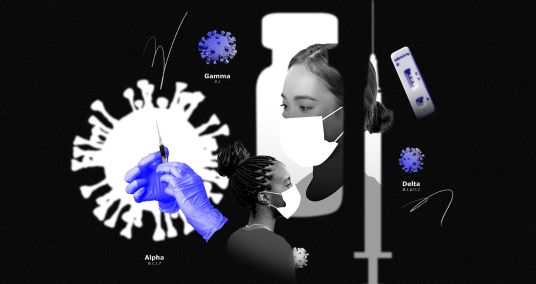

What to know about the new 'FLiRT' COVID variants that are spreading: Your guide to the latest virus news

Here’s your go-to guide with everything you need to know about COVID-19, including the latest "FLiRT"variants and concerns that they made evade immunity.

11 min read - EntertainmentYahoo Entertainment

How to watch the 2024 Eurovision Song Contest in the US

It's almost time for the Eurovision Song Contest! Here's everything you need to know about the international music competition.

4 min read - LifestyleYahoo Life Shopping

The 50+ best Amazon deals this weekend: Save up to 80% on Mother's Day gifts, gardening tools, tech and more

Among our faves? A sleek Electrolux stick vac that's over 50% off and a best-in-class KitchenAid stand mixer for $240, to name a few.

1 min read - HealthYahoo Life Shopping

The 10 best online therapy services for 2024

May is Mental Health Awareness Month - Talk through your troubles without leaving the house with one of these trusted online therapy services including Thriveworks, Brightside and Circles.

10 min read - BusinessEngadget

Sony quickly backs down on Helldivers 2 PSN requirement for PC players

After creating a massive kerfuffle by forcing Helldivers 2 PC players to link their accounts to the PlayStation Network, Sony is backing down.

2 min read - HealthYahoo Canada Style

Paulina Porizkova, 59, says hip replacement surgery was 'an unexpected bonus' to her 'sex life'

The supermodel says those who need a hip replacement 'won't regret it,' after her personal journey.

7 min read - SportsYahoo Sports

NBA playoffs: Officials admit they flubbed critical kick-ball call in controversial final minute of Pacers-Knicks

Tuesday's last-2-minute report should be interesting.

4 min read - SportsYahoo Sports

Blockbuster May trade by Padres, MVP Ohtani has arrived, Willie Mays’ 93rd birthday & weekend recap

Jake Mintz & Jordan Shusterman discuss the Padres-Marlins trade that sent Luis Arraez to San Diego, as well as recap all the action from this weekend in baseball and send birthday wishes to hall-of-famer Willie Mays.

2 min read - SportsYahoo Sports

Phil Mickelson on the majors: 'What if none of the LIV players played?'

Phil Mickelson hints that big changes could be coming to LIV Golf's rosters, and the majors will need to pay attention.

4 min read - SportsYahoo Sports

Timberwolves' Rudy Gobert questionable for Game 2 vs. Nuggets due to 'personal reasons'

Rudy Gobert may not play due to the birth of his first child.

2 min read - PoliticsYahoo Finance

Social Security just passed Medicare as the government's most pressing insolvency risk

An annual government report offered a glimmer of good news for Social Security and a jolt of good news for Medicare even as both programs continue to be on pace to run dry next decade.

5 min read - CelebrityYahoo Canada Style

Ashley Sonnenberg, fiancée of Edmonton Oilers' goalie Jack Campbell, prepares for wedding with Los Angeles bachelorette bash

The goalie and his Vancouver-born fiancée have been engaged since 2022.

2 min read - SportsYahoo Sports

Sky rookie, No. 3 WNBA pick Kamilla Cardoso out at least 4-6 weeks with shoulder injury

Cardoso led South Carolina to a national championship, then became the third pick in last month's WNBA Draft by Chicago.

2 min read - SportsYahoo Sports

Victor Wembanyama wins NBA Rookie of the Year via unanimous vote after delivering on unprecedented hype

Victor Wembanyama did everything for the Spurs as a rookie.

6 min read - SportsYahoo Sports

The Scorecard: Andy Pages looks set to go down as one of the fantasy baseball waiver wire pickups of the year

Fantasy baseball analyst Dalton Del Don delivers his latest batch of hot takes as we enter Week 6 of the season.

6 min read - SportsYahoo Sports

Victor Wembanyama is on the path to GOAT. So, why don’t we talk about it that way?

Looking back at Wembanyama's rookie season, the numbers suggest the Spurs sensation is on track to be the greatest ever.

11 min read - SportsYahoo Sports

LIV's Talor Gooch announces an invitation to play in PGA Championship

Despite not qualifying through traditional channels, LIV's Talor Gooch apparently will be playing in Valhalla.

2 min read - SportsYahoo Sports

2024 NBA offseason previews: Teams' needs, free agents, draft picks, cap space and more

The 2023-024 NBA season isn't yet over. A number of teams are still dreaming of championship glory. But for those that have been bounced from the playoffs, it's time to reassess and re-evaluate for next season.

2 min read - SportsYahoo Sports

Former Jaguars RB Fred Taylor got his Florida degree 26 years after leaving for NFL

Fred Taylor made a promise to his grandmother.

2 min read - StyleYahoo Canada Style

Vote now: Who was the best and worst dressed at the 2024 Met Gala?

Some A-list guests bloomed while others withered when it came to "The Garden of Time" dress code.

6 min read - SportsYahoo Sports

Mavericks extend head coach Jason Kidd after defeating Clippers in Round 1

Jason Kidd will remain the head coach in Dallas.

2 min read - PoliticsYahoo Finance

New EV tax credit rules mean cars with Chinese materials won't qualify — but there's a catch

New rules from the Treasury Department will make it harder for vehicles to qualify for the federal EV tax credit, though the automakers were also granted a reprieve.

4 min read - SportsYahoo Sports

Monday Leaderboard: Brooks Koepka is ready to slow the Scottie Scheffler train

A dominant LIV win and a heartbreaking PGA Tour loss headline this week's top golf stories

6 min read - SportsYahoo Sports

Celtics-Cavaliers preview: Why Boston is still an overwhelming favorite even without Kristaps Porziņģis

We break down the second-round series between the Boston Celtics and Cleveland Cavaliers and make our prediction.

8 min read - SportsYahoo Sports

Who will the Chiefs face in the NFL season opener? Let's look at the candidates

The Chiefs have some good home opponents this season.

3 min read - SportsYahoo Sports

Texans: Tank Dell 'will make a full recovery' after being shot, but his status for Week 1 isn't clear

Details of Dell's injury remain unclear, and his status for the start of the 2024 season is uncertain.

3 min read - SportsYahoo Sports

Colorado's social media squabble, athlete compensation models and fried chicken battery

On today's pod Dan Wetzel, Ross Dellenger, and SI's Pat Forde recount Colorado's latest social media drama, potential athlete compensation models, and a man who was arrested for throwing fried chicken at his sister.

1 min read - SportsYahoo Sports

Bengals QB Joe Burrow is throwing again, drawing rave reviews from his teammates, coach

If Burrow is indeed back to form, there's reason for hope in Cincinnati of a return to Super Bowl contention.

2 min read - StyleTechCrunch

This year's Met Gala theme is AI deepfakes

Whether you love or hate celebrity culture, the Met Gala is an event. In the photo, Katy Perry appears to be wearing a massive gown decorated with three-dimensional floral appliques. As the pearlescent gown drapes down to the ground, its long train fades into realistic-looking moss, which cascades across the beige and red Met Gala carpet.

4 min read - SportsYahoo Sports

NBA playoffs: Jalen Brunson scores 43 points, Knicks outlast Pacers for 121–117 win in Game 1

Jalen Brunson scored 43 points, leading the New York Knicks to a 121–117 win over the Indiana Pacers in Game 1 of their second-round NBA playoff series.

3 min read - WorldYahoo Sports

Ukrainian former Olympic weightlifter Oleksandr Pielieshenko killed defending his country

Oleksandr Pielieshenko joined his country's military soon after Russia's invasion, the National Olympic Committee of Ukraine said Monday.

1 min read - SportsYahoo Sports

The Spin: Hitter performances to buy low and sell high on

Some key hitting performances need a trip under the magnifying glass. Fantasy baseball analyst Scott Pianowski does just that and advises managers on what to do next.

6 min read - BusinessTechCrunch

Boeing Starliner's first crewed mission scrubbed

Boeing's Starliner launch tonight has been postponed "out of an abundance of caution" scarcely two hours before the historic liftoff. After years of delays and over $1 billion in cost overruns, the mission is set to be Boeing's first attempt to transport astronauts to the International Space Station. Once the issue is resolved with the upper stage, the United Launch Alliance Atlas V will carry the CST-100 Starliner capsule to orbit along with the two onboard astronauts — Butch Wilmore and Sunn

3 min read - SportsHawgBeat

Roster construction may hinge on NBA Draft for Calipari, Arkansas

Arkansas head coach John Calipari will utilize returning college talent from the NBA Draft to help build his roster.

3 min read - SportsHawgBeat

John Tyson explains role in Arkansas hiring John Calipari

John Tyson, the CEO of Tyson Foods and billionaire from Northwest Arkansas, has become somewhat of a local celebrity around Fayetteville in recent weeks. After word got out he was somewhat of a middleman between Arkansas Athletics Director Hunter Yurachek and new Razorback basketball coach John Calipari, Tyson became a hometown hero, getting a standing ovation at Calipari's introductory press conference inside Bud Walton Arena on April 10.

4 min read - CelebrityUs Weekly

Bridget Moynahan Posts About Loyalty After Tom Brady Roast: ‘Never Would’ve Did That S–t to You’

The day after her relationship with Tom Brady was a focal point of his Netflix roast, Bridget Moynahan made her sly rebuttal. Moynahan, 53, took to Instagram on Monday, May 6, to share a very appropriate quote given the circumstances. The quote read: “Loyal people take s–t more personal because they never would’ve did that

2 min read - CelebrityIn Touch Weekly

Gisele Bundchen Is ‘Livid’ With Tom Brady After Roast: ‘The Jokes Hit Below the Belt’

One person who isn't laughing at Tom Brady's Netflix roast on Sunday, May 5, is his ex-wife, Gisele Bündchen, who is not happy with jokes es about her -- especially ones that hinted at her possible infidelity. ”Gisele isn't just furious with the people who roasted Tom and made fun of her, she’s livid with...

2 min read - CelebrityPeople

Jessica Biel Bathed in 20 Lbs. of Epsom Salt to Slip into 2024 Met Gala Dress, Attends Without Justin Timberlake

The actress' husband Justin Timberlake missed out on the star-studded event because he's on a world tour

2 min read - CelebrityPeople

Kendall Jenner Rocks Never-Worn Archival Dress with a Butt Cutout (and Ultra-Long Hair!) at the 2024 Met Gala

"It’s literally a ‘sleeping beauty,'" Jenner said of the Alexander McQueen design, which has only been shown on a mannequin previously

4 min read - CelebrityPeople

Jelly Roll's Daughter Bailee Gets Her First Car at 16 — and Her Choice Is Surprising: 'What Her Heart Desires'

The country star is dad to daughter Bailee and son Noah Buddy, 7

3 min read - StylePeople

Pamela Anderson Breaks Her Makeup-Free Streak for 2024 Met Gala Debut — and Icon Pat McGrath Did Her Glam!

The '90s icon, author and activist made her mark on the 2024 Met Gala red carpet. All about her look and Pandora jewels

3 min read - StyleTheBlast

Doja Cat Arrives To The 2024 Met Gala Wearing Nothing But A Towel: 'Epic Fail'

A-List celebrities have arrived at the 2024 Met Gala, but Doja Cat is someone who is standing out thanks to her wardrobe choice.

4 min read - USFox News

Trump's legal team returns to court after Bragg's own witness implodes case and more top headlines

Get all the stories you need-to-know from the most powerful name in news delivered first thing every morning to your inbox.

2 min read - USPeople

Authorities Reveal How Missing Surfers from U.S. and Australia Found at Bottom of Well in Mexico Died

Brothers Jake Robinson, 30, Callum Robinson, 33, and Jack Carter Rhoad, 30, were last seen on April 27 before being discovered dead

3 min read - CelebrityFox News

Tom Selleck risks losing California ranch with cancelation of 'Blue Bloods'

Tom Selleck's run on "Blue Bloods" is coming to an end, and with the cancelation of the popular series, the actor admits he may lose his ranch.

3 min read - CelebrityThe Hill

Patriots owner tells Putin: ‘Give me my f‑‑‑ing ring back’

New England Patriots owner Robert Kraft called out Russian President Vladimir Putin on Sunday, telling the leader to give him his “f‑‑‑ing ring back,” in reference to a long-running allegation that Putin stole one of his Super Bowl rings during a 2005 meeting. The remark came during Sunday night’s “roast” of former Patriots quarterback Tom…

3 min read - CelebrityPeople

Bridget Moynahan Shares Quote About 'Loyal People' After Tom Brady Was Roasted for Leaving Her While Pregnant

Though many of jokes were made in jest, some of Brady's most scathing roasts came at the expense of his prior relationship with Moynahan

2 min read - CelebritySnopes

Fact Check: The Truth About Rumor ABC Booted Steve Harvey Off 'Family Feud' After On-Air Slip-Up

"'Stunned and blindsided by the show I called home for the last 14 years,' Harvey tweeted, after being booted from hosting," an article claimed.

3 min read - CelebrityThe Wrap

Nikki Glaser Says She Was ‘Surprised’ by Tom Brady-Jeff Ross Roast Standoff: ‘I Believe That Was for Real’ | Video

The comedian also shares a number of jokes that didn't make it into the Netflix special on Sunday The post Nikki Glaser Says She Was ‘Surprised’ by Tom Brady-Jeff Ross Roast Standoff: ‘I Believe That Was for Real’ | Video appeared first on TheWrap.

3 min read - USWFXT

‘Decided to close that chapter’: Popular Boston radio station shakes up morning drive show

Boston’s home for classic rock announced changes to its popular morning drive show on Monday.

1 min read - USCNN

Husband of American woman reported missing in Spain arrested in Florida, FBI says

The husband of an American woman reporting missing in Spain has been arrested, the FBI announced.

3 min read - CelebritySheKnows

Kim Kardashian's Less Than Warm Welcome at Tom Brady Roast Hints That Her Influence Is Declining

Kim Kardashian did not have the best night at Netflix’s live event, The Greatest Roast of All Time: Tom Brady. After being introduced by roast master Kevin Hart, she was greeted by an overwhelming round of boos coming from the audience. Even after she tried to start her monologue, the negative reaction only got louder. It’s a shocking turn of events for the …

3 min read - CelebrityParade

Fans Revolt After Martha Stewart Posts Picture With Controversial Celebrity

Many called out Stewart for her questionable companionship.

2 min read - PoliticsAssociated Press

House Republicans are ready to hold Attorney General Merrick Garland in contempt over Biden audio

House Republicans plan to move forward next week with holding Attorney General Merrick Garland in contempt of Congress for his refusal to turn over the unredacted audio of an interview that was conducted as part of the special counsel probe into President Joe Biden’s handling of classified documents. The House Judiciary Committee is set to convene on May 16 to advance contempt charges against the Cabinet official, according to a person familiar with the matter who was granted anonymity to discu

3 min read - StylePeople

Tyla Gets Lifted Up the 2024 Met Gala Steps in Her Form-Fitting Sand Dress

The singer wore Balmain for her Met Gala debut

2 min read - USNBC News

Tom Brady caught on camera warning comic about Robert Kraft massage joke at Netflix roast

Brady lashed out at funnyman Jeff Ross during Sunday's "The Roast of Tom Brady" on Netflix over a massage joke about New England Patriots owner Robert Kraft.

2 min read - CelebrityGood Morning America

Tom Brady's roast rebuttal on deflategate brought down the house

Celebrities filled the Kia Forum in Los Angeles on Sunday for the "Greatest Roast of All Time: The Roast of Tom Brady," a made-for-streaming live comedy event where the seven-time Super Bowl champion quarterback took on three hours of full-contact comedy, absorbing blows from former teammates and comics on everything from Deflategate to divorce. Eight of Brady's former New England Patriots teammates joined him onstage -- Drew Bledsoe, Randy Moss, Rob Gronkowski, Julian Edelman, Rodney Harrison,

3 min read - USKLAS articles

Report details what led to Las Vegas substitute teacher punching student

A substitute teacher punched and slapped a Las Vegas valley high school student causing him to become unconscious after the student used a racial slur against the teacher, according to the arrest report. While the physical fight was caught on video, what led up to it was not. Those details were in the arrest report for Re'Kwon Smith, 27.

2 min read - PoliticsLA Times

Donald Trump puts America on notice again: If he loses, he won't go quietly

Trump was asked whether the election would end in political violence if he lost. "It depends," the former president said. Here's what he meant by that.

4 min read - SportsNBC Sports Boston

Tom Brady Roast: Winners and losers from cathartic night for Patriots

Bill Belichick was a surprise hit at "The Roast of Tom Brady" Netflix special, while a former Patriots player had more of a rough night.

6 min read - CelebrityPeople

Caitlin Clark Endures Another Awkward Moment with Reporter Asking About Her Boyfriend Before WNBA Debut

The Indiana Fever star was asked if her "bae" would be in attendance before making her preseason debut in Dallas

4 min read - CelebrityMiami Herald

Aaron Hernandez’s fiancée speaks out after jokes during Tom Brady roast. ‘It’s sad’

“Should have been off limits.”

2 min read - SportsUSA TODAY Sports

Sierra Leone jockey Tyler Gaffalione could face discipline for Kentucky Derby ride

Sierra Leone and Forever Young made contact several times in the final furlong Saturday as they tried to catch Kentucky Derby winner Mystik Dan.

2 min read - WorldBusiness Insider

Watch an exploding Ukrainian drone boat dodge fire from the air to kill one of the small, high-speed Russian ships still fighting in the Black Sea

Ukraine's military intelligence agency said its forces used Magura V5 naval drones to destroy a Russian military speedboat in Crimea.

3 min read