Schools, roads, projects cost a lot. County officials disagree over how to pay for them

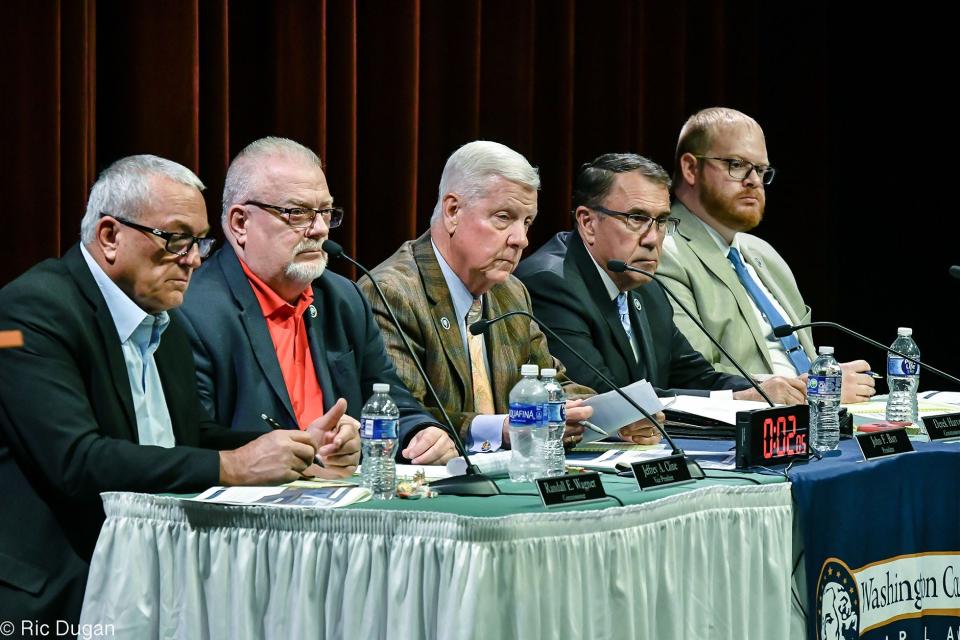

A recent progress report on the county's new budget draft led to a spirited discussion among the Washington County Commissioners over tax rates and finances.

Bottom line, don't look for a change in your local income tax rate this year.

Here's the background: Each year, the state of Maryland distributes "disparity grants" to jurisdictions whose per-capita tax revenues are less than 75% of the statewide average. And every year, Washington County seems to qualify.

But calculations for these grants are based on how much the county assesses for income taxes. Counties that charge the full allowable 3.2% income tax get more; those who don't get less.

Washington County charged the full 3.2% for Fiscal Year 2021, and, according to county records for that year, received a $7.8 million disparity grant in addition to local income tax revenues.

The following year, the previous board of county commissioners cut the income tax rate to 3%, and the grant was $6.7 million, although the county actually received a little more.

It was cut again for Fiscal Year 2022, to the current 2.95%. The disparity grant dropped to $3.8 million. This year, the state anticipates it will be less than $3 million.

There have been two schools of thought among the current set of commissioners. Two hold that the rate should never have been cut — that charging the full amount actually had little monetary impact on those with lower incomes, and longterm county obligations for education, infrastructure and other capital projects mean the county needs to prepare its finances now.

Two are just as adamant that the rate should not be raised again, because the cumulative effect of anticipated hikes in state taxes, local utility rates and reassessments of real property values are enough for households and businesses to absorb.

They also argue that since the Maryland state government is having budget challenges of its own, disparity grants could be cut … and could even go away altogether.

And one appears to be trying to see both sides, but leaning against raising the rate for now.

Boonsboro apartment fire: One occupant transported to hospital from Boonsboro apartment house fire

Belt-tightening or delaying costs? Or both?

CFO Kelcee Mace recently presented an updated draft of the county's $300 million budget to the commissioners, noting that more than $14 million in General Fund requests from various county departments and agencies had already been cut.

Commissioner Derek Harvey noted that some of the cuts might not have been so severe if funding streams — for example, taxes and fees — had been adjusted incrementally.

Earlier in that meeting, for example, the commissioners agreed to raise the 911 fee on your phone bill from 75 cents to $1.25. It was the first time it had been raised in 20 years.

Mace told the commissioners that in Fiscal Year 2023, costs for the 911 system totaled $5.7 million, while income from the fee totaled only $1.4 million, leaving a shortfall of $4.3 million that the county had to pay for through other sources.

"As we saw earlier today, there's been opportunities maybe for revenue," Harvey said. "If we had that $4.7 million operating deficit from the 911, that would be 4.7 million more dollars if we'd stayed on top of that one. You know, if we could just correct it in once or over three years, you could potentially gather another $4 or $5 million."

He and County Administrator Michelle Gordon noted a number of new capital projects are on the horizon, and Gordon repeated warnings she's made before that the capital budget is underfunded, as is the county's pension fund. And, Harvey said, the county is expanding its authority over emergency services.

And that's when he revisited the matter of local income taxes.

Harvey had suggested last year that the county consider raising the rate back to 3.2%, but found little support among the other commissioners. He has found little more this year.

He understood, he said, that "it's a tough time to raise a tax" on families. He also understood, he said, an argument Commissioner Wayne Keefer has made that raising taxes would induce people to move elsewhere. But he raised the potential of a tiered income tax rate, that would allow lower rates for lower-income residents.

Gordon made the case that underfunding infrastructure projects would hurt the county's ability to attract new business and residents, or to keep them when they do come. "You have to find that balance," she said.

"We're attracting a lot of business," commissioners Vice President Jeff Cline replied. "And right now we got more than we can handle with $1.5 billion in investments. So there counters your argument on that."

Then he turned to Harvey.

"And I'd like for you to explain what the tier tax rate is," he said. "You mean tax more people who make more money — and is that fair?"

Harvey explained that cutting taxes reduces revenue to pay for road maintenance, parks and schools — which he said affects more people with median or lower incomes than people who can afford other options. The question, he said, is whether households earning more than $100,000 can afford to pay a little more.

"At the end of the day … do you increase revenue so you can fund some of the things that are needed? We're not even funding the school budget at an inflation level. And I understand that clearly," he said. "And we're not able to position ourselves for some of the more capital projects and we're underfunded on some other things substantially, whether it's the pension plan or others. …Two years ago, it wasn't hurting the economy at 3.2%."

"When you have a progressive tax structure, the people you tax the most are job creators," Keefer replied. "I don't think our infrastructure is that bad. I don't think our schools are that bad. I think we have good schools. Everything could be improved, I'm sure, but you know some of the smartest people in our community chose to come here. Because of everything that we're talking about needs to be better. I think we live in a great community … we need to keep spending under control."

And while Cline and Keefer are frequently of different minds, this issue was an exception.

"I'm in agreement with you," Cline said. "What do you think of that?"

Student of the Week winner: Herald-Mail Student of the Week: See this week's winner

Where's the revenue-raising balance?

Keefer took aim at the disparity grant program. "That's your economic way to make your community better — raise taxes on a poorer community," he said. "My economics schooling, that doesn't make sense."

"But we're not raising taxes on a poorer community," Harvey replied. "Because even if you don't have it tiered, their taxes below the median level of income hardly goes up at all."

"That's right; you just want to tax the business owners," Keefer said.

"No, I'm just saying even if you don't have a tier, the reality is it doesn't hit at the lower levels," Harvey said. "But not having services hits at the lower levels — not having enough money for some of the programs does disproportionately hurt people at the lower levels."

Although commissioners' President John Barr had stated his position the week before, Harvey asked Barr to weigh in again.

"I've made it very clear I didn't agree when they cut it several years ago," he said. "And you know, it's hard for me to continually to go to Annapolis and ask for assistance and funding when we aren't fully helping ourselves. And that's that's just the bottom line.

"I think anyone making under the medium household … probably doesn't, the tax rate, whether it's 2.95 or 3.2, doesn't affect them because I think at the end of the year, when they file their taxes, it's immaterial.

"And we sit here and we look at inflation, we look at the needs of the school, and I fully understand their challenges. I feel for them. We talk about a new courthouse, we talk about a new detention center that's busting at the seams. Frankly, I feel like we need to help ourselves and raise the rate."

"I think we're getting way too deep in the weeds right here for this discussion," Commissioner Randy Wagner interjected.

New Washington County attorney: Zachary Kieffer replaces Circuit Judge Kirk Downey as Washington County's attorney

Let's just get it all out there

But Cline wasn't quite finished. He told Barr he didn't buy the claim about asking for help from the state; that was politics, he said. And when the commissioners raised the county's income tax rate, "it was a different time," he said. "The economy was better and now we're not. We're gonna raise water rates, we're gonna raise phone rates, where's it stop on the average person?"

"I wanted to hear that," Harvey said.

And the discussion continued a while longer along those lines. "I don't think we have a consensus to move forward with any tax rate adjustment," Gordon concluded.

"I'm not asking for that," Harvey said. "I wanted the discussion. I wanted the people to hear the different perspectives."

Wagner said he still stands by having raised the tax before, because it helped pay for first responders. "I'll stand by that 'til the day I die," he said. And now, he added, he's "sympathetic" to the infrastructure and school needs.

"But bottom line is … me personally? I'm seeing this now where everybody needs to tighten our belt a little bit. We didn't do $14 million worth of stuff. Schools might not get everything they want. We might not get everything we want. … I think it's just bad timing. I don't know when good timing is but I think it's bad timing."

Harvey said he agreed with Wagner, but was glad for the discussion.

"We have to look at all of the options here," he said. "People have to understand what the options are. If you don't have a discussion about it, you're not going to be able to educate anybody.. And when we don't fund the schools … people need to understand what the thinking is up here.

"We need this sort of dialogue, in my view, to be more public," he said.

"I think we just dialogued," Wagner said. "Movin' on."

This article originally appeared on The Herald-Mail: Budget update leads to squabble among commissioners over county taxes