AVIXA Report: February Pro AV Growth Disappoints

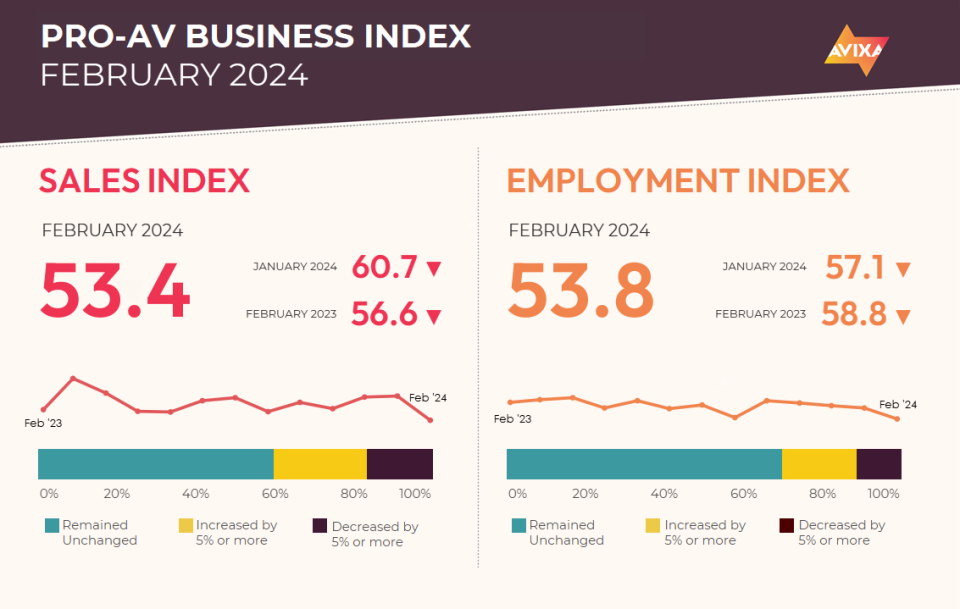

After a positive start to 2024, the February Pro AV Business Sales Index (AVI-S) delivered disappointing news. Growth continued, but the level—53.4—represents the slowest rate since January 2021 and 7.3 points lower than the January mark.

The underlying data for the AVI-S reflects three categories of responses about month-to-month revenue change: increase, no change, and decrease. What stands out about this slow growth result is that it reflects an exceptionally high level of respondents reporting no change, at 59.7%. By comparison, in January 2021 when the AVI-S was 52.0, the percentage of respondent reporting no change was just 48.5%. In fact, the 59.7% no-change figure is the second-highest ever no-change level in the seven-year history of the index.

[AVIXA Report: Solid Close to Solid (but Complex) Year]

So, the current low growth figure represents stability more than negativity. Unsurprisingly, comments from survey respondents were a mixed bag: some disappointment over slow growth, some happy with good growth, and a lot saying not much changed. Two areas of consensus were improving supply and that hiring is not easy (though relatively few companies are seeking new workers).

Entering 2023, there were strong fears of a widespread recession, especially in Europe. Thankfully, those fears were largely avoided. GDP even grew strongly in the United States. But unfortunately, recession does appear to have hit some economies.

The Bundesbank announced in February that Germany was likely in recession, and Britain recorded back-to-back quarters of GDP contraction to close out 2023. Initial numbers suggested Japan had also recorded back-to-back GDP contractions in 2023, though subsequent revisions contradicted the early reports. The news isn’t excessively negative: There is no global recession, and Britain already appears to be growing comfortably again. But this economic weakness can’t be ignored when we assess the state of AV and wonder why the AVI-S showed such slow growth in February.

Because the AVI-S and the AVI-E (the AV Employment Index) rarely diverge too far, it’s unsurprising to see the AVI-E also come in low. The February mark of 53.8 is not quite as much of an outlier as the AVI-S (it’s only 3.3 points lower than the January mark, less than half the drop of the AVI-E), but it’s still the lowest figure since early 2021.

Weakness in Pro AV job gains is a contrast to the wider economy, where labor markets continue to be a bright spot. The latest U.S. Bureau of Labor Statistics report showed an increase of 275,000 jobs in February, a mark that is ahead of both pre-pandemic norms and many other months in the past year. Wages also increased 4.3% year-on-year, faster than inflation. It will be interesting to watch how recession pressures in Britain and Germany percolate out through the rest of the world and through the labor market.

The Pro AV Business Index report is derived from a monthly survey of the AVIXA Insights Community, a research community of industry members that tracks business trends in commercial AV. For more information about joining the AVIXA Insights Community, visit www.avixa.org/AVIP.