Global Micromobility Market Expected to Hit $360 Billion by 2030, Driven Mostly by E-Bikes Sales

Booming Industry

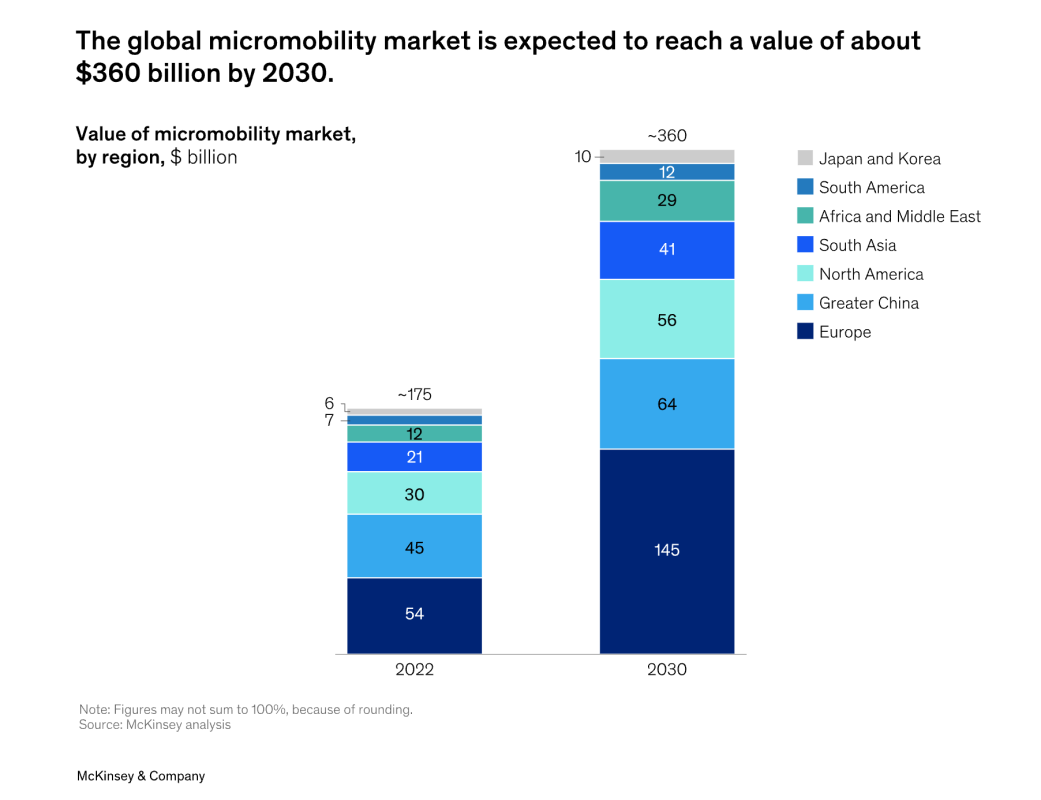

Micromobility options like e-scooters, bikes, and mopeds are gaining significant traction and are poised to reshape urban transportation. According to a recent McKinsey ACES Consumer Survey, nearly one-third of participants intend to increase their use of micromobility, and almost half plan to replace their private vehicles with alternative modes of transport. McKinsey projects the global micromobility market will surge to around $360 billion by 2030, up from $175 billion in 2022, largely driven by e-bike sales. Europe is expected to account for the largest share of this market growth.

This comes as no surprise, considering the massive growth over the past few years, especially during the Covid-19 pandemic. And despite the current economic pressure on buyers and lower sales numbers in 2023, sales have continued to grow overall, especially compared to analogue bike sales.

As technology and infrastructure continue to improve and more money is invested in creating a safer and more structured environment for the electric bike movement to thrive, the number of people who choose to use an alternative mode of transport will most likely also increase. More and more people are leaving their car at home or downsizing their family to one vehicle, opting instead to travel via electric bike, thereby reducing the number of car trips annually.

McKinsey & Company

Cause For Concern?

Innovation in mobility is a complex process that takes time and significant investment. Transforming the automotive industry to support electric vehicles and building software for autonomous driving involves extensive testing and reworking (ask Elon and Tesla how that is going).

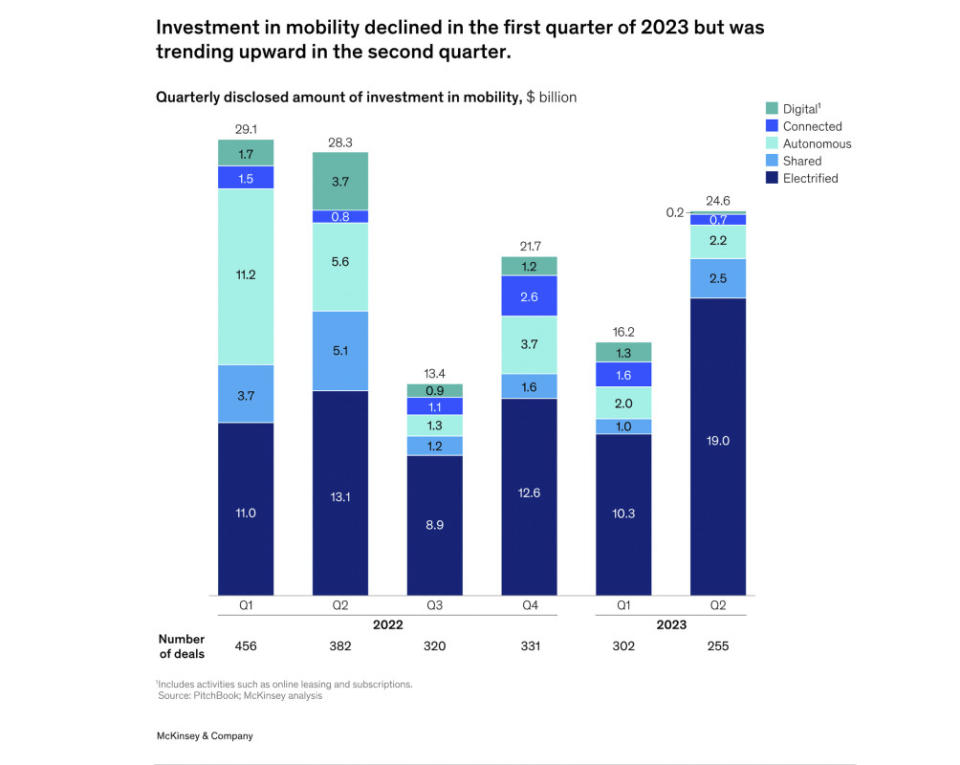

In early 2023, external investors reduced funding by 44% in the first quarter compared to the previous year and by 13% in the second quarter. However, by late 2023, mobility investment showed improvement and is expected to continue in 2024. Companies specializing in electrification, particularly batteries and autonomous vehicles, are attracting the most investment.

Related: Sparking Change: Are Sodium-Ion Batteries Going To Replace Lithium-Ion In The Future?

Is a drop in funding a big problem for the EV and micromobility markets? All markets ebb and flow, with money flowing in and out as sentiment changes, new trends emerge, and others fall by the wayside. Quarterly reports are a great indicator of short-term market trends, but if you look at the bigger picture of the micromobility market, there has been an overall increase in market adoption over the past decade or more.

In the above chart, you can even see the overall rise in the amount of money invested in electrified mobility over the last six quarters. The 'Electrified' segment is the only one of the 5 in this chart that has seen an overall increase in money invested. This is an excellent sign of the growing interest in electrified mobility options.

McKinsey & Company

Growing Demand For Batteries

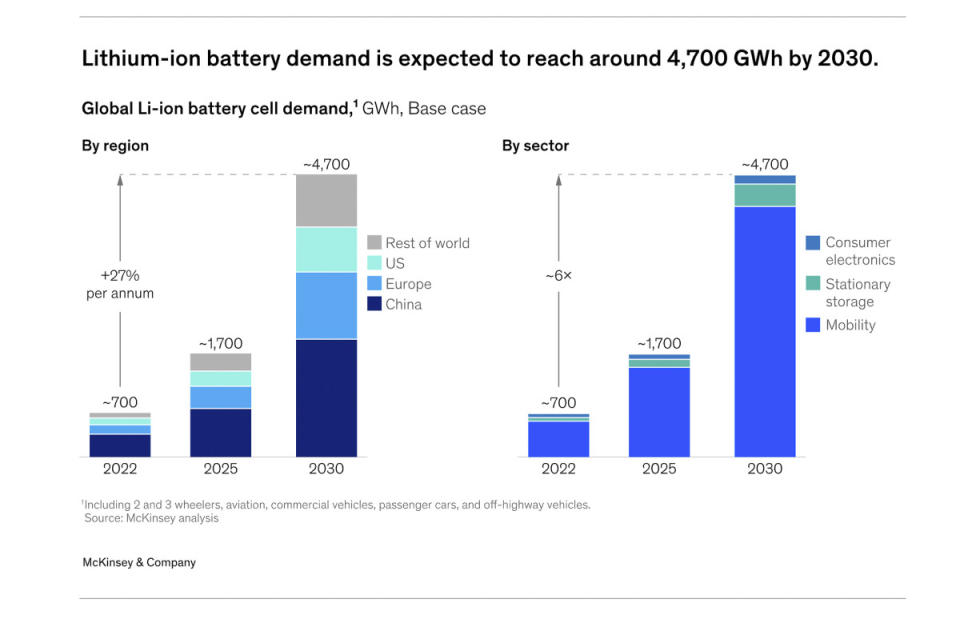

The McKinsey Battery Insights team predicts that the entire lithium-ion battery industry will grow by 27% each year from 2022 to 2030, reaching over $400 billion in value and a market size of around 4,700 gigawatt-hours (GWh).

Most of this demand—approximately 4,300 GWh—will come from mobility applications such as electric vehicles. The remaining demand will come from stationary storage and consumer electronics, but these sectors will make up a smaller share.

Concerns over the amount of mining and environmental damage that goes into creating lithium-ion batteries is always a point of contention. To combat this narrative, many companies are improving their recycling efforts, including joining initiatives like Call2Recycle, which improves the recycling process for end-of-life batteries. There are also companies looking at changing the type of materials used in battery production, hoping to reduce the amount of mined metals needed for a strong and consistent battery, such as potential breakthroughs in sodium-ion batteries.

McKinsey & Company

China's EV Dominance

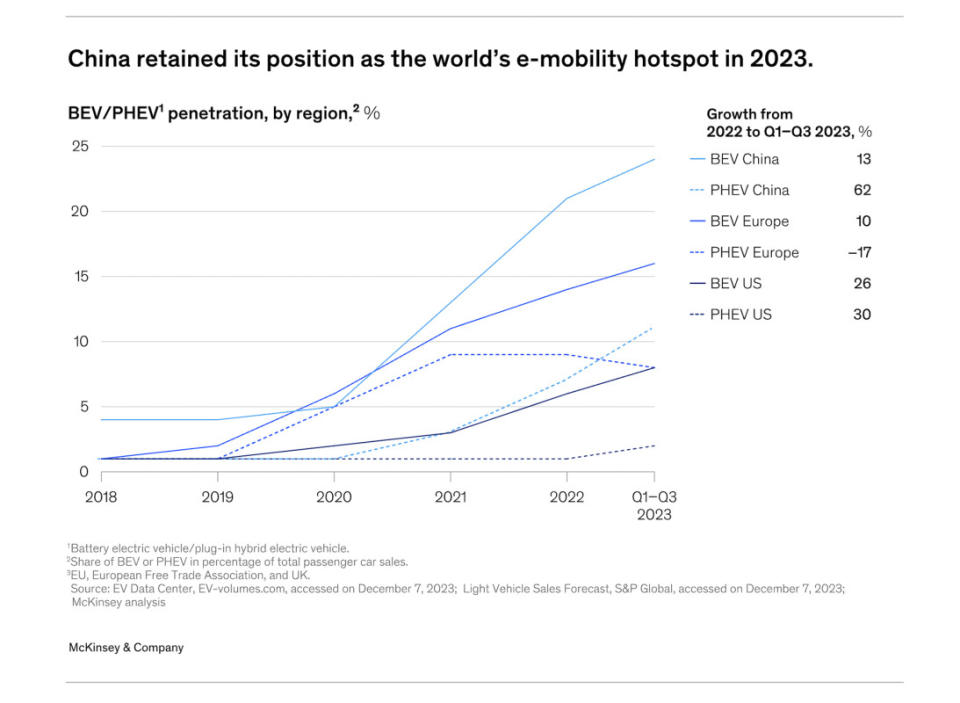

The fact that China is still dominating the EV market should not come as a surprise, especially after the previous chart about their demand for lithium-ion batteries. McKinsey predicts a significant increase in demand for battery electric vehicles (BEVs) worldwide, with sales growing from 6.5 million units in 2021 to around 40 million units by 2030. In 2023, China remains the leading market for electric vehicles, with one in four cars being a BEV.

The biggest surprise in this chart is that all sectors are growing in popularity across the board, except for plug-in vehicles in Europe, which are down 17% over the last few quarters. This may be caused by the European CO2 emissions rules, whose strict rules and threat of full ban in 2035 may be stagnating sales. Thankfully, Europe has been a major adopter of electric bikes for years and has been leading the charge on infrastructure and implementation of electric bike technology for years.