Rep. Nixon: New IRS Direct File program helps Florida taxpayers flourish beyond April 15

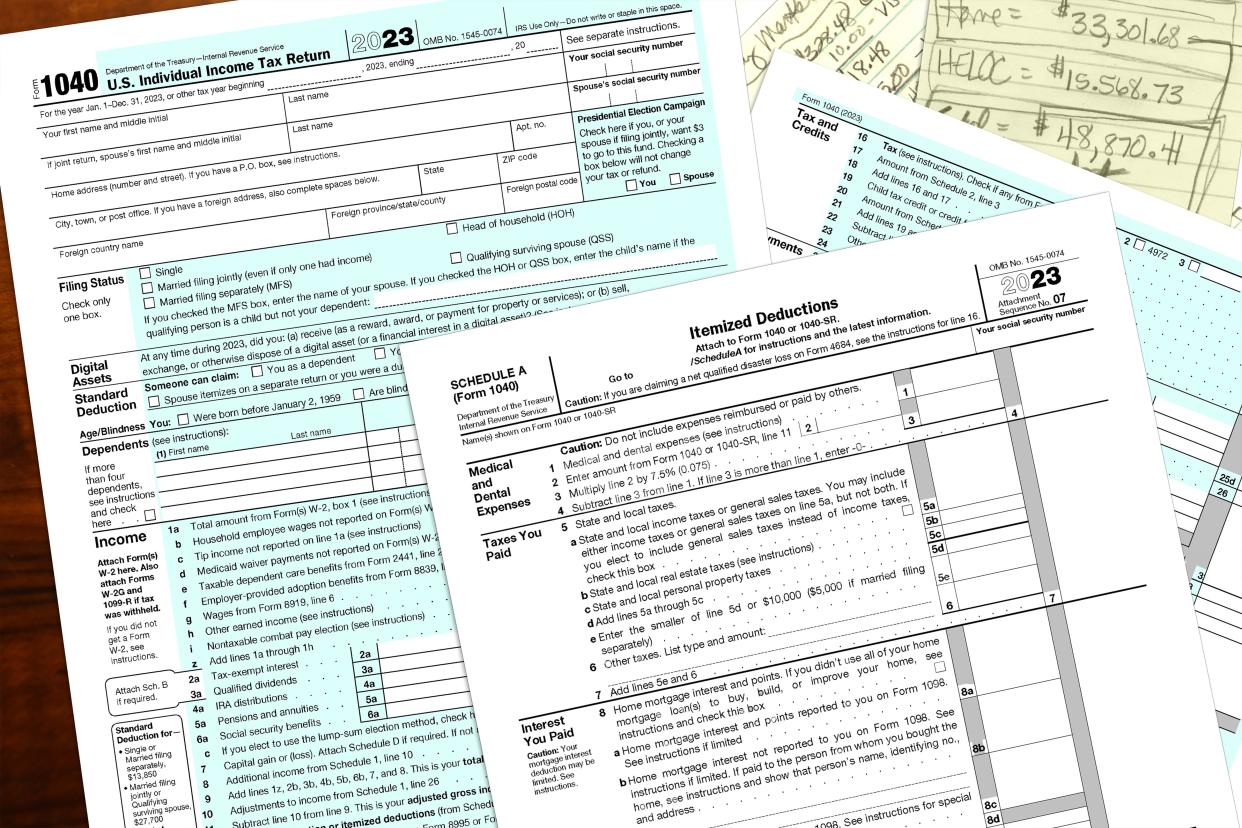

Tax season is upon us and millions of Floridians are primed to file their taxes soon, whether on paper, with the help of a certified public accountant, H&R Block, or (as will be the case for most) online through a private company like TurboTax. We know how tenuous, confusing and expensive filing taxes can be.

We also know how important it is that the process works smoothly so that people get the vital tax credits they deserve.

Thankfully, there’s a better, easier and cost-free option available for over 3 million Florida taxpayers with simple returns. This filing season, the IRS is piloting a new Direct File program — available in English and Spanish — that allows eligible taxpayers to file their tax returns online with the IRS, directly and securely for free.

On average, Floridians spend nine hours and $150 every tax season, even though the overwhelming majority have simple tax cases and should be able to file in minutes and for free. Millions more find it too hard or expensive to file taxes at all and miss out on lifesaving benefits like the child tax credit or earned income tax credit.

For example, nearly 1 in 5 Florida households eligible for the earned income credit do not claim it, because it is either too complicated to file themselves, or because lack of better options caused them to turn to an unregulated tax preparer.

In a 2015 study examining the competency of tax preparers in Tallahassee and Raleigh, N.C., it was found that 90% of returns completed by paid preparers had undiscovered errors.

Roughly half of all Black and Latino children — whose families are disproportionately employed in low-wage jobs due to systemic barriers to economic security — are owed the child tax credit. In 2021, during this credit's expansion, over 3.8 million Florida children became eligible.

However, a complicated tax filing system has resulted in eligible families not being able to claim the tax credit. This disproportionately impacted Black, Latino and low-income families as national surveys consistently found that these families were the least likely to receive the expanded child tax credit in 2021. Our tax system should not harm those who are the most excluded.

Instead, it should uplift them. Recent polling on the Direct File program shows that 96% of Hispanic Floridians and 99% of Black Floridians support the IRS offering this free service.

I’ve seen firsthand how difficult tax filing season can be for many of my constituents. We need a tax filing process that allows Floridians to thrive. Additional polling reveals that most Florida residents — regardless of party lines, race and income support — want to file their taxes for free and directly with the IRS.

Letters: Who knew our parents had it wrong when teaching us to vote for best candidate?

The Direct File program gives taxpayers the choice to cut out the greedy middleman of tax preparation companies like TurboTax. For far too long, these for-profit companies have taken advantage of a broken system to exploit taxpayers and intentionally target low-income taxpayers.

Intuit, the parent company of TurboTax, agreed to pay $141 million to the 4.4 million low-income Americans they managed to steer away from free tax-filing services. You may remember receiving a piece of this settlement as more than 350,000 Floridians fell victim to Intuit’s deceptive practices.

Floridians deserve better. They deserve an option to file their tax returns for free, directly with the IRS, and this pilot program is one step to making that a reality for all of us. All Florida filers can check the Direct File website to see if they are eligible for the pilot program.

With this Direct File program, we are one step closer to making the tax system more equitable and accessible so that it works for all Floridians and not just the wealthy and corporations.

Rep. Angela Nixon serves District 13 in the Florida House of Representatives.

This guest column is the opinion of the author and does not necessarily represent the views of the Times-Union. We welcome a diversity of opinions.

This article originally appeared on Florida Times-Union: Pilot IRS program a step to free direct filing for all Floridians