Mexico’s Central Bank Stays Cautious About Any Future Rate Cuts

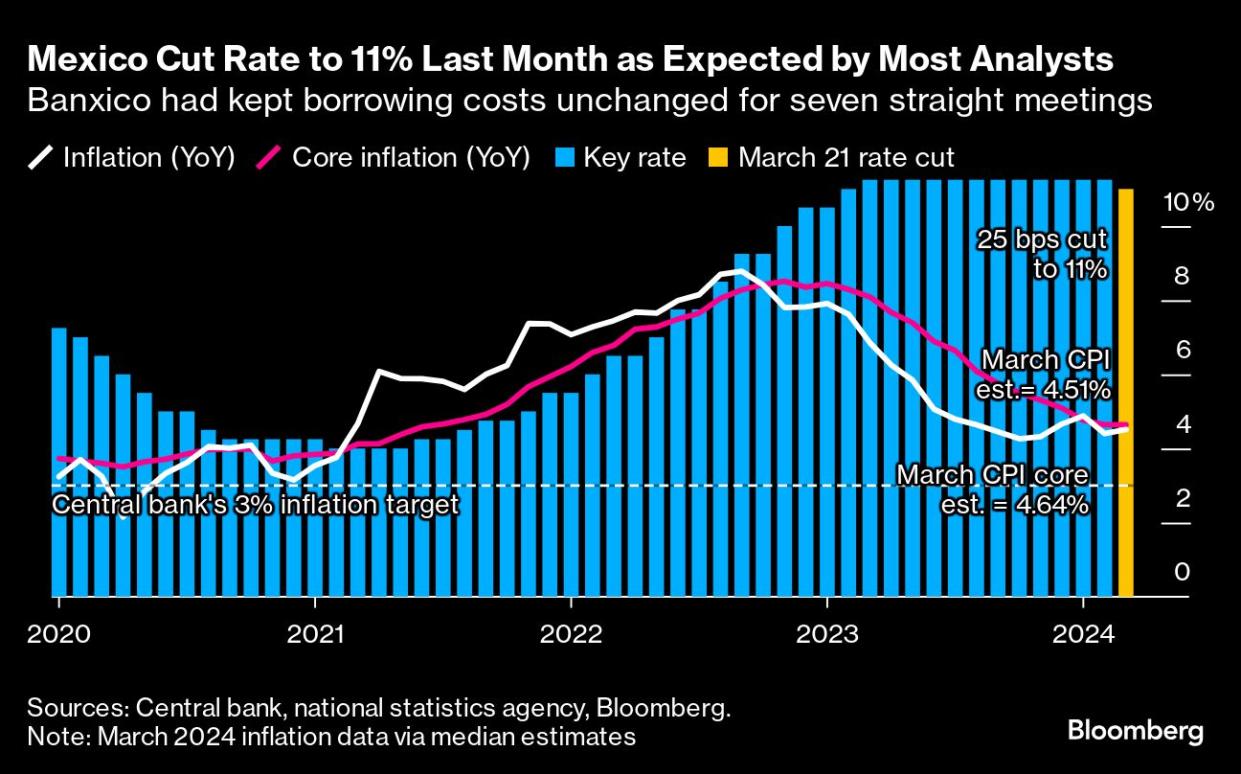

(Bloomberg) -- Mexico central bank members raised concerns about a resilient domestic economy and inflation when they delivered their first interest rate cut since 2021, signaling any future reductions would be gradual.

Most Read from Bloomberg

Texas Toll Road Takeover to Cost Taxpayers at Least $1.7 Billion

Saudi Crown Prince MBS’s $100 Billion Foreign Investment Quest Falters

Zimbabwe Replaces Battered Dollar With New Gold-Backed Currency Called ZiG

Giving Up China Is Hard, Even for Argentina’s Anarcho-Capitalist

S&P 500 Falls 1% as Oil Jump Spurs Flight to Bonds: Markets Wrap

Before the March cut, some policymakers expressed concern over services inflation and a tight labor market, according to the minutes of last month’s meeting. Given the risks, members called for small adjustments and cautioned against rapid reductions going forward, board members said in the document published Thursday.

“Monetary policy should continue being managed prudently” and the assessment of additional rate cuts “would be made on a meeting-by-meeting basis,” said one member. Others echoed that view, saying the changes should involve “fine-tuning” and be “implemented gradually, not only in terms of magnitude but duration.”

Read More: Mexico Cuts Key Interest Rate For First Time Since 2021

The board of Banxico - as the central bank is known - reduced borrowing costs by a quarter-point to 11% last month. Governor Victoria Rodriguez said after the decision that any further adjustments would have to be considered one at a time, and that the bank would proceed “step-by-step.”

Domestic consumption this year is expected to offset some of the weakness in external demand, especially from the U.S., according to one member.

Irene Espinosa, the one member who voted for the bank to hold rates, said monetary policy faced addition challenges, including pressures from wage increases and expansionary fiscal policy. In that context, she said any borrowing cost cuts would be “premature.”

Banxico targets inflation at 3%, plus or minus one percentage point. Annual inflation stood at 4.48% in the first half of March, with core inflation - which excludes volatile items such as food and fuel — accelerating to 4.69%.

Read More: AMLO Spends Like Never Before to Set Up His Successor’s Victory

One of the members said the federal government would need to spend significantly less or increase revenue in order to achieve the deficit reduction expected in 2025. Another member said that even if public spending moderates, private investment could provide an additional boost to the economy.

Most Read from Bloomberg Businessweek

How Bluey Became a $2 Billion Smash Hit—With an Uncertain Future

China’s Real Estate Tycoons Lost $100 Billion in the Housing Collapse

©2024 Bloomberg L.P.