Majority of $1.5B franchise tax refunds would flow out of Tennessee, new records show

- Oops!Something went wrong.Please try again later.

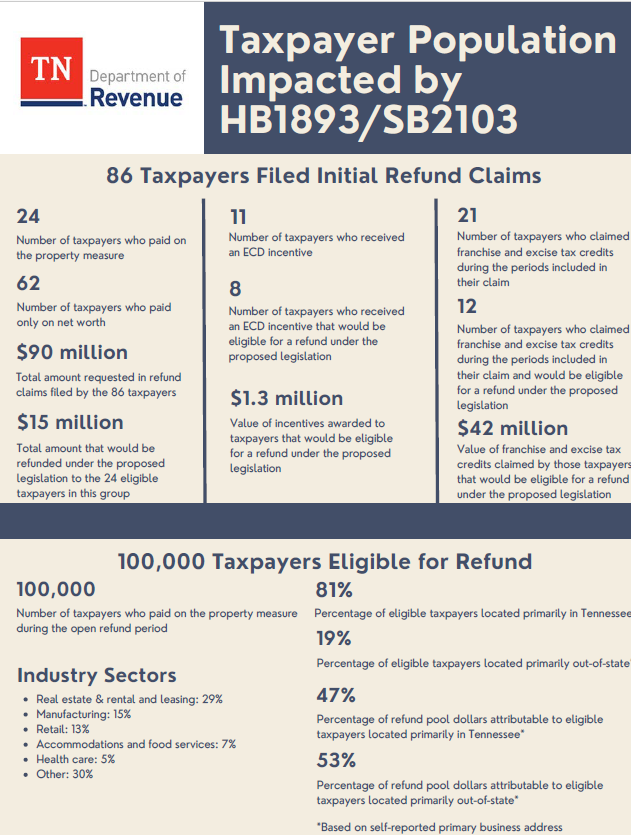

As Tennessee lawmakers take up final negotiations on a $1.9 billion franchise tax change package this week, new records obtained by The Tennessean show the landmark legislation was initially prompted by $15 million in valid franchise tax refunds sought by 24 businesses, and that if approved, a majority of the money would be headed out of state.

Gov. Bill Lee’s largest spending item this year is a proposal to change the method by which the state charges franchise taxes to businesses, eliminating the property tax calculation — a move that’s expected to cost the state $400 million in revenue beginning this year.

Lee’s proposal also includes $1.5 billion in refunds for up to 100,000 businesses which paid taxes based on the property measure over the last three years.

While 81% of the estimated 100,000 businesses eligible for a refund are located primarily in Tennessee, 53% of the refund dollars would be headed out of state, according to a revenue department analysis included in the new records.

Administration officials have said the refunds are indispensable to avoid lawsuits and court-ordered penalties and have emphasized that refunds would go businesses of all sizes.

Of the 100,000 taxpayers who would be eligible for refunds, 29% are in real estate, 15% in manufacturing, 13% are in retail, 7% are in accommodations and food service, and 5% are in health care, the records show.

House and Senate leadership remained at an impasse after a brief Conference Committee meeting Tuesday morning.

House leadership is pushing for public disclosure of business names and refund amounts — something they say is a “make or break” to the deal — and only one year's worth of refunds.

Lee said Monday he opposes those transparency measures, and the Senate version does not include them. It remains unclear how much Lee’s family business, the Lee Company, would financially benefit from the refund, something critics of the deal regularly cite.

Administration officials have repeatedly said the change was prompted by more than 80 companies that approached the state seeking refunds. The Lee administration has declined to release details about the companies, letters indicating potential liability, or how much money companies sought in refunds from the state.

More: Tennessee declines to name 80 companies that prompted the $1.6B franchise tax change

New records obtained by The Tennessean in a records request to Lee's office show that while 86 companies did file initial refund claims with the state, as officials have said, only 24 of the 86 paid franchise taxes based on the property measure and would be eligible for a refund under the Lee administration’s remedy. Of the $90 million in refunds the 86 companies requested, $15 million would go to the 24 eligible companies.

“Most of the taxpayers that have already filed for a refund would not be eligible for a refund under the administration’s proposed remedy because they did not pay franchise tax on the property measure,” Lee spokesperson Elizabeth Johnson told The Tennessean in an email on Monday.

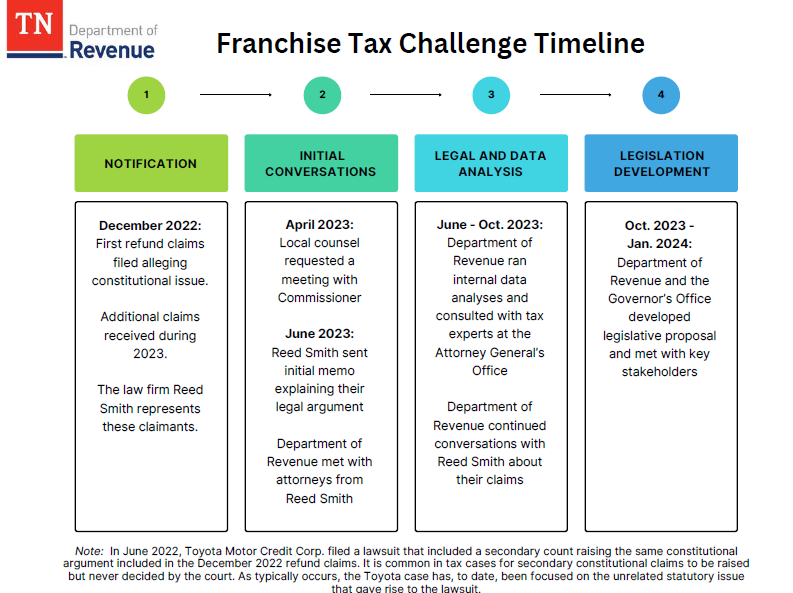

The first refund claims were filed in December 2022, and further claims were filed in 2023. Claimants are represented by the law firm Reed Smith LLC, according to the records, which include emails, a timeline and presentations and documents from both Lee's office and the Department of Revenue.

Representatives from the Department of Revenue met with attorneys from Reed Smith prior to conducting the analysis, and continued those conversations while developing the reform proposal, according to a timeline of the legal challenge obtained by The Tennessean.

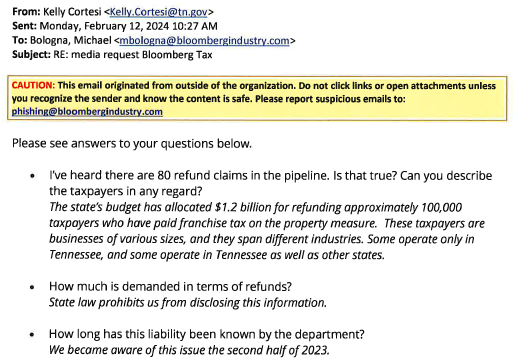

The Tennessee Department of Revenue has said that sharing information about the companies would violate state laws protecting taxpayer confidentiality. For example, email records show that in response to a Feb. 9 request from a Bloomberg Tax reporter for the total amount of refunds requested by companies, revenue spokesperson Kelly Cortesi responded that “state law prohibits us from disclosing this information.”

Cortesi also cited state taxpayer confidentiality laws when asked for details by The Tennessean.

But while the Lee administration declined to disclose to the media the amount of refunds sought by the 86 companies, officials circulated fact sheets with that information to lawmakers, according to records obtained by The Tennessean.

Ten days after telling Bloomberg Tax that sharing the refund amount requested by companies would violate taxpayer confidentiality, the Department of Revenue shared handouts on the franchise tax reform that contained that exact information with lawmakers, according to an email sent by Lee’s Chief Counsel Erin Merrick.

“Revenue will share these handouts broadly with members,” Merrick wrote in an email to deputies in the counsel’s office on Feb. 22. An early committee vote was initially set for the next week.

Cortesi in a statement to The Tennessean for this story said the aggregate amount of refunds requested is not confidential.

“The Department of Revenue routinely prepares informational sheets for legislation for meetings with legislators, and we do not consider them to be private materials,” Cortesi told The Tennessean an email.

While the aggregate information for the 86 companies was shared with lawmakers, it was never publicly disclosed during committee hearings, via PowerPoint presentations to the public, or in other public comments. Officials only ever spoke generally about companies that would be eligible for a refund.

Instead, administration officials cited the more than 80 taxpayers that had already filed for franchise tax refunds while arguing the urgency of the reform. Officials never publicly said that while 86 companies had sought about $90 million in refunds, only 24 of the 86 that originally filed would be eligible for a refund, or that the refund amount to which they were entitled totaled $15 million.

“The Department of Revenue has not misrepresented any information,” Cortesi told The Tennessean. “The department has consistently stated that approximately 100,000 taxpayers would be eligible for the remedy under the proposed legislation. This is only a portion of all franchise taxpayers.”

More: Tennessee Gov. Bill Lee opposes franchise tax transparency measure backed by House GOP

Vivian Jones covers state government and politics for The Tennessean. Reach her at vjones@tennessean.com or on X at @Vivian_E_Jones.

This article originally appeared on Nashville Tennessean: Majority of $1.5B franchise refunds set to go out of Tennessee