Electric Bike Imports Down Slightly in 2023, While Acoustic Bike Imports Fall Drastically

In the annals of commerce, 2023 might be earmarked as the year most would prefer to sweep under the rug. Inventories ballooned, sales plummeted, and the once-solid relationships between suppliers and retailers strained under the weight of unprecedented challenges. While the horizon doesn't promise swift relief from these woes, there may be a silver lining that can be the main point of hope for the future: sales growth for electric bikes.

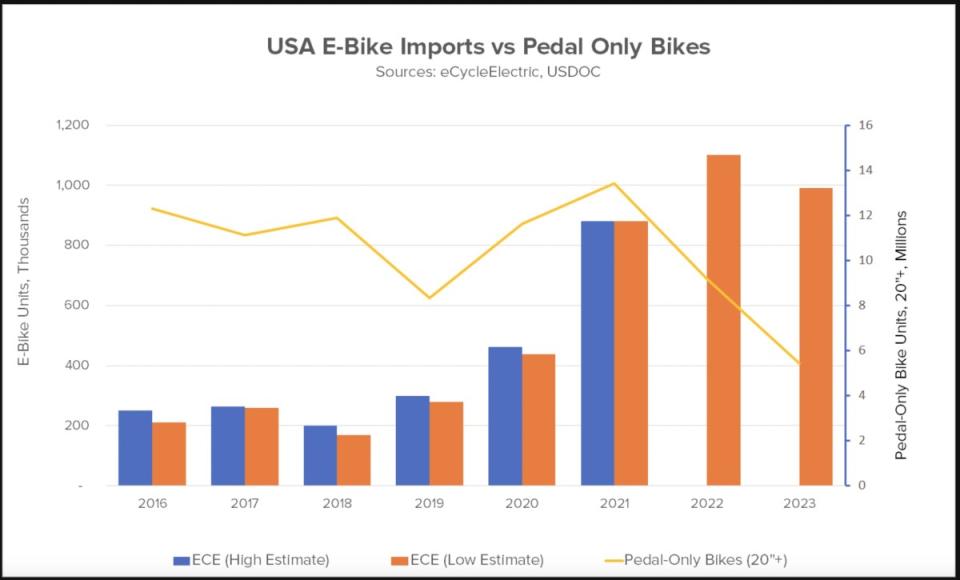

A recent chart, courtesy of Ed Benjamin's eCycleElectric consultancy, speaks volumes about the direction of the electric bike industry (and consequently the cycling industry in general). This chart, showcasing the 2023 import figures for both e-bikes and traditional pedal-only bicycles, paints a nuanced picture of an industry in flux.

eCycleElectric

In 2023, both categories witnessed a decline in imports, a direct response to the frantic efforts by suppliers to rein in the torrents of orders flooding toward retailers. This has been apparent with industry wide prices being slashed to reduce the amount of excess inventory, including numerous 2-for-1 deals from a variety of brands, unheard of in the years previous. Notably, pedal-only bike imports plummeted by a staggering 41% from 2022, itself down over 31% from the preceding year. These numbers are the lowest in over 40 years, sending waves of uncertainty throughout the industry.

In contrast, e-bike imports experienced a more modest decline of 10% from 2022. While still a drop, this figure belied a resilient market, with a 25% increase noted from 2021. Yet, the significance of e-bikes extends beyond mere import numbers. Over the years, they've stealthily encroached upon the territory once dominated by their pedal-only counterparts, steadily chipping away at market share. From a negligible 2% in 2016, e-bikes now command over 18% of pedal-only bike sales as of 2023.

Observers speculate that the 20% threshold, when e-bike imports match a fifth of pedal-only bike figures, could herald a seismic shift in the industry landscape. This conjecture, however, warrants scrutiny. A substantial portion of e-bike sales, particularly the budget-friendly models flooding the market, stem from direct-to-consumer channels, a realm devoid of direct pedal-only equivalents. Consequently, comparisons based solely on import numbers might obfuscate rather than elucidate the true dynamics at play.

Related: Analog vs. Electric—A Real Fight or a Discussion?

The lingering question persists: why does an inventory glut persist into 2024 and beyond despite drastic import cutbacks in preceding years? The answer lies in a 5-letter word that dominated the early part of the decade: COVID. Sales skyrocketed with a surge in demand during lockdowns, supply chains being clogged up, and cheap, interest-free loans. Banking on sales continues into the foreseeable future, and manufacturers create an overabundance of stock. Yet, with interest rates rising and budgets tightening, consumers decided to forego buying another new bike. The aftermath of overzealous stockings continues to haunt the industry. Yet, amidst the inventory quagmire, e-bikes emerge as a beacon of resilience.

As the industry navigates the choppy waters of uncertainty, the ascent of e-bikes seems poised to redefine the cycling landscape in the coming decade. While challenges abound, the subtle allure of electric-powered two-wheelers hints at a future where innovation and adaptability reign supreme.