Latest Trump hush-money battle: how to instruct jurors on the coverup of a coverup and crimes within crimes

- Oops!Something went wrong.Please try again later.

Testimony in Donald Trump's Manhattan hush-money trial concluded Tuesday.

The parties then argued over how the judge would instruct the jury on the law.

The judge said he wanted it to be "as easy as possible," but the jury charge is still set to be complex.

Lawyers in the Donald Trump hush-money trial spent Tuesday afternoon in a spirited battle over this question: What will the judge tell jurors right before they begin their deliberations next week?

The prosecution and defense fought for three hours over this, the so-called "jury charge," splitting hairs over what language New York Supreme Court Justice Juan Merchan would use to instruct the seven-man, five-woman jury on the law.

The level of skill and fervor in these arguments was no surprise.

The jury charge is so important, so sacrosanct, that Merchan will order the doors to his courtroom sealed for its duration, with no one in the well or audience allowed to enter or leave.

He's then expected to tell jurors something like this:

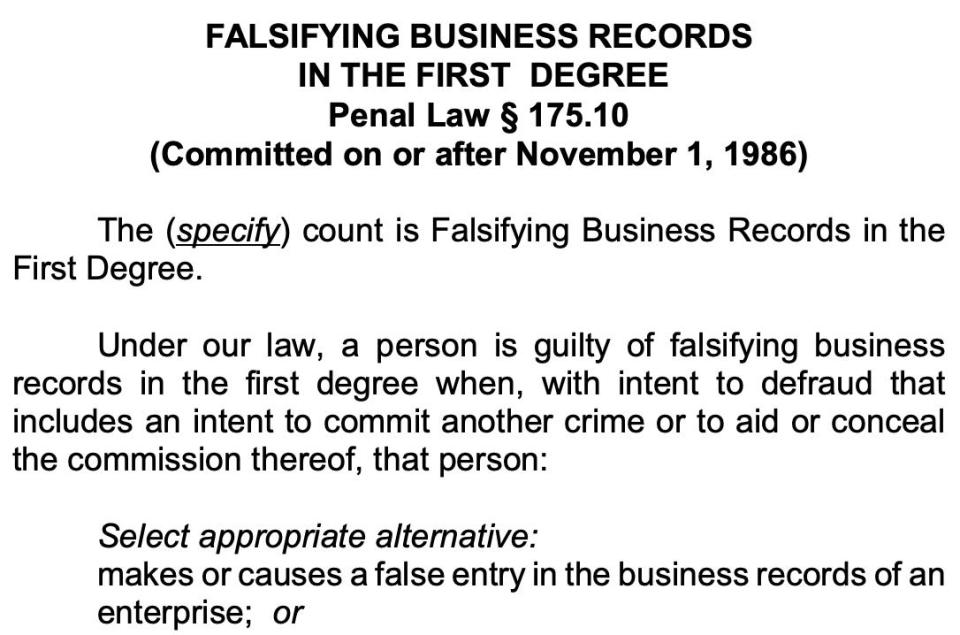

"Under our law, a person is guilty of falsifying business records in the first degree when, with intent to defraud that includes an intent to commit another crime or to aid or conceal the commission thereof, that person makes or causes a false entry in the business records of an enterprise."

These are the opening paragraphs to the New York state court system's jury-charge guidelines for falsifying business records in the first degree.

It's the basic starting template for any New York judge who needs to charge a jury on what's known in legal shorthand as first-degree falsifying.

Trump has been charged with 34 counts of this one felony. That's the entirety of his indictment. There's one count for each of 34 invoices, checks, and Trump Organization ledger entries — all of the records that prosecutors allege Trump "caused" to be falsified throughout 2017, his first year in office.

Prosecutors for Manhattan District Attorney Alvin Bragg allege that each falsified invoice, check, and ledger entry counts as a felony because it concealed an underlying crime. (They say the underlying crime is a violation of state election law — more about that in a bit.)

How does the prosecution allege they were falsified?

Bragg says each of the 34 records disguised the true nature of a year's worth of payments to Trump's "fixer"-turned-foe, Michael Cohen, by making them look like monthly legal retainer fees.

In reality, Bragg alleges, Trump wasn't paying Cohen a monthly retainer at all — he was instead concealing an illegal conspiracy to influence the 2016 election.

Prosecutors allege that rather than compensating Cohen for legal work — Cohen testified he did only a few hours of work for Trump in all of 2017 — the payments secretly reimbursed Cohen in monthly installments for a campaign-law-violating $130,000 hush-money payment to the porn star Stormy Daniels.

How do they decide?

OK, it's a little tricky.

Let's say business records were indeed falsified to hide hush money. That's the coverup of a coverup. And let's say that the hush-money payment — which silenced Daniels just 11 days before the 2016 election — was itself illegal. That's a crime within a crime.

Still, it's not terribly tricky, right?

Trump faces 34 counts of only a single charge, first-degree falsifying, for which the standard charging language barely fills two pages.

And for each count, the jury must consider just two things: whether Trump caused the record to be falsified and whether he did so to hide his intent to commit "another crime."

If prosecutors meet their burden to prove both tiers — falsification and intent to conceal another crime — beyond a reasonable doubt, then Trump is guilty. If they don't, then Trump is not guilty.

Prosecutors don't even have to prove that "another crime" was actually committed. They just have to prove that Trump intended to commit another crime and then falsified records to hide his tracks.

The jury charge for this single felony should be easy, right? Clear-cut and beyond dispute?

Wrong.

Yes, first-degree falsifying is the only law in Trump's indictment.

But it's not the only law jurors must understand and weigh when they begin deliberations as early as Wednesday.

Prosecutors allege that Trump falsified the hush-money reimbursements in order to conceal his intent to commit an obscure New York election-conspiracy law.

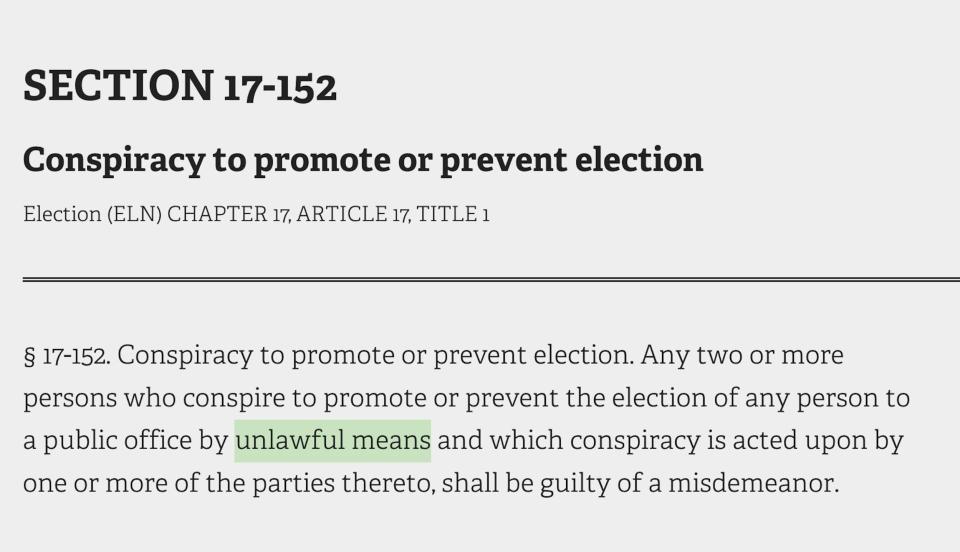

This is what they mean by Trump's "intent to commit another crime." Under the prosecution theory, this other crime is breaking election law section 17-152, which makes it a misdemeanor to conspire to influence an election "by unlawful means."

A crime within a crime within a crime

So you see, to win a conviction, prosecutors must demonstrate three layers of unlawfulness involving at least three separate laws.

They're alleging Trump committed a crime (under the Federal Elections Campaign Act) within a crime (under the state election-conspiracy law) within a crime (under the first-degree falsifying charge he's actually indicted on).

It's a Russian nesting doll of wrongdoing, though only the outermost doll, first-degree falsifying, needs to be proved beyond a reasonable doubt.

Prosecutors also plan to give jurors two alternatives to the FECA violation, the innermost of the three nesting dolls.

These alternatives are a violation of federal, state, and/or city tax laws (alleging that Cohen's hush-money reimbursements were unlawfully disguised as taxable income) and yet another records-falsification violation (alleging that Trump was responsible for bogus hush-money paperwork at the National Enquirer).

That means three layers of wrongdoing under a half-dozen potentially applicable laws, all with their own wording and definitions, much of which had to be argued over on Tuesday.

What is a "conspiracy"? What is "intent"? What is "accessorial liability"? Do those definitions differ, law to law?

And then there were broader, more-arcane questions, including this one:

Must jurors agree unanimously on the "unlawful means" at the center of the case?

Meaning, must all 12 jurors agree that, in causing Cohen to pay the hush money, Trump conspired to violate FECA campaign-contribution limits? Or can some jurors find that Trump conspired to violate tax law, while other jurors see the falsification of National Enquirer business records as the central offense?

In other words, do jurors need to be unanimous in deciding which of the three options, if any, is the central unlawfulness?

That brings us back to Tuesday's charge conference and why the sides fought for three hours as the defendant and many in the audience struggled to stay awake.

"This is, obviously, an extraordinarily important case," the defense lawyer Emil Bove told the judge, in arguing that jurors be instructed that they must unanimously decide on an underlying wrongdoing.

"The most critical point here is that the jury does not need to conclude unanimously what the specific unlawful means are," Matthew Colangelo, a prosecutor, argued back Tuesday, referring to "well-established New York law."

"So I think the key point here for this instruction," Colangelo added, "is to advise the jury that, yes, there has to be some unlawful means, and to alert them as to what those unlawful means are, but also advise them that they don't have to unanimously agree on each of the unlawful means."

"We think your honor has some discretion," countered Bove.

Merchan was not swayed.

"I think I understand what you're saying, what you mean when you're saying it's an important case," Merchan told Trump's lawyer. "What you're asking me to do is change the law, and I'm not going to do that."

Charging the jury is a tedious task

Tuesday's debate was granular stuff.

In general, Bove pushed for longer, more complex definitions of such terms as "contribution" and "unlawful means." This was in the apparent hope that the narrower the definitions, the less likely jurors would find that Trump's actions fell within their bounds.

Prosecutors, meanwhile, fought to keep the charge as simple as possible.

"As we discussed, we think the jury needs less, not more, on FECA instructions," Colangelo, the prosecutor, argued at one point on Tuesday.

"And we think the term 'for the purpose of influencing an election' is a pretty straightforward term that jurors can understand," Colangelo added.

In awarding the most "wins" to prosecutors, Merchan chose brevity over expansiveness.

"Some of the issues are confusing enough, I think," the judge said Tuesday. "We want to make it as easy as possible for the jury."

Merchan told prosecutors and Trump's lawyers that he'd give them the final draft of his instructions on Thursday.

He told jurors to expect his charge to last "at least an hour."

Read the original article on Business Insider