'Ecstatic': Nebraska caregivers get some relief in the form of a tax credit

Thirteen years ago, Nebraska nursing instructor Tara Spiehs Garst had to leave her job to take care of her son who was born with Trisomy 18, a genetic condition that causes multiple birth defects.

Three years later, she had a daughter who was born with the same condition. Since then, Spiehs Garst's family has lived on a reduced income and pays thousands of dollars out of pocket for services and supplies, having to cut numerous corners. Spiehs Garst even went without a cell phone for a year, but the emotional impacts have been just as daunting.

"My people that I interact with are physicians, are therapists, my children's medical providers, that's who my social interaction is with because they're my full time job," Spiehs Garst said. "I can't leave them to go and do other things. Somebody has to be there to take care of them."

She is just one of 179,000 caregivers in Nebraska who face similar challenges, including emotional and financial burdens, every day.

These challenges sparked the Caregiver Tax Credit Act, sponsored by Nebraska State Sen. Eliot Bostar. The act creates a nonrefundable tax credit for caregivers that covers about 50% of eligible expenditures used for the care of family members each year. The maximum credit is $2,000, and it is $3,000 for family members who served in the military or who have a dementia diagnosis.

This tax credit comes as federal and state governments are trying to solve the senior care crisis, in which the cost of care continues to skyrocket while more of the population ages. Today, there are over 53 million caregivers in the United States, as people have stepped in to care for family members who can't afford rent at senior care centers or to pay at-home nurses.

“We're relying more and more on caregivers and family members to provide that care because the healthcare system is bursting at the seams," Associate State Director for Advocacy and Outreach with AARP Nebraska, Jina Ragland said. "We have a huge desert of accessibility to health services but also for having the workforce development enough to provide inside facilities."

Nebraska is now the second state to establish a caregiver tax credit. Bostar's bill is modeled after Oklahoma's, which went into effect at the beginning of this year. Unlike Oklahoma's legislation, Nebraska's tax credit does not have an age requirement for eligible family members, recognizing that people of all ages receive care at home.

The non-refundable tax credit is capped at $2.5 million, but Ragland points out that it will save the state money in the long run. According to the Nebraska AARP, family caregivers in the state provide over 168 million hours of unpaid care valued at approximately $2.8 billion every year.

"Family caregivers are the backbone of the U.S. care system, helping parents, spouses and other loved ones remain in their homes," Bostar said during a floor debate last month. "LB 937 will help ensure Nebraskans in need or care can stay in their homes when their health is failing, eliminating the need for the much more costlier option and added emotional burden of being cared for in a taxpayer-funded nursing home."

Although the tax credit has wide bipartisan support, it saw an unexpected roadblock during the first round of debate in late March when a handful of amendments, including a controversial dollar-for-dollar tax credit for donations to crisis pregnancy centers, were tacked on at the last minute. The credit was eventually advanced and passed with a unanimous vote on the second to last day of session. It recently crossed the finish line after Nebraska Gov. Jim Pillen signed it Tuesday.

"With the baby boomer generation retiring and getting older and all of our nursing homes seemingly closing right and left, we will have to address more creatively how we take care of these folks," state Sen. Jana Hughes said during floor debate. "Encouraging them staying at home is a very, very good thing."

More: Caregivers spend a whopping $7,200 out of pocket. New bill would provide tax relief.

'The backbone'

Like caregivers across the country, Sarah Rasby of Nebraska had to make financial and emotional sacrifices to take care of her 35-year-old twin sister, Erin Lewis, who went into cardiac arrest and survived an anoxic brain injury, leaving her unable to walk, speak or move her body. Rasby spent hours a day caring for her sister for three and a half years before she passed away in 2022.

"There's just really not a lot of time for the caregivers to care for themselves because they're giving so much of their life to the other person,” Rasby said, noting may caregivers face social isolation. "The tax credit will help them identify as caregivers, but at the same time, those in the thick of it will start feeling some more value."

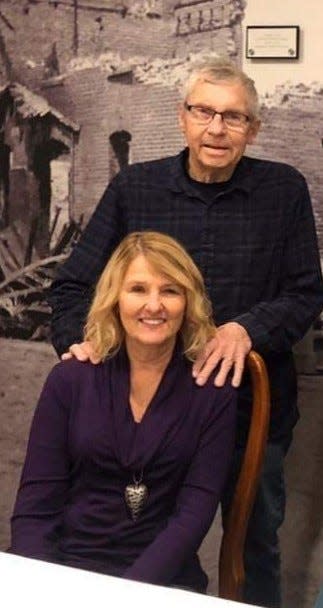

Joyce Beck had made similar financial and emotional sacrifices to take care of her husband, Jerry. Beck's husband suffered a heart attack while he had multiple sclerosis and had to have a quadruple bypass at the age of 52. He was later diagnosed with cancer, leading Beck to retire early from her position as a hospital CEO to care for him after it spread. Jerry eventually passed away about three years ago.

Beck is "ecstatic" the caregiver tax credit passed, saying it is an acknowledgment of the sacrifices caregivers make and will relieve some of the financial burdens they face.

"I'm proud that Nebraska is the second state in the United States to pass this because it shows the rest of the country that we are compassionate, we care about our people, and we want to take care of everyone," Beck said.

Although she's not a caregiver anymore, Beck knows the experience all too well. She wasn't able to return to work after her husband passed and had to collect her pension and social security early on top of paying thousands of dollars out of pocket for medical bills. Despite the financial and emotional hardships, she was honored she got to spend the last few years of her husband's life caring for him.

"It's so hard to watch someone pass away by inches, it’s like almost a nightmare to watch," Beck said. “It is truly just an honor to be able to take care of someone like that and to help them every step of the way. It's the hardest thing you’ll ever do but it is the most rewarding thing you’ll ever do."

This article originally appeared on USA TODAY: Nebraska passes family caregiver tax credit, second state to do so