Does homeowners insurance cover damages due to Texas wildfires? Here's what to know

Many families that were displaced or lost their homes in the Smokehouse Creek Fire are starting all over from scratch.

Nothing can stop natural disasters but now many Texan families are burdened by financial strife because of no insurance.

Those who lost their homes to the wildfires mostly had homes in rural areas outside of the city. According to the Texas Tribune, Texas homeowners who go without insurance tend to be lower-income.

“Homeowners in the state’s rural areas are more likely to not have insurance than their urban counterparts,” the publication said. “Some 11% of homeowners in the state’s major metropolitan areas don't have homeowners insurance, whereas about 26% of homeowners in rural areas lack it.”

Track wildfires in real-time: Wildfires burn more than one million acres in Texas panhandle

What does homeowners insurance cover?

According to the Texas Department of Insurance, home insurance protects homeowners financially if the property is damaged or destroyed by something the policy covers, like a fire or storm. It’s not legally required but it’s best to protect the investment and lenders like to see potential homeowners have it.

What are the types of Texas homeowners insurance?

The Texas Department of Insurance mentions there are several types of home policies that are combined into one package. Those policies include:

Dwelling coverage pays if your house is damaged or destroyed by something your policy covers.

Personal property coverage pays if your furniture, clothing, and other things you own are stolen, damaged, or destroyed.

Other structures coverage pays to repair structures on your property that aren’t attached to your house. This includes detached garages, storage sheds, and fences

Additional living expenses coverage pays if you have to move while your house is being repaired to fix damages your policy covers. Additional living expenses include rent, food, and other costs you wouldn’t have if you were still in your home.

Personal liability coverage pays medical bills, lost wages, and other costs for people that you’re legally responsible for injuring. It also pays if you’re responsible for damaging someone else’s property. It also pays your court costs if you’re sued because of an accident.

Medical payments coverage pays the medical bills of people hurt on your property. It also pays for some injuries that happen away from your home – if your dog bites someone at the park, for instance.

Texas wildfires: These 7 photos of the Texas panhandle wildfires illustrate just how destructive they are

What are the average costs of homeowners insurance?

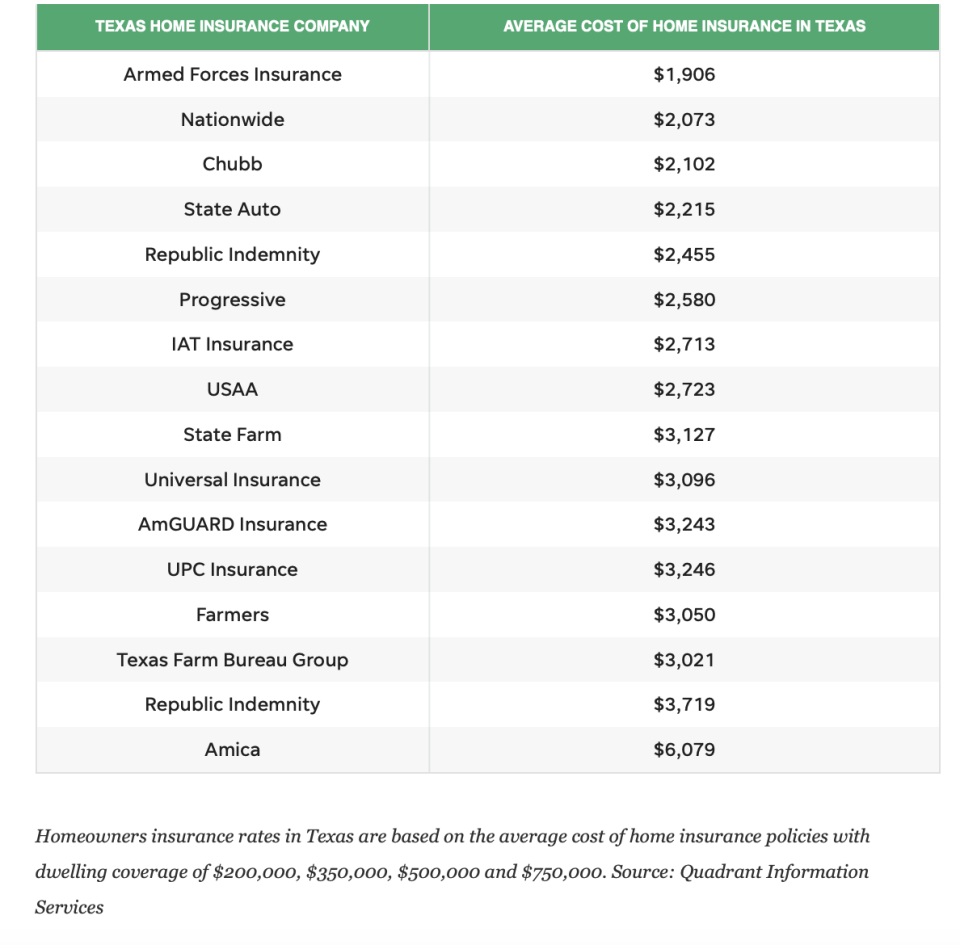

Texas has some of the highest insurance rates in the U.S. According to Nerdwallet, Texas’ average cost of home insurance is $3,875 per year, or about $323 per month.

There are several options for homeowners insurance. The cheapest option is the Armed Forces insurance, which averages out to $1,906 annually but you have to be in the military, a veteran or part of the military community.

Here’s a look at the average cost of homeowners insurance:

What do policies cover?

There are common probabilities and threats that insurance will and will not cover. Here’s what homeowner’s insurance policies will likely cover according to the Texas Department of Insurance.

Fire and lightning

Sudden and accidental release of water or smoke

Explosion

Theft

Vandalism, malicious mischief, riot, and civil commotion

Aircraft and vehicles

Windstorm, hurricane, and hail (but not if you live on the Gulf Coast)

Texas wildfires: These are largest, deadliest and most destructive wildfires in Texas, US history

What Texas homeowners insurance won’t cover?

Homeowners might have to purchase a separate policy for the following:

Flooding

A continuous water leak; policies also won’t cover mold removal, except to repair damage caused by a covered risk

Termites, insects, rats, or mice

Losses that occur if your house is vacant for the number of days specified by your policy

Wear and tear

Earthquakes or earth movement

Wind or hail to trees and shrubs

See map of Texas wildfires: The Smokehouse Creek Fire is so big it could cover Los Angeles

How to make a claim if you were affected by Texas wildfires

If ever in a situation where your home is damaged from a fire, you must act swiftly.

There are some steps to follow if you're in this situation, according to the Texas Department of Insurance.

Document the damage. Take pictures and video of the damage throughout your home if you can. Create an inventory of personal items that were damaged by the fire or smoke. The documentation is needed so you provide proof to an insurance adjuster.

Know your living expenses. If you are forced to leave your home, the insurance company should pay for the expenses. You can ask an insurance provider for a cash advance to cover living expenses or document the expenses to include them as part of the claim. The insurance company will only cover the cost of essentials such as hotels, food, clothing, and toiletries.

File a claim. Call the insurance provider to start the claims process. The insurance company will send a claims adjuster to your property within two weeks to inspect the damage and estimate the repairs. The insurance company must react to the claim within a reasonable amount of time. If the insurance company accepts the claim, they must give you the money within five business days. If the claim is rejected, the insurance company must provide an explanation in writing.

This article originally appeared on Austin American-Statesman: Does homeowners insurance cover damages due to Texas wildfires?