Interest rates won't get much higher, analysts say

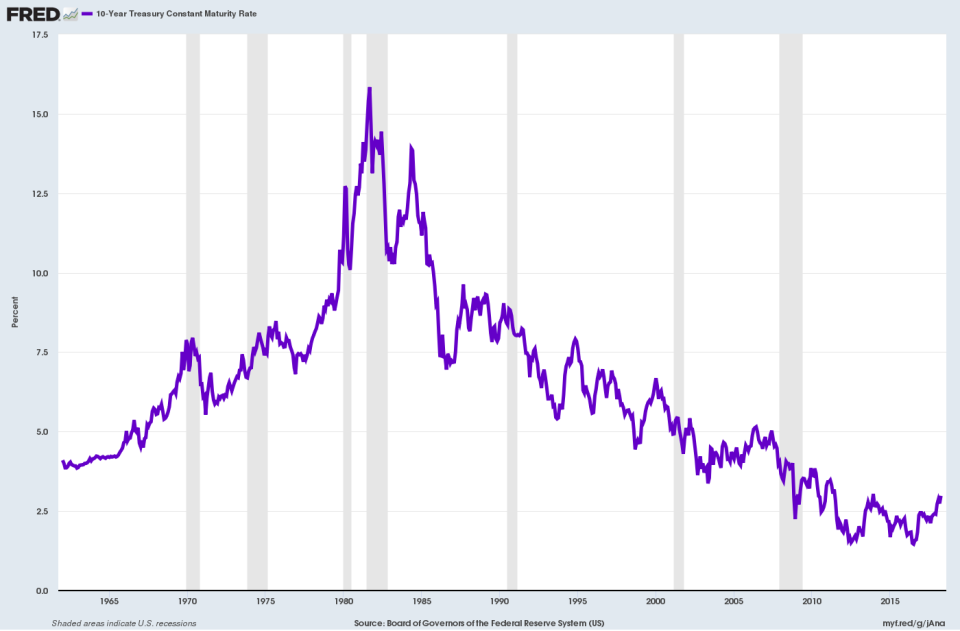

After hitting 3% on Tuesday, U.S. 10-year Treasury yields (^TNX) are likely to stall out or fall in the coming months, analysts say, as there are too many factors working against inflation for yields to move much higher.

Investors pointed to the weakness of the U.S. dollar, long-term inflation expectations, central bank policy and a number of other key factors that will limit further rises in interest rates for the foreseeable future.

“I just don’t see the catalyst for a sustained rise above 3%, in 10-year yields” said Subadra Rajappa, head of U.S. rates strategy for Societe Generale in New York. “I’ve said pretty consistently we could get to 3%, which is more of a mechanical trade, not really a key technical level, but beyond that I just don’t see how we could keep going higher.”

Rajappa said that much of the move higher in yields has been driven by a momentum trade and she sees U.S. growth this year hovering around 2%, which would weigh on long-term inflation expectations given the amount of fiscal stimulus that has been pumped into the U.S. economy by tax cuts and spending increases by Congress.

Lou Brien, rates strategist at DRW Trading in Chicago, said that the lack of wage increases for workers has shown no sign of relenting, as the number of unions remains historically low and employees have limited negotiating power. That means that even as corporate earnings rise, workers have been unable to increase their share of the profits, meaning they have less to spend as consumers.

People are also taking on more debt, Brien said, with indebtedness rising to its highest levels in years in a number of readings. Consumer spending rose by its fastest pace in more than a year, spurred by increases in consumer credit (up 7.8%) and mortgage borrowing (up 3%). Spending on U.S. general purpose credit cards surged 9.4% last year, to $3.5 trillion, according to industry newsletter Nilson Report.

With debt rising and wages not keeping track, consumers will have to make either/or decisions about their spending, making it more difficult for businesses to raise prices.

“I go back to the idea that inflation and inflation expectations is the key determinant of long-term rates,” Brien said. “Therefore I come back to the [question] of who can afford inflation when you’ve got to pay all that credit card debt each month. Because you just make other choices.”

A recent survey by Bloomberg found that more than half of the 56 analysts surveyed expect the 10-year yield to end 2018 within 25 basis points of 3 percent, meaning a range-bound remainder of the year.

Some see rates going higher

Not everyone is convinced rates are set to stick around their current levels. Moody’s Investor Service said it expects rates to rise to 4%, but not until 2020, and only after a “modest correction” in asset prices.

“We believe U.S. growth will remain resilient,” Moody’s economist Elena Duggan said in a note. “However, rising rates will put pressure on refinancing costs for highly leverages [sic] companies and households.”

There’s also the matter of overseas investors buying U.S. Treasuries because they offer significantly higher yields than comparable developed market government debt. The spread between 10-year U.S. Treasuries and 10-year German government bonds, or Bunds, has widened to near its highest level in a decade recently. As more investors seek the higher return of U.S. interest rates, it pushes prices up and yields down.

Societe Generale’s Rajappa said she expects the gap between Treasuries and Bunds to thin as the euro zone’s economy continues to improve and the European Central Bank slows its bond-buying program. However, that will be the result of Bund yields rising and U.S. yields remaining near their current level.

Weighing further on interest rates is the fact that the Federal Reserve’s interest rate hiking cycle is just beginning to impact the market, said BMO Capital Markets Head of U.S. Rates Strategy Ian Lyngen.

“When a central bank tightens policy it slows the economy and it cuts inflation,” he said. “We have no inflation to speak of; the economy is good, not great; and there’s a 12-18 month lag between monetary action and it flowing through to the real economy. So [the real economy is] just now starting to feel the impact of the first two or three rate hikes.”

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.