Emerging markets see net outflow for the first time since November 2016

In the latest sign that investors are losing their appetite for risk, emerging markets’ stocks and bonds showed their first net outflows among non-resident investors in nearly a year and a half last month, a recent study from the Institute of International Finance (IIF) shows.

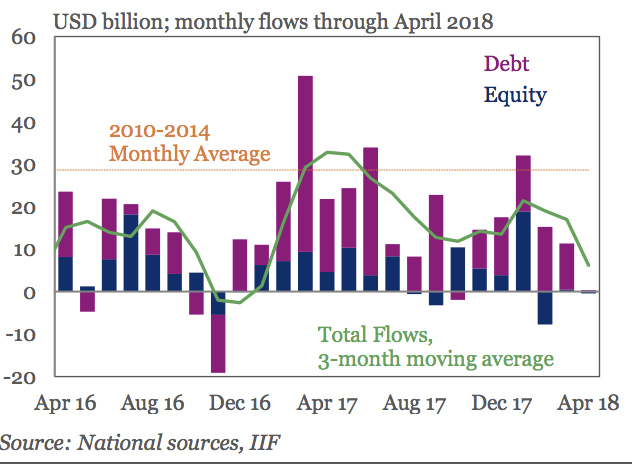

The most jarring decline was in emerging market bonds, which fell from $11 billion of money flowing in during March to just $0.3 billion of inflows last month. EM stocks recorded outflows of $0.5 billion, IIF said. The biggest outflows came from Asia, with emerging market nations in that region losing $7.8 billion during the month.

The net outflows from non-resident investors in April was the first time the asset class has seen a net pullback of investment since November 2016 when EM investors expected U.S. President Donald Trump’s election to hurt the growth of many emerging countries by delivering on campaign trail promises to scrap trade agreements and take a hard line on deals with China.

The IIF reported last week that $5.6 billion flowed out of emerging market bonds and stocks during just the April 16-25 timeframe. The sharp turnaround in positive flows that had gone to the asset class for most of the year was sharpest on April 23 as the U.S. 10-year Treasury note’s yield (^TNX) approached 3%, triggering the organization’s “reversal alert,” which denotes an unusually large turnaround in asset flows.

“EM debt flows were hit particularly hard, in ways reminiscent of the taper tantrum in May 2013,” IIF’s Sonja Gibbs, Emre Tiftik and Fiona Nguyen said in the release. “This highlights the sensitivity of EM portfolio debt flows to U.S. rates. The main driver has been the breach of 3% by U.S. 10-year Treasury yields for the first time in over four years, in part reflecting concerns about the projected rise in the U.S. Federal budget deficit.”

The 2013 taper tantrum was a major investor pullback in emerging market stocks and bonds after the Federal Reserve announced it would begin to ease, or taper, its quantitative easing program and raise U.S. overnight interest rates from near 0%. EM assets saw massive outflows after the comments from then-Fed Chair Ben Bernanke with U.S. equities plunging and bond yields shooting higher.

Despite significant volatility for much of this year, including February when declines in U.S. stocks sent EM investors into a panic, April marked the first time all year that flows for the entire month in both stocks and bonds were negative.

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.