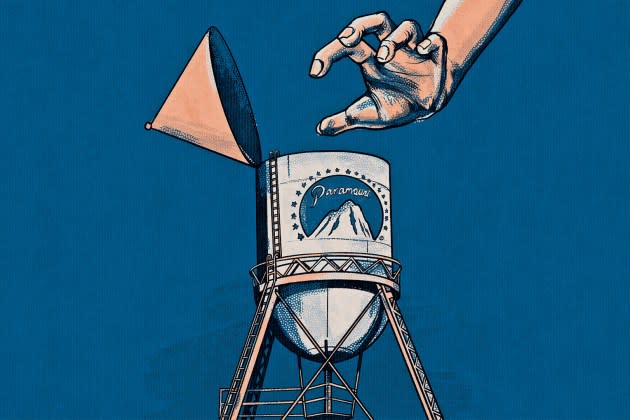

What’s Next for Paramount? Shari Redstone Has a Preferred M&A Path

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Will Shari have to break up the band? Or is a comeback on the horizon for Paramount Global?

More than four years after Shari Redstone won the battle to merge Viacom and CBS, the entertainment mogul is at a crossroads in the M&A soap opera that threatens to envelop her beloved but beleaguered media empire.

More from Variety

Redstone, non-executive chair of Paramount Global and its controlling shareholder, is understood to have been unimpressed by the recent $11 billion offer for the Paramount Pictures film studio from Apollo Global Management and Legendary Entertainment. Team Redstone is known to be in discussions with David Ellison’s Skydance Media on a partnership that would ultimately bring together Paramount Global, Skydance and Redstone’s National Amusements Inc. holding company in what has been described as a complicated two-step transaction.

Those talks have been going on for months, while Paramount Global’s market cap has sunk to less than a third of its $30 billion valuation at the time Viacom and CBS Corp. became one in December 2019.

If Paramount Global were to sell the studio business, “the rest of the company may appear hollow,” MoffettNathanson analysts led by Robert Fishman and Michael Nathanson wrote in a March 20 research note. Such a transaction “would be a fundamental shift in a flywheel for businesses already in decline.” On the other hand, Apollo’s bid “could help Paramount secure an increased price for the whole company if that is the preferred path without having to break up the company,” the analysts wrote.

The Apollo bid was worth more than Paramount Global’s $7.8 billion market cap as of March 25, a premium Redstone can’t ignore. Paramount Pictures is seen as the media conglom’s most monetizable asset: It owns or has rights to more than 3,500 movie titles, including the “Star Trek,” “Godfather,” “Transformers,” “Indiana Jones,” “Scream” and “Mission: Impossible” franchises, plus popular prestige pics like “Forrest Gump” and “Titanic.” (Paramount Global, Apollo and NAI have declined to comment on the M&A talks.)

For Paramount Global, selling itself in pieces would be “value-destructive,” David Joyce, a media and entertainment analyst at Seaport Research Partners, wrote in a note. Carving off sections of the Paramount mountain would be complex, given the interconnectivity of the IP among the various film and TV studios under its umbrella, Joyce noted. It also would disrupt existing synergies among Paramount Global’s three segments: TV media, filmed entertainment and direct-to-consumer streaming.

Market conditions may compel Redstone to pull the rip cord on an M&A solution sooner rather than later.

In a sign of the urgency of the situation, Paramount Global was placed on “credit watch negative” by S&P Global on Feb. 23 because its free operating cash flow generation remains “weak” relative to peers given its smaller scale and the ongoing decline in linear TV and streaming losses, and because it is shouldering a $14.6 billion debt load as of the end of 2023. S&P warned that it could cut Paramount’s credit rating (from its current BBB-, S&P’s lowest investment-grade rating), which would put more pressure on the company’s balance sheet.

The Skydance deal is understood to be attractive to the powers that be at Paramount Global because of the familiarity factor. The companies have worked together for more than a decade in producing and distributing movies such as the “Mission: Impossible” and “Transformers” franchises. At this stage, the big question seems to be whether Redstone is ready to give up a significant chunk of her iron-clad control in order to keep the assets assembled by her late father, Sumner Redstone — Paramount Pictures, CBS, Nickelodeon, MTV, VH1, Comedy Central, BET, CMT and more — under one roof.

By multiple accounts, Redstone at present is determined to tune out the short-term noise while she considers her long-term options. Brushing aside a $3 billion-plus premium for Paramount Pictures suggests she still sees bigger things and brighter days ahead for the house that Redstone built.

Best of Variety

From 'The Idea of You' to 'Apples Never Fall': The Best Book-to-Screen Adaptations to Read This Year

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.