PayPal Skyrockets After Earnings Beat

PayPal Holdings Inc. (NASDAQ:PYPL) reported its second-quarter earnings on Tuesday, revealing a staggering $6.8 billion in quarterly revenue, which beat its estimate by $20 million. Moreover, the company managed to taper its expenses to surpass its bottom-line earnings target by 6 cents per share.

Much of the company's successful quarter was due to embedded growth instead of inflationary pass-through to its consumers. For example, PayPal's total payment volume reached 339.8 billion, posting 13% growth on a currency-neutral basis.

Furthermore, the company added 400,000 new accounts in the quarter, accumulating to approximately 429 million active accounts (a 6% year-over-year increase).

Looking ahead, PayPal is one of the few blue-chip companies that expect accelerated growth in the second half of the year. Many of the world's leading companies expect softening earnings due to a fading economy. However, the company's management is bullish and believes it will achieve a net account increase of 10 million by the end of its financial year. Additionally, it is thought that PayPal will reach an earnings per share target of $3.97, which is higher than its previously estimated $3.85.

Key drivers

Even though competition is rising in the digital payments space, PayPal maintains its broad-based market dominance, resulting in a five-year compound annual growth rate of 18.03%.

With new offerings such as "buy now, pay later" and a variety of high-growth subsidiaries like online coupon tracker Honey, PayPal is able to maintain its growth trajectory.

Another factor worth considering is the company's ability to cannibalize. It is well known that the digital payments space has received a large influx of new competitors. However, with the economy tilting, many of the smaller players might suffer severely, leaving PayPal in a position where it can absorb short-term financial headwinds to drive out much of the rising competition.

Valuation

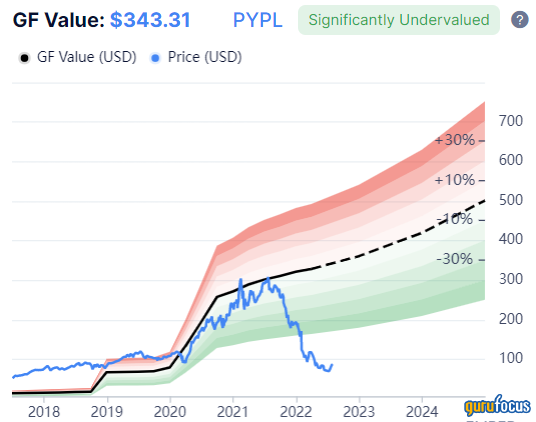

According to the GF Value Line, PayPal's fair value is around $343 per share, meaning the stock's traded price is likely mispriced by the market.

PayPal is also undervalued on a relative basis. For instance, the stock's price-to-cash flow and price-earnings ratios are at normalized discounts of 58.48% and 53.42%, respectively, implying the stock is trading below its cyclical peak.

Concluding thoughts

PayPal produced a triumphant second quarter by beating earnings estimates. Additionally, the company raised its guidance and expects a robust year-end earnings report with consistent user growth.

The stock is undervalued based on certain metrics, conveying that a value gap is present.

This article first appeared on GuruFocus.

generic

generic