How the Major Streamers Stack Up Right Now in Subscribers and Revenue | Charts

Entertainment stocks have been battered in 2022 as competition in the crowded streaming field heats up and economic uncertainty weighs on consumers’ wallets.

Shares in the major Hollywood companies with streaming services are all down double digits year to date: Disney (36%), Netflix (46%), Paramount Global (36%), Comcast (29%) and Warner Brothers Discovery (54%).

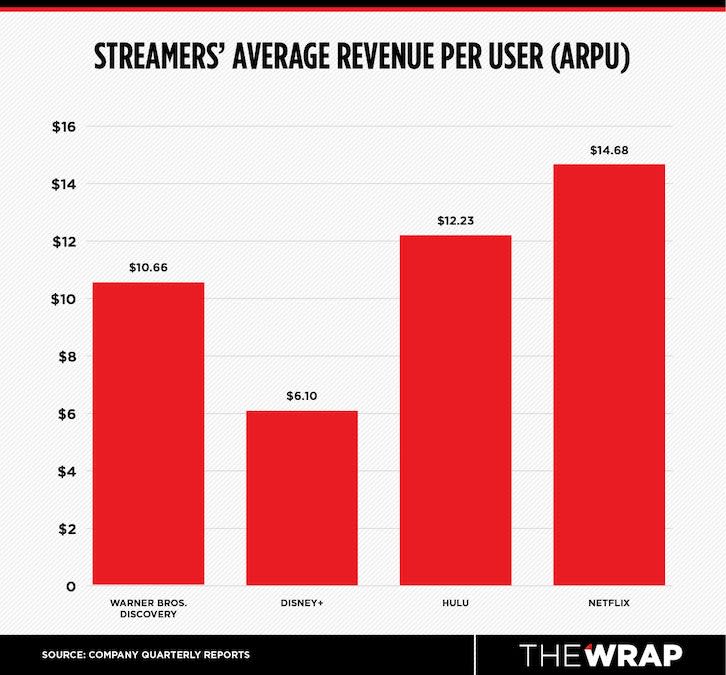

So how do the major streamers stack up? Well, analysts have focused on two key metrics — total subscribers, particularly newer services looking to gain a foothold in the space and achieve some scale to justify their heavy spending on content, and the average revenue per user, a measure of just how much those subscribers are contributing to the bottom line.

It’s worth noting that two of the biggest streamers, Amazon Prime Video and AppleTV+, don’t release subscriber or ARPU figures. (Amazon said last year that more than 200 million Prime members worldwide streamed its content.) Both are divisions of tech giants for whom video streaming is seen as an ancillary operation, at least for now.

Also Read:

Netflix Blew a $100 Million-Plus Box Office Windfall From ‘Glass Onion’

Netflix

Netflix gained 2.41 million paid subscribers in its third quarter for a total of 223.09 million paid subscribers. That came after the company reported its first drop in subscribers in a decade, for both of the first two quarters — a shocker that sent the stock price into freefall and battered the entire streaming sector.

As a result, the company sped up plans for a cheaper $6.99-per-month ad supported tier called “Basic With Ads” in the U.S. and 11 other markets. There are no figures yet for the new service, which launched last month, but the hope is that it will generate a new revenue source without shedding too many existing subscribers seeking a less expensive option.

Executives also teased that Netflix will begin monetizing account sharing in early 2023 as it looks to tap further into households giving their passwords to friends and family. The company has previously estimated that 100 million households in the U.S. and Canada are sharing passwords.

Looking ahead, the streaming behemoth is expecting to add 4.5 million paid subscribers in the fourth quarter for a total of 227.59 million paid subscribers. But that transparency may soon be history. The company also said it would no longer provide guidance for paid membership starting in the fourth quarter, but noted it would continue to provide global and regional subscriber breakdowns.

In addition to dominating in total subscribers, Netflix has led the pack on average revenue per user, racking up $16.32 in the U.S. and Canada, $10.81 in the Europe, Middle East and Africa region, $8.58 in Latin America and $8.34 in the Asia Pacific region.

Disney+

In the quarter ending Sept. 30, Disney+ gained 12.1 million subscribers for a total of 164.2 million, up 39% from 118.1 million during the same period a year ago. Despite the gain, the company’s direct-to-consumer division posted a record loss of $1.47 billion, with profitability for Disney+ not expected until September 2024 — assuming there is no overall economic downturn.

One key factor in the dismal financials: Disney+ has lagged behind its rivals with an ARPU of just $6.10 domestically, and $5.83 internationally when excluding the Indian service Disney+ Hotstar. When you factor in Hotstar, that ARPU figure plummets to a measly 58 cents.

Disney’s disappointing earnings results prompted a leadership shakeup, with Bob Iger returning as CEO for the next two years, replacing his successor Bob Chapek. Iger has already begun a reorganization of Disney’s Media & Entertainment Distribution formed under Chapek, which has included the departure of DMED head Kareem Daniel.

“Every transaction that occurs at this Company emanates from some form of creativity, and therefore it is my No. 1 priority. It is the focus,” Iger told Disney employees at a town hall on Nov. 28. “It’s not about how much we create. It’s about how great the things are that we do create. That’s what we’ll be focused on with an incredible team of creative executives across the Company.”

Iger’s appointment comes ahead of the Dec. 8 launch of Disney+’s $7.99-per-month ad-supported tier. In tandem with the move, the monthly cost of ad-free Disney+ will increase from $7.99 to $10.99. Disney also continues to leverage bundling with ESPN+ and Hulu, which accounted for over 40% of the fiscal year-end domestic Disney+ subscriber count.

Also Read:

Bob Iger’s Disney To-Do List: The 7 Biggest Things the Returning CEO Needs to Fix Now

Hulu

Hulu gained a total of 3.4 million subscribers during the quarter for a total of 47.2 million, compared to 43.8 million a year ago.

Hulu’s SVOD service counted 42.8 million subscribers, an 8% increase from 39.7 million during the same period in 2021, while Hulu and Live TV made up the remaining 4.4 million subscribers, a 10% jump from 4 million during the same period in 2021.

Disney recently raised the price of ad-free and ad-supported Hulu to $14.99 and $7.99 per month, respectively. Starting Dec. 8, bundles with ad-supported Hulu will cost between $9.99 and $14.99 per month, while the ad-free Hulu bundle will cost $19.99 per month. Hulu and Live TV bundles will cost between $69.99 and $82.99 per month.

Hulu is actually No. 2 in ARPU among all the top streaming services, boasting an average of $12.23 for its SVOD service. Combined ARPU from Hulu and Live TV and SVOD was a whopping $86.77.

A major question Iger will need to address is what the future of Hulu looks like in Disney’s overall streaming strategy. While Chapek has previously expressed an interest in combining Hulu with Disney+, doing so would require exercising the company’s option to buy out Comcast’s minority stake as early as January 2024.

HBO Max/Discovery+

Warner Bros. Discovery — which owns HBO, HBO Max and Discovery+ — reported a total of 94.9 million direct-to-consumer subscribers across all its platforms, an increase of 2.8 million from the previous quarter. The figure includes 53.5 million domestic subscribers and 41.4 million international subscribers.

The company expects to incur up to $4.3 billion in pre-tax restructuring charges, according to a U.S. Securities and Exchange Commission filing in October. The restructuring is expected to be substantially completed by the end of 2024 and result in around $3.5 billion in cost savings.

On the revenue side, Warner Bros. Discovery boasted global ARPU of $7.52, domestic ARPU of $10.66 and international ARPU of $3.68.

Looking ahead, the company plans to combine HBO Max and Discovery+ into one streaming service, with a U.S. rollout expected in spring 2023.

“By 2023, HBO Max will not have raised its price since its launch,” Jean-Briac Perrette, president and chief executive officer of Warner Bros. Discovery’s Global Streaming and Interactive division, added during the company’s Nov. 3 earnings call. “So it will have been three years, since pricing has moved, which we think is an opportunity, particularly in this environment.”

Also Read:

Paramount Global Debuts Pluto TV in Canada

Paramount+

Paramount Global’s global direct-to-consumer base has reached a total of nearly 67 million subscribers, with Paramount+ gaining 4.6 million subscribers in its latest quarter for a total of 46 million. However, 1.9 million subscribers were removed following the launch of its replacement, SkyShowtime, in the Nordic nations. Meanwhile, the company’s free ad-supported streaming service, Pluto TV, reached 72 million monthly active users globally.

The company has not disclosed its average earning per paid user, but Bloomberg Intelligence estimated that Paramount+’s global ARPU was $5.13 for its latest quarter.

During Paramount’s Nov. 2 earnings call, CEO Bob Bakish warned the company would undergo a restructuring due to “ongoing macroeconomic pressures” impacting the industry and advertising market. “As we navigate this period, Paramount will continue to rely on the fiscally disciplined approach that has been our advantage in good times and bad,” Bakish said. “We have always been mindful of cost management as a company, and we are now taking additional steps to improve efficiency across our organization.”

The steps include a reorganization of Showtime and Paramount Television Studios into other parts of the company and a reassessment of its international operations, marketing and ad sales units. Taht’s led to layoffs impacting ad sales, CBS Studios and Paramount Television Studios divisions and an executive shakeup that has elevated Amy Reisenbach to CBS Entertainment president.

Also Read:

Is Lack of Star Power on ‘The Crown’ Season 5 Tanking Demand for the Show? | Charts

Peacock

At the end of the third quarter, Comcast’s Peacock had more than 15 million paid subscribers in the United States. Additionally, executives noted on the company’s latest earnings call that Peacock had approximately 14 million bundled and free users — totaling around 30 million monthly active accounts.

Comcast also has not officially released ARPU figures for its streaming services, though NBCUniversal CEO Jeff Shell told CNBC on Oct. 4 that Peacock is “doing an ARPU of close to $10” on its paid subscribers.

Shell has also emphasized that the long-term aspiration for Peacock is to balance out the company’s media business. “We’ve said all along that our strategy in streaming is different than some of the premium SVOD players like Netflix and Disney+. We view it as a part of our business,” he explained. “We manage it as one. We make decisions on programming as one. We sell advertising across the business as one. And as viewership shifts from linear to Peacock, we want Peacock to get to a level and a scale that causes our business to be balanced as consumer sentiments and advertiser sentiments change.”

Looking ahead, the company expects Peacock’s losses for 2022 to total roughly $2.5 billion, with a loss in the fourth quarter reflecting the cost of new content. In the third quarter, Peacock posted revenue of $506 million on an adjusted loss of $614 million.

Also Read:

Why Paramount’s Streaming Strategy Places It in a Precarious Position | Charts

generic

generic