Eastern Caribbean CBDC ‘DCash’ Goes Offline for Over 2 Weeks

The Eastern Caribbean Central Bank (ECCB) has been forced to crash its digital currency project – dubbed DCash, citing technical issues.

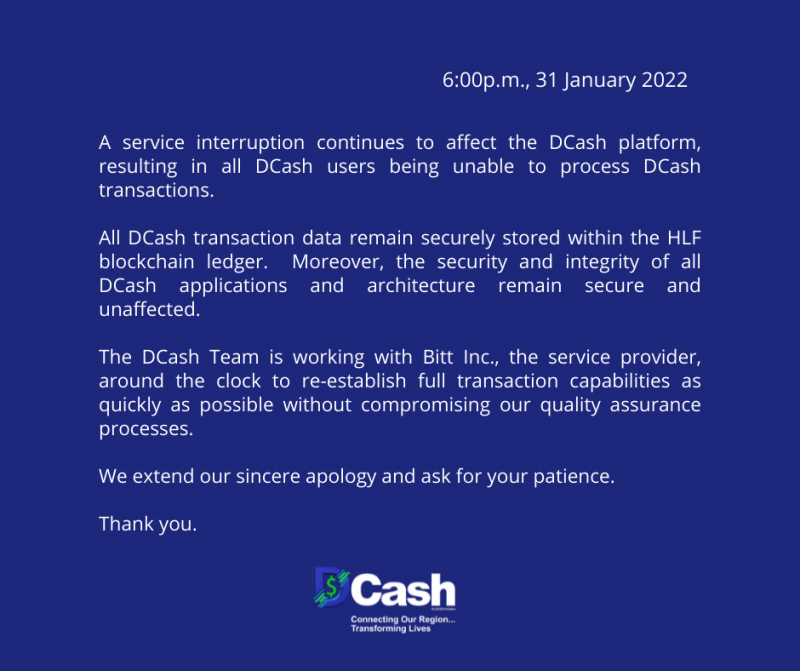

DCash, the central bank digital currency (CBDC) used by seven Caribbean nations, went offline two weeks ago, impacting the ability of users to complete transactions on the platform.

The outage which reportedly began on January 14, still remains offline and the bank is uncertain when it will resume.

DCash is a joint deal signed by the bank and the Barbados-based fintech Bitt, which also facilitated the launch of Nigeria’s eNaira. Antigua and Barbuda, Grenada, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent are now using the digital dollar, launched in March 2021.

Karina Johnson, a DCash project manager at the bank told Bloomberg that officials are working “round the clock” with the Bitt team to quickly “re-establish full transaction capabilities.”

“The security and integrity of all DCash applications and architecture, including all central bank and financial institutions, and merchant and wallet apps remain secure and unaffected,” Johnson stated.

Users Relate It to “Badly Designed” CBDC

The DCash platform going blank has left holders of the CBDC in limbo. The ECCB said in a statement that it is “fully aware of the impact of this service interruption.”

The bank has been sanguine in restoring the interruption stating that it is an “unfortunate” situation.

However, users took a toll on social media, criticizing DCash as a “badly designed CBDC.”

Eastern Caribbean CBDC pilot DCash goes down https://t.co/nmp1SrrLNQ

"A key criticism of CBDC is that if the network goes down, the entire country’s citizens can’t use their money"

That's a key criticism of badly designed CBDCs, not CBDCs in general.

— Dave "Woking 9 to 5" Birch (@dgwbirch) January 31, 2022

DCash, similar to Bitcoin and Ethereum, has been enabling users to make payments and transfers in real-time without fees, without the need for a bank account to participate.

The recent technical issues mean that the payment system cannot upgrade till it resumes and that some transactions have failed. This has disappointed a number of users across the seven Caribbean nations and the bank said it will “honor” these when back online.

Offline Use of CBDCs

One of the challenges identified by many central banks is how to ensure that the CBDCs can still be accessed offline.

CBDC service partners such as Bitt, G+D, ConsenSys, and Accenture have been providing technical support to the digital currency projects, which means that technical outages like these could impact more than one country.

To resolve such issues, many central banks and private partners have come up with offline CBDC solutions. But such transactions if not with a secure solution could open themselves up to digital counterfeiting.

Payment giant Visa, for instance, released a white paper in December 2020, that addresses some of the security problems of CBDC offline payments.

This article was originally posted on FX Empire

generic

generic