NVIDIA: The 2016 Yahoo Finance Company of the Year

The Trump rally. The energy recovery. The resurgence of Wall Street. Think those are the year’s big financial stories?

They’re interesting, sure. But something much bigger is going on at one company most Americans have never heard of.

Shares of Nvidia (NVDA), the nation’s 314th biggest public company—and rising fast—have nearly tripled in price this year. That sort of explosive growth happens sometimes at startups that catch a megatrend, or at floundering companies left for dead that dig themselves out of a perilous hole. Nvidia—pronounced en-VID-ee-ah—is neither. It has been around since 1993, making processors that power video games. And though it struggled a few years ago, Nvidia now enjoys a surprising near monopoly on some of the most promising technologies of the future.

Nvidia’s unseen processors help power Google searches, Amazon’s Alexa digital assistant, Tesla’s self-driving cars and movie recommendations on Netflix. They’re also the brains behind breakthroughs in artificial intelligence that are wowing researchers. “It’s destiny meets serendipity,” CEO Jen-Hsun Huang tells Yahoo Finance. “People think it’s an overnight success, but like most overnight successes, it took us years.” Investors, it turns out, are piling into Nvidia because they expect it to leapfrog traditional chipmakers such as Intel (INTL) and AMD (AMD), to power the next wave of computing. We see their point, and have chosen Nvidia as the Yahoo Finance Company of the Year, joining past winners such as Facebook (FB), Under Armour (UA) and Disney (DIS).

A tour of Nvidia’s campus in Santa Clara, Calif., in the southern half of Silicon Valley, could leave you wondering if the company suffers from strategic schizophrenia. Punked-out gamers share office space with hypereducated researchers who talk of using artificial intelligence to cure cancer and fight poverty. In one corner, there’s a couch-filled fun room demonstrating the latest in virtual-reality entertainment; in another, an atomic microscope able to see each of the 18 billion transistors on a chip the size of a cocktail napkin.

There’s a common denominator, however, that links it all together—something called a graphics processing unit, or GPU, analogous to the CPUs that began powering PCs in the 1980s. Huang and two co-founders started Nvidia in 1993 with a plan to improve the blocky, primitive quality of computer-game graphics. The company name was meant to connote enviable video images on a computer screen. There were a lot of competitors, but Nvidia updated its products rapidly and consistently, and invented the GPU in 1999, becoming the lead provider of hardware that allowed games to run smoothly and feature rich, realistic graphics. Revenue rose 11-fold from the company’s fiscal year 2000 through 2008.

The recession that erupted that year led to two years of losses, and there was another problem: the rise of mobile devices and the decline of PCs threatened to make Nvidia a fading legacy company. Nvidia tried to develop a version of its hardware for mobile devices, but it didn’t work out. That product, however, turned out to be a good fit for dashboard and console displays in cars. So Nvidia got into the car business, selling automakers GPUs that enable distinctive, game-quality graphics on dashboard displays for music, climate and map settings. “We’re in over 10 million cars,” says Danny Shapiro, Nvidia’s senior director of automotive. “A Tesla, with its nice big touchscreen, is driven by Nvidia. Audis, with their controller and their navigation and the virtual cockpit, that’s Nvidia.” There’s still a ton of upside, however, since global automakers sell about 90 million cars each year.

Artificial intelligence applications

In 2012, the serendipity happened. Academic researchers discovered that Nvidia’s GPUs were able to provide the massive computational power required in the burgeoning field of artificial intelligence. GPUs are known as “parallel” processors because they can conduct billions or trillions of operations at the same time. CPUs, by contrast, are good at running many different types of code, making them an efficient, all-purpose platform for computers and mobile devices that do a lot of different things. Compared with GPUs, however, CPUs are computational slow-pokes.

In a stroke of luck, or foresight, or both, Nvidia also began to write software that accompanied its GPUs and made them programmable, so they could be tailored to whatever a user wanted to do with them. “They wrote very, very good software,” says James Wang, a former Nvidia product manager who’s now an analyst for ARK Invest, which has a long position in Nvidia. “They had to be the top 1% of programmers to even try that.”

Interest in artificial intelligence, which is basically the ability of software to program itself, has exploded since 2012. Computations that once took weeks or months are now done in hours or minutes, with advances occurring far faster than predicted by Moore’s Law, which holds that processing power on conventional CPUs doubles every two years or so. And Nvidia suddenly cornered the market on the processors that made it possible. Its main competitor on graphics chips, a company called ATI, was bought by AMD in 2005, and its products fell out of favor as AMD began to struggle amid the PC slowdown. Nvidia, by contrast, started to land big clients such as Google parent Alphabet (GOOGL), Facebook, IBM (IBM), and Amazon (AMZN), which need AI capabilities for their huge cloud-computing operations. There are also hundreds of research labs and at least 1,500 startups worldwide developing AI applications, most of them using Nvidia’s GPUs as the technology backbone. Overall, Nvidia is working with 20,000 companies on AI applications.

AI is still the domain of geeks, but the “deep learning” it allows machines to accomplish could transform the everyday lives of ordinary people more than any computing development to date. Traditional software can only do what programmers tell it to do. That means programmers have to anticipate every scenario that could possibly occur and provide if/then instructions telling the software how to react. AI is different because the software can learn what to do by observing and analyzing gargantuan amounts of data, noticing patterns on its own and coming up with solutions governed by a set of rules. Huang calls AI “a Thor’s hammer that fell from the sky.” “We can finally use computers to solve problems no human software engineer could previously develop software for,” he says. “This is a big deal. There are too many problems in life where there are no easy equations for it.”

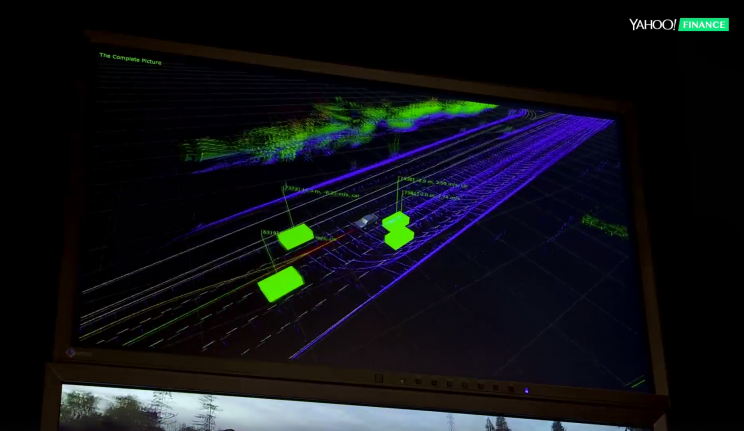

Self-driving cars require AI, for example, because programmers can’t possibly anticipate every combination of factors that could pose a danger on the road. Medical researchers and pharmaceutical firms hope to use AI to discover new drugs and disease cures by seeking insights among troves of data that human researches could never crunch on their own, even if armed with supercomputers. Many AI applications require the ability to analyze millions of images, to figure out the difference, say, between a normal biological cell and one with a slight imperfection.

At a more familiar level, AI enables voice recognition by Siri, Alexa, Cortana and other bots humans have begun talking to, along with shopping recommendations provided by Amazon, movie recommendations provided by Netflix (NFLX), personalization offered by Pinterest and many other advanced web features becoming commonplace. If you’re not impressed yet, just wait a few months; you will be.

During the last 12 months, Nvidia’s eclectic portfolio of bets began to pay off on the top and bottom lines, which both exceeded anybody’s expectations. In the latest quarter, revenue soared 40% compared with the prior quarter, and 54% from the same quarter in 2015. Net income was up 108% quarter-over-quarter and 120% year-over-year. The blowaway results pushed Nvidia’s stock up 30% the day they were announced, adding $11 billion to the company’s value in a single trading session. The company now employs more than 10,000 people, up 800 in the last year alone.

Nvidia’s good fortune has also made Huang, the founder and CEO, an unlikely billionaire. Huang was born in Taiwan to parents who spoke scant English and wanted to send him and his brother to the United States, to learn the international language of business. They located a school in rural Kentucky that would take the two boys—but mistakenly thought it was a prep school when in reality it was a reform school for delinquents. The two brothers toughed it out, with Huang becoming a teenage table-tennis champ. When the parents finally arrived in the States, they settled in Oregon, with Huang earning an electrical engineering degree from Oregon State. He followed that with a master’s degree in the same discipline from Stanford, and started Nvidia shortly after that. He now owns 21.5 million shares in the company—about 4% of the total—which are worth roughly $2.1 billion.

A generation of gamers

Nvidia’s numbers look more remarkable when you break down where they’re coming from. Gaming—the company’s original market—accounted for 62% of revenue during the latest quarter. And that was up 63% year-over-year. Most legacy businesses mature and flatline, but gaming is a $100 billion industry enjoying a kind of second life, with worldwide revenue growing by more than 8% per year. The PC segment, where Nvidia is strongest, pulls in $27 billion and is growing around 5% per year. Fueling the growth: high-end gaming PCs able to run remarkably realistic games, the new phenomenon known as esports (or electronic sports) and the ubiquity of mobile apps that hook young users on games the moment they start using a smartphone or tablet. “Almost everybody who grows up today grows up a gamer,” says Jeff Fisher, who’s in charge of Nvidia’s gaming division. “As a result, there’s just a ton of energy and a ton of investment in this space.”

Nvidia is also emerging as the lead supplier for the platforms that will serve as the brains for self-driving cars, which could become a $40 billion industry within a decade. But that revenue is just beginning to trickle in, with most of Nvidia’s automotive business still coming from display chipsets. Again, the current business generates healthy cash flow while future business looks even brighter.

AI may represent the company’s biggest source of growth in the future, even though revenue from that division is still small, as well. The overall mix of the large-and-still-growing businesses, with key investments in the most fertile technologies of the future, explains why investors love the company. “The gaming business provides the scale,” says Wang of ARK Invest. “If a 5-person startup did this, it would be very costly. Because Nvidia sells tens of millions of gaming GPUs every year, they have the gaming business to subsidize the whole effort. It’s kind of like Google has its search business subsidizing the whole rest of the company.”

Room to run

Is Nvidia a bubble? Wall Street doesn’t think so. Even with the stock up 193% so far this year, 28 analysts surveyed by S&P Capital IQ predict the stock will outperform, on average, during the next 12 months. S&P forecasts that revenue will grow another 29% during the next two years, with the profit margin rising to 25%, which would be higher than Apple’s current margin. No wonder the popular refrain among investors following the company is that Nvidia is the next Intel.

Nvidia’s success has obviously caught the attention of competitors, or rather, companies that hope to become competitors. “Now that these applications have become very hot, there’s definitely competition on the horizon,” says Mark Hung, a research vice president at Gartner. Intel has announced two acquisitions during the last year meant to beef up its AI offerings. AMD is investing more in the graphics business it acquired in 2005 in a bid to catch up with Nvidia. And big cloud operators like Alphabet and Facebook are developing their own AI technology, perhaps so they can bring the capability in-house instead of relying on Nvidia.

Still, Nvidia’s early foothold in the industries of the future could become an enduring edge. “First mover advantage in some of these industries is quite significant,” says Hung. “Even if there are more competitors, if the overall pie is growing faster than the competition, then it’s still a good story.”

Huang, the CEO, likes to say the development of AI is in the first at-bat of the first inning, and he foresees far more dramatic change ahead than the digital era has produced so far. “The AI revolution will be the largest computing revolution ever,” he says. “This is the first computing technology that has come along in a long time that we can imagine affecting every single industry.” If it’s not affecting yours, it soon will be.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman.