What to Watch: As Pandemic Shopping Shifts Cement, Beauty Brands Broaden Distribution

In an effort to meet shoppers wherever they may be, beauty companies are leaning into broader distribution.

Courtesy Photo

More from WWD

Why the Fiorucci Store Was the Mother of All Retail Concepts

Unites States Retail in the Aftermath of Police Brutality Protests

Drunk Elephant and Tatcha are now sold at Kohl’s, via Sephora, and Clinique and Shiseido are at Target, via Ulta Beauty. Brands are also experimenting with shop features on Instagram, TikTok and Snapchat, as well as livestreaming platforms, such as Newness. Amazon has also launched livestream shopping.

It’s a major shift for an industry that long thought broad or mass distribution would tarnish brand reputations.

“There’s less snobbery, maybe, about what environments you’re in. It’s coupled in recognizing that people’s shopping behaviors have changed,” said Lucie Greene, futurist and founder of Light Years.

The change was brought on at least in part by the pandemic — when stores closed temporarily and shoppers moved online or to mass retailers where they could buy everything in one place.

“We saw in the pandemic that Amazon and then mass, drugstore and grocery became outlets for beauty, and to their credit they responded very quickly to elevate their offer,” Greene continued. “At the replenishable level, even if it’s somewhat premium like YSL Touche Éclat … I don’t think it would tarnish a brand’s reputation to have it in a vending machine or in a drug or mass environment.”

Larissa Jensen, vice president and beauty industry adviser at the NPD Group, said the shift has been a long time coming, and represents the beauty industry letting go of some of its long-held but inaccurate ideas around brand perception.

“This is not necessarily a new concept. We’re just catching up to what the consumer has been wanting all along,” Jensen said. “There are these lines that are drawn internally from an industry side, not a consumer side. We talk about mass, we talk about prestige, but at the end of the day from the consumer’s view, none of that even matters.

“From a consumer perspective it’s like, Oh, my God [X brand] is in Target — great. They’re not thinking [X brand] is no longer a luxury brand,” she added.

When it comes to true luxury brands selling products in the hundreds of dollars, the emerging accessibility approach does not apply, experts said.

“Scarcity, 100 percent, is something that elevates the feeling of luxury,” Greene said, referencing the Hermès beauty line and limited-edition fragrance projects from Louis Vuitton.

But for brands and retailers under those price points, broader distribution has the potential to bring in new customers — and many companies are leaning into experimentation.

courtesy

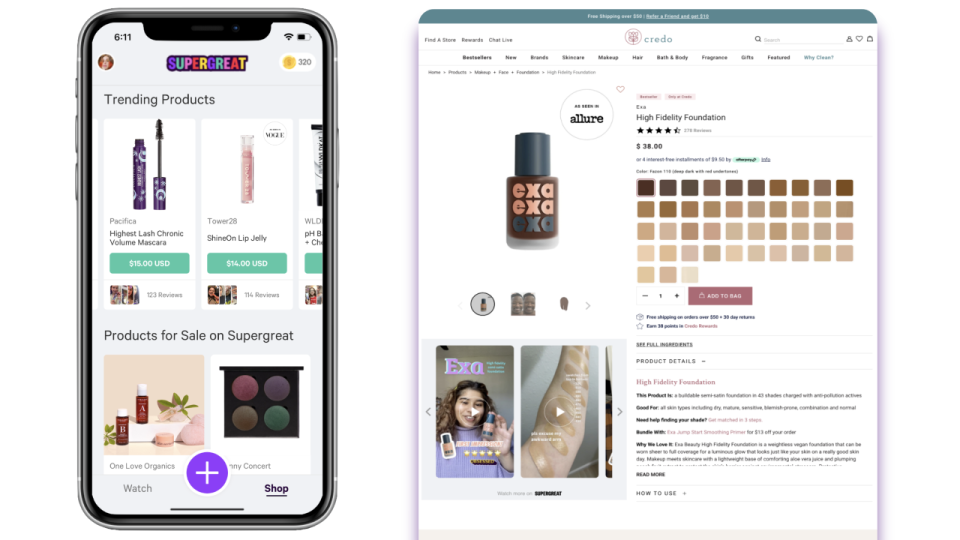

This January, beauty retailer Credo is set to launch an expanded partnership with beauty review community Supergreat. The partnership, a three-month test, will allow Supergreat viewers to shop Credo products via livestream in the Supergreat app. Credo’s entire catalogue of more than 100 brands and 1,200 stock keeping units has been integrated into Supergreat via Shopify, the companies said.

“Superhosts will be able to tag products in their lives and the customers watching it will be able to shop those products,” said Sophie Streimer, marketing assistant at Credo. “It feels like you’re just FaceTiming with your friends.”

Last year Credo had begun working with Supergreat to include the app’s user-generated views on brand pages on the website.

“You can see those reviews on the pages, and our brands are very excited about that because they’re getting more reviews and they’re very authentic,” Streimer said. “Being able to watch people actually see a swatch on their face or on their arm, it’s really helped with purchasing behavior.”

Credo’s goal is to add new customers, Streimer said, especially Supergreat’s Gen Z and Millennial users. “We’ve already seen that with the streams we’ve been hosting. The viewer knows what clean beauty is, they’ve heard about it but don’t really know what it means, nor do they know what Credo is. It’s been a great opportunity to educate and bring that new customer in.”

The future of beauty shopping, according to Greene, will involve a massive overlap between social media, entertainment and commerce.

“The whole picture of how commerce, social media, and entertainment — and entertainment being user-generated and entertainer created — is becoming more and more consolidated into these virtuous ecosystems. I see a lot of this rise of shoppable beauty-tainment — beauty is becoming almost an entertainment vertical in its own right,” Greene said, talking about YouTube’s beauty festival and video content on Tiktok and Instagram.

“The seamlessness or the inspiration of that being connected to a sale is becoming streamlined in line with what we’ve already seen happen on steroids in places like China,” Greene said.

For The Ordinary, which sells ingredient-led products at low price points, distribution accessibility is “extremely important,” said Nicola Kilner, chief executive officer of The Ordinary’s parent company, Deciem.

“Through the rise of social now, when your brand becomes in demand, it becomes in demand all over the world,” Kilner said. “It takes a lot of time to catch up your distribution with that.” Within the next year, The Ordinary will look to expand its global distribution by launching in India and the Middle East, she added.

The brand is sold in freestanding stores, with Ulta Beauty, Sephora, and in those retailers’ new partners, Target and Kohl’s, respectively.

Kilner said broad distribution works for a brand like The Ordinary because it is “functional” beauty, not “emotional.” The additional Target and Kohl’s distribution is bringing in new customers, Kilner said, but isn’t free from cannibalization.

“We’ve obviously seen an increase in sales, so we know there are incremental customers. But we also know there is some cannibalization where the old customers are shopping in Target, so they can just pick it up in Ulta-Target rather than in freestanding Ulta,” she said.

But younger shoppers, in particular, are looking for the added convenience factor, Kilner noted.

Two-year old BeautyStat has expanded its distribution rapidly over the past 18 months, with more retailers lined up for 2022. The Vitamin C-focused line is sold at most major department stores, as well as a variety of online players, said founder and CEO Ron Robinson.

“If there’s incremental consumers in places where we’re currently not sold, yes, we should expand into those channels,” Robinson said, adding that he doesn’t worry about brand erosion but does look out for cannibalization.

Niche chain Cos Bar has been a good partner, he said, because the locations are in different areas and serve different consumers than BeautyStat’s department store retailers. “We’re seeing incremental growth — we’re seeing that is a customer that’s not finding us at Saks or Nordstrom or Neiman Marcus,” Robinson said.

Beyond the incremental sales, Mousumi Behari, digital strategy lead and retail expert at Avionos, said brands that makes themselves more available to consumers will also have the benefits of added data.

“Beauty brands do have to be more accessible…through social media and online,” Behari said.

“What we’re seeing a lot more are things like artificial recognition and those types of digital capabilities,” Behari said. “For the customer, ultimately, this is a great thing because they are able to ‘try things on,’ so to speak, without really going into a store. And what it’s doing for the brands is it is giving the brands so many more customer data points that they didn’t have.”

Those data points can be used to inform product creation, Behari added. “The more accessible options are going to be driven by customer data, and that data is going to lead to personalization,” she said.

For more from WWD.com, see:

Categories, Channels Blur in Beauty

The Major Plans of Mass Beauty Retailers

Sephora’s Future Focus With Martin Brok

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.