Deere & Co.: No Getting Around the Valuation

- By Nathan Parsh

Deere & Co. (NYSE:DE) reported quarterly earnings last week that were much better than anticipated by Wall Street analysts. The company has had several weak quarters in a row, primarily due to the severity of the Covid-19 pandemic. Is this enough to make up for the stock's rich valuation?

Quarterly highlights

Deere reported fourth-quarter and full fiscal 2020 earnings results on Nov. 25 (the company's fiscal year ended Nov. 1).

Revenue declined 0.5% to $8.66 billion for the quarter, but topped analysts' estimates by more than $1 billion. Earnings per share grew 25 cents, or 5.3%, to $2.39, which was 94 cents ahead of expectations. Net income grew 4.8% to $757 million. For context, revenue had declined 12.4% and 20% and earnings per share was down 5.2% and 40% over the last two quarters.

For the fiscal year, revenue decreased 9.5% to $35.5 billion. Adjusted earnings per share was lower by 14.4% to $10.15 while net income fell 15.4% to $3.25 billion. The difference in declines was due to a lower share count compared to fiscal 2019.

Agriculture and Turf sales, which represented 72% of total sales for the quarter, grew 7.7% to $6.2 billion. This segment benefited from higher realized prices and an improvement in volume and mix. These gains were offset by a small headwind from currency exchange and production costs. Operating margins climbed an impressive 470 basis points to 13.9% due to higher prices, volume and mix and lower overall expenses. Most regions that Deere operates in saw an improvement in sales as well.

Construction and Forestry sales decreased 16% to $2.45 billion. Lower sales were primarily the result of lower shipment volumes that were only partially offset by higher realized prices. Operating margins were down 90 basis points to 8.0% due to weaker volume and mix and higher employee-separation expenses. Deere did enjoy lower warranty, research and development and selling, general and administrative expenses.

Deere also provided some guidance for the current fiscal year. The company forecasts 10% to 15% growth in its Ag and Turf segment. Deere expects that the Asia region will be down slightly in fiscal 2021. U.S. and Canada agriculture are expected to grow 5% to 10%, with most other regions flat to up 5%.

Construction and Forestry is seen rebounding to 5% to 10% growth worldwide. The North American construction market is likely to be down mid-single-digits, but will be offset by approximately 5% growth in North American compact construction. Global forestry is projected to be flat to up 5% from the previous year.

Deere ended fiscal 2020 with $75.1 billion of total assets, including $7.7 billion of cash and cash equivalents on its balance sheet. This compares to total liabilities of $62.1 billion, which includes $23.4 billion of current liabilities. Deere has $13.3 billion of debt due within one year and total debt of $46 billion.

The company's balance sheet is in decent shape, though it does have a significant amount of current debt that is not covered by cash on hand. Deere did generate $4.8 billion of free cash flow last fiscal year, but this seems to be an outlier as the company's three previous years saw negative free cash flow. Not helping matters is that the company expects operating cash flow from equipment to be almost half of what it was in the previous year. This could mean that Deere will likely have to refinance current debt or took on additional debt to meet its obligations for the year.

Analysts surveyed by Yahoo Finance have an average estimate of $12.78 of adjusted earnings per share for the current fiscal year. This would be a 26% increase from the prior year.

Deere produced a fourth quarter that topped estimates and was a generally better result than the two previous quarters, which were facing severe Covid-19 headwinds. Analysts also expect that fiscal year 2021 will see earnings per share grow at a very high rate.

However, this isn't enough of a reason to buy shares of Deere since it looks incredibly overvalued.

Using analysts estimates and the current share price of around $260, Deere has a forward price-earnings ratio of 20.3 today. This is steep premium to the stock's 10-year average price-earnings ratio of 13.7 according to Value Line.

Expectations for fiscal 2022 are higher, most likely due to analysts' belief that a recovery from Covid-19 is likely to have taken place by then. Analysts believe Deere will produce adjusted earnings per share of $15.45, which would give the stock a multiple of 16.8 times next year's earnings.

Even giving Deere a premium to its historical valuation, say in a range of 14 to 16 times this year's earnings estimates, would mean a sizeable decline from the current price. Applying analysts' estimates for this year to this target range results in a price range of $179 to $204. This would result in a 22% to 31% decline from current levels.

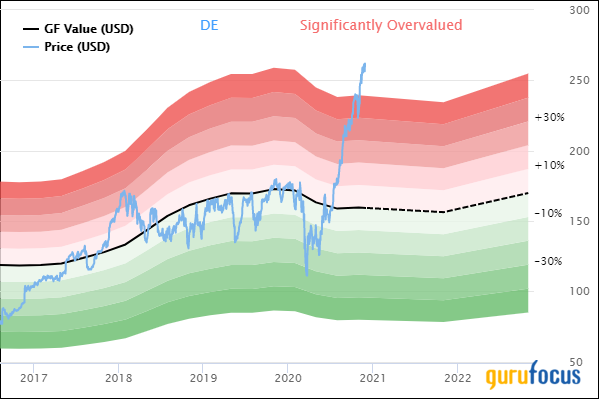

GuruFocus believes that Deere is even more overvalued than I do.

GuruFocus gives Deere a GF Value of $159.36, which is below even the low end of my target price. Using the current price gives shares a price-to-GF Value of 1.63. Shares of the company would have to decline 39% to reach their intrinsic value according to GuruFocus, earning Deere a rating of significantly overvalued.

Final thoughts

Deere's turnaround in the fourth quarter was quite strong. The company beat on both the top and bottom lines. The company also expects that its end markets will be mostly flat to higher in the current fiscal year. This is a very positive sign for the company.

That being said, Deere is extremely expensive compared to its own historical valuation. Investors buying today could be looking at a high double-digit decline if the stock were to return to its normal valuation. The losses could be even higher if Deere were to trade with its intrinsic value according to GuruFocus.

Despite the quarterly results, I am inclined to avoid Deere. There is just no getting around the stock's valuation at the moment and I would wait for a severe pullback before adding the name to my portfolio.

Disclosure: The author has no positions in any stocks mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.