Warren Buffett is 'almost certain' that stocks will beat bonds over time if rates stay low

While Warren Buffett doesn't prognosticate on where interest rates are heading, the legendary 89-year-old investor expects stocks to continue to outperform bonds over time.

"Our perhaps jaundiced view is that the pundits who opine on these subjects reveal, by that very behavior, far more about themselves than they reveal about the future. What we can say is that if something close to current rates should prevail over the coming decades and if corporate tax rates also remain near the low level businesses now enjoy, it is almost certain that equities will over time perform far better than long-term, fixed-rate debt instruments,” Buffett wrote in Berkshire Hathaway’s (BRK-A, BRK-B) widely-read annual letter.

Buffett has long argued that stretched stock market valuations are justified by the fact that interest rates are at historically low levels. On Friday, the 30-year Treasury bond yield fell to a record low.

That said, Buffett cautioned that his "rosy prediction" for equities "comes with a warning."

"Anything can happen to stock prices tomorrow,” he said. “Occasionally, there will be major drops in the market, perhaps of 50% magnitude or even greater. But the combination of The American Tailwind, about which I wrote last year, and the compounding wonders described by Mr. [Edgar Lawrence] Smith, will make equities the much better long-term choice for the individual who does not use borrowed money and who can control his or her emotions. Others? Beware!"

In the opening of this year's letter, Buffett highlighted a once "obscure economist and financial advisor," Edgar Lawrence Smith, whose 1924 book “Common Stocks as Long Term Investments” would change the investment world. Specifically, the main takeaway from the book is that well-run companies retain and reinvest earnings to grow the business. Today, as Buffett points out, this once novel idea is now well-known: "combining savings with compound interest works wonders."

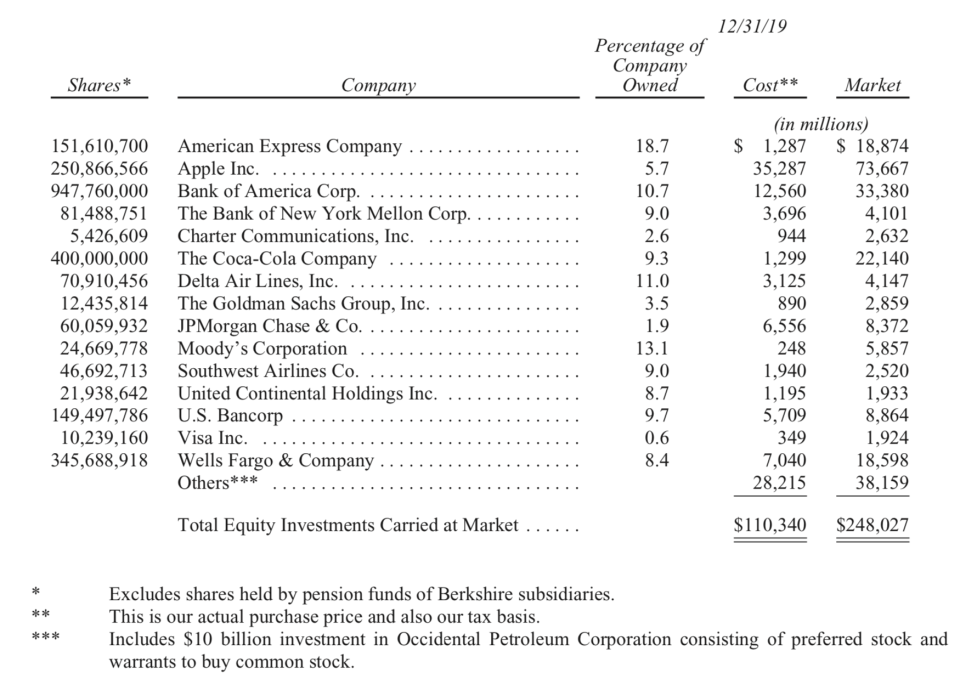

Elsewhere, Buffett touted Berkshire Hathaway's $248 billion stock portfolio, which includes names like American Express, Apple, and Delta Airlines. Rather than stock holdings, Buffett views these as companies Berkshire Hathaway "partly owns." He added that these are companies "earning more than 20% on the net tangible equity capital required to run their businesses" and are profitable "without employing excessive levels of debt."

"Returns of that order by large, established and understandable businesses are remarkable under any circumstances," Buffett wrote. "They are truly mind-blowing when compared to the returns that many investors have accepted on bonds over the last decade — 2 1/2% or even less on 30-year U.S. Treasury bonds, for example."

Julia La Roche is a Correspondent at Yahoo Finance. Follow her on Twitter.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.