Your voter guide to Jackson County’s stadiums tax for the Kansas City Royals and Chiefs

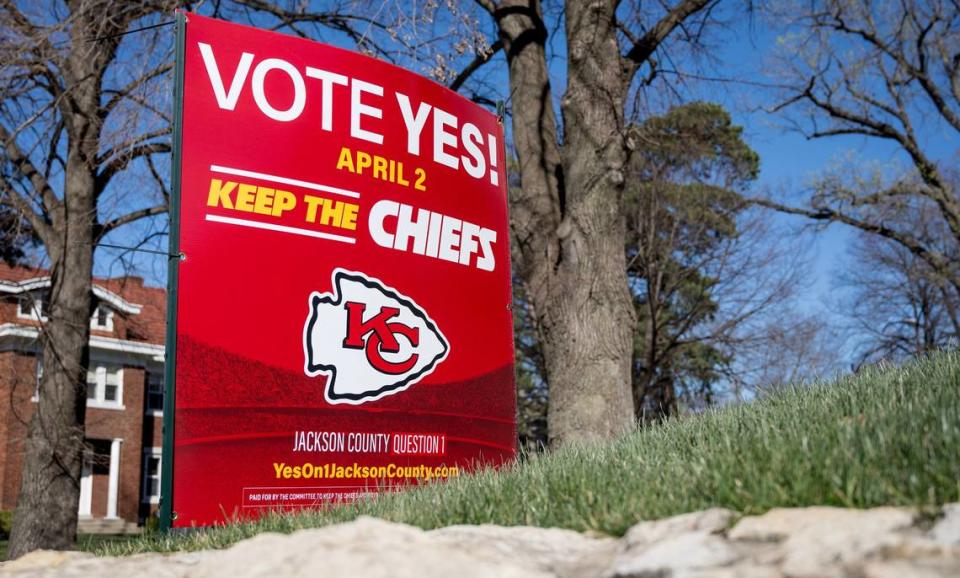

After a heated campaign, Tuesday is Election Day — the final moment when Jackson County voters will decide whether to issue a 40-year, 3/8th-cent sales tax to help pay for a new Royals stadium in the Crossroads and renovations to the Chiefs’ Arrowhead Stadium.

In the final days, the teams have come forward with community benefits pledges and have announced lease deals with the county sports complex authority. The Jackson County Legislature still needs to approve those agreements.

Still unknown are the total costs of the projects, how much the Royals will contribute toward their new stadium, exactly how much the county would pay or how many additional dollars the teams would seek from the city or the state.

This is your guide to voting in the stadiums tax election, and the best answers we could find to the most common questions we’ve been hearing from readers.

These are the basics

If “yes” votes win, the current 3/8th-cent sales tax that funds the Truman Sports Complex would be repealed, and a new countywide sales tax would be put in place for 40 years, ending in 2064. The Royals would use the tax money to help pay for a new stadium in the East Crossroads, and the Chiefs would renovate Arrowhead Stadium.

If “no” votes win, the existing sales tax will continue until 2031, when the teams’ current leases expire.

The teams have shared renderings of their proposed projects and have pledged financial contributions: $1 billion from the Royals for the estimated $2 billion ballpark district, and $300 million from the Chiefs for $800 million renovations. However, while the Chiefs’ contribution is cemented in the lease documents, the Royals’ contribution to a new stadium is not.

The teams have also pledged contributions totaling $260 million over 40 years — about $3.5 million per team per year — that a committee of county and team-appointed representatives would give to social and economic causes across the county throughout the life of the tax.

Why is the election now?

The short answer is, the teams wanted the tax to appear on the April 2 ballot, and the Jackson County Legislature voted to make that happen.

The longer answer involves some political back and forth. In December, Jackson County legislator DaRon McGee moved to put the stadiums sales tax on the April ballot, before the Royals had a selected site, a lease or any other public commitments.

Then in January, the Royals and Chiefs issued a joint statement promising a few concessions to the county if voters approve a sales tax for both teams in April, and the Jackson County Legislature voted in favor of putting it on the ballot.

County Executive Frank White vetoed the ordinance, saying he wanted more binding commitments from the teams before the issue went to the ballot.

On Jan. 22 — the second to last day possible to get something added to the April ballot — the teams sent the county a new signed letter of intent with commitments to some of the requests that county legislators had.

The Jackson County Legislature then voted to override White’s veto, putting the stadium’s sales tax on the April 2 ballot.

What are the plans for a new Royals stadium?

In February, the Royals announced plans for a new baseball stadium in the East Crossroads, just south of downtown Kansas City. The proposed footprint covers six city blocks, extending from Grand Boulevard to Locust Street, and 17th Street to Truman Road.

The plan also includes a ballpark district east of the stadium with offices, retail and residential development.

However, as of this past week, the plans for the ballpark district are up in the air. After urging from Kansas City Mayor Quinton Lucas, the Royals agreed for their development to not extend over Oak Street, meaning that the eastern border could be Oak instead of Locust.

The Royals plan to have the stadium ready for Opening Day 2028, said Sarah Tourville, the team’s executive vice president.

Royals officials have been talking about a new ballpark for years. The team said they’d announce a site by October 2023, but didn’t until February.

Where would the sales tax money go for a new Royals ballpark?

The Royals announced they would pay at least $1 billion of the estimated $2 billion project that would include the stadium and surrounding ballpark district. The team has not yet publicly released a budget or total dollar amount, and the lease deal did not put the team’s contribution in writing.

The proposed Jackson County sales tax would go toward a loan the county would take out to build the new stadium, and would also go toward paying off the remaining $200 million the county still owes from the last round of Kauffman and Arrowhead renovations in 2006 that the existing tax is paying back.

The rest of the money needed for the project would come from undetermined sources, likely including the city and the state.

Gov. Mike Parson said Missouri wouldn’t put state money toward the project until voters approve the county sales tax, and Kansas City officials said the teams haven’t officially asked for city money yet.

The team said it would cover any overruns once a budget is set.

How might the Crossroads change?

The 17.3-acre Royals development would displace some Crossroads businesses, but how many is unclear as the Royals adjust their plans regarding Oak Street. The former Kansas City Star printing facility would be demolished as well.

The team has pledged to assist displaced businesses with “rent support, relocation assistance, tenant improvements, and payroll coverage to help with employee retention.”

Some Crossroads businesses said they were concerned about higher rents and having to relocate if a stadium came to the neighborhood, as well what they describe as the detrimental effect a stadium could have on the artsy vibe in the area. However, some developers said they could profit from selling their properties as values rise.

What about parking?

The Royals have said there will be plenty of space for fans, citing 40,000 parking spots in the “greater downtown area” within a 20-minute walk of the proposed ballpark, compared to 26,000 at Kauffman Stadium.

There are 21,000 existing, multiuse spots within a 10-minute walk of the new stadium, according to the Royals. The team said it needs 9,000 spots for its 35,000-person stadium.

What would a renovated Chiefs stadium look like?

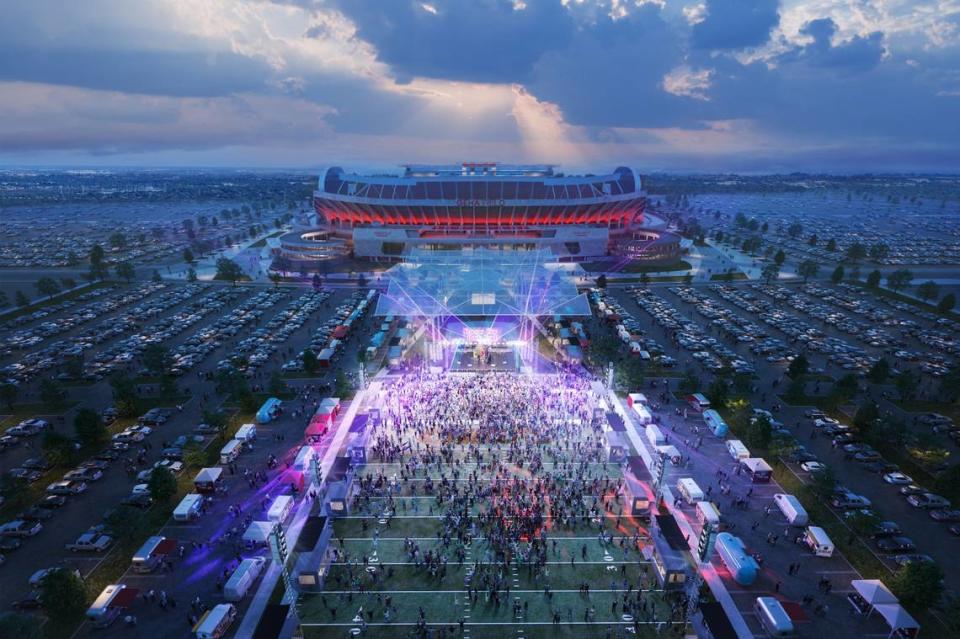

The Kansas City Chiefs announced plans for an $800 million renovation to GEHA Field at Arrowhead Stadium, including a new video board, end zone suites and a covered fan zone where Kauffman Stadium currently stands. The team would pay for $300 million of the project.

What is a community benefits agreement, and what would it include?

For large projects that use public dollars — like stadiums and entertainment districts — it’s not uncommon for organizations like sports teams to sign a contract promising to add amenities or other measures to help local residents in exchange for the tax money they receive for their development.

The community benefits agreement negotiations for the Kansas City stadiums project were tumultuous. Several groups who were part of the negotiations abandoned them after being disappointed by what they described as the teams’ lack of earnest cooperation.

The teams, on the other hand, described the community contributions they pledged as historic.

Local social justice groups had lobbied for things like expanded bus service, affordable housing and day care around the stadium, as well as a living wage for workers at the stadiums, union jobs and contributions from the teams to support things like violence prevention and education initiatives.

The teams pledged $266 million over 40 years to go to committees of county and team-appointed members who would give the money to different social and economic causes in Jackson County each year throughout the life of the tax.

According to Kansas City Public Schools, the Royals agreed to compensate the district for the property tax revenue it would lose if the Royals build in the Crossroads.

What have the teams promised if the tax passes?

The Royals and Chiefs announced lease agreements with the Jackson County Sports Authority. The county legislature still needs to approve those leases for them to become legally binding.

The teams would split any extra money if the tax brings in more than the county needs to make its debt payment, which is for the money it’s still paying back for the last round of stadium renovations and the loan it would take out to build the new stadium and upgrade Arrowhead. They could only use the tax money for stadiums operations and management, not for players’ and coaches’ salaries. That’s the same as how it works now under the existing tax.

The leases also contained some promises from the teams that are not in the existing tax agreement. If the new tax passes, the teams said they would:

Give up the $3.5 million they receive every year from the county’s parks property tax levy starting after 2030.

Pay for their insurance on the stadiums, which the county pays for now.

The Chiefs did not agree to keep the team’s headquarters and training facility in Jackson County, but they did say they’d give the county the first shot at making an offer if the team wants to move its training facility.

Neither team specifies in the leases how much they would expect to receive from city, county and state taxpayers for their projects. But they do count on all three of those governments to come up with cash to support the stadium projects.

Would taxpayers pay more with the new tax than they do now?

Both the existing stadiums tax and the proposed one are sales taxes at the same rate of 3/8th-cent on purchases made in Jackson County. However, the ballot question would establish that tax for 40 years — as opposed to the seven years left on the current tax. That adds up to more tax money over time.

How much will this actually cost the county?

The tax could generate around $2 billion over its 40 years. That’s based on past figures showing the existing 3/8th-cent sales tax brought in $48.6 billion in 2022.

Who supports the tax?

The Committee to Keep the Chiefs and Royals in Jackson County is organizing the yes vote campaign, led by the teams, who have contributed more than $3 million.

Organizations that have endorsed the campaign include:

Greater Kansas City Chamber of Commerce

Kansas City Area Development Council

Independence Chamber of Commerce

Mid-America Carpenters Regional Council

Greater Kansas City AFL-CIO

Heartland Black Chamber of Commerce

Greater Kansas City Building & Construction Trades Council

Hispanic Chamber of Commerce of Greater Kansas City

Freedom, Inc.

Kansas City Fraternal Order of Police

SEIU Local 1

Who opposes the tax?

The Committee Against New Royals Stadium Taxes is running the “vote no” campaign, chaired by former City Councilmember Becky Nace.

Other organizations that are lobbying against the tax include:

Good Jobs Coalition, a group of organizations representing low-wage workers, recently pulled out of negotiations with the teams and came out in opposition of the tax.

KC Tenants were the first organized group to announce their opposition last month.

Sunrise Movement KC, an environmental advocacy group

More2, a coalition of congregations advocating for social justice

What is the question voters will see on the ballot?

The ballot language describes taking away the current tax and putting in a new one.

Here is the exact wording of Jackson County question 1:

Shall the County of Jackson repeal its countywide capital improvements sales tax of three-eighths of one percent (3/8%) authorized by Section 67.700 of the Revised Statutes of Missouri and impose as a parks sales tax of three eighths of one percent (3/8%) authorized by Section 644.032 of the Revised Statutes of Missouri for a period of 40 years, to provide funding for park improvements, consisting of (1) site preparation and clearance, developing, constructing, furnishing, improving, equipping, repairing, maintaining, and operating both Arrowhead Stadium and its surrounds, and a new baseball stadium and its surrounds, to retain the Kansas City Chiefs in Jackson County, Missouri and the Kansas City Royals in Kansas City, Jackson County, Missouri pursuant to long term leases; and (2) refinancing debt obligations previously incurred to finance or refinance improvements to the Harry S Truman Sports Complex?

What else to know before you vote

Polls will be open from 6 a.m. to 7 p.m. on Tuesday.

In Kansas City, check your voter status on the Kansas City Election Board website to find your polling place. In the rest of Jackson County, put your information in the Voter ID Lookup section in the election board’s website’s sidebar.

Registered Missouri voters will need a government-issued photo ID to vote.

Accepted forms of photo ID for Missouri include:

A non-expired Missouri driver’s license or a state ID

A non-expired military ID, including a veteran ID card

A U.S. passport or another form of photo ID issued by the U.S. government or the state of Missouri that has not expired

The Star’s Mike Hendricks, Sam McDowell, Eleanor Nash, Allison Dikanovic, Blair Kerkhoff, Joseph Hernandez, David Hudnall and Pete Grathoff contributed to this report.