Unoccupied Huntersville apartment complex tops delinquent taxes list in Mecklenburg County

MECKLENBURG COUNTY, N.C. (QUEEN CITY NEWS) — A so-far unoccupied apartment complex in Huntersville tops a recently released list of the top 100 delinquent taxes in Mecklenburg County.

The complex off of Old Statesville Road, which is operated through The Pointe at Caldwell LLC, owed $326,474.28 as of March 8, according to a posting of the tax amounts on the county website.

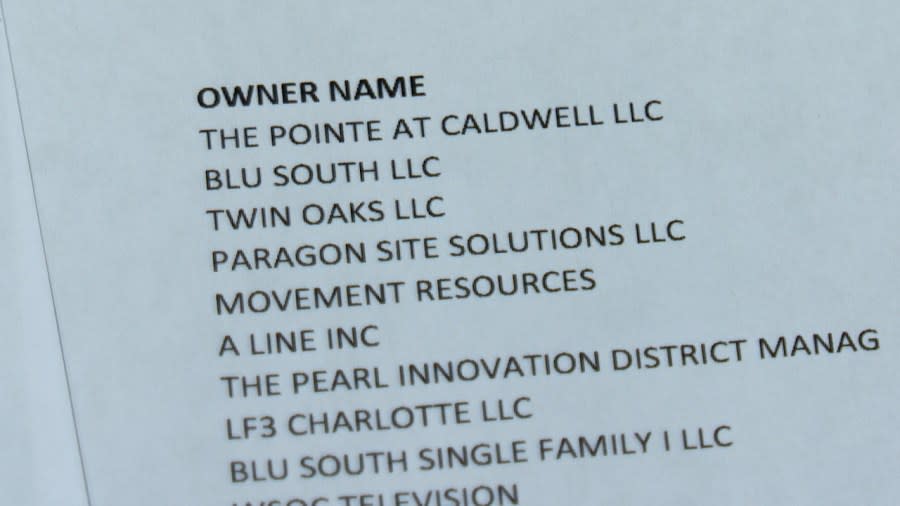

The LLC is one of several associated with developers on the list.

Efforts to reach them were unsuccessful and no one was at the property when Queen City News drove to the complex Wednesday afternoon.

Proposed 42% average rate insurance increase rejected by NC insurance commissioner

Queen City News looked through the list, focusing on developers who are building but whose tax bills appear to be piling up.

But each company or organization we reached out to and responded to gave various on and off-record statements on why the numbers may not be entirely accurate.

One developer, who showed up multiple times on the list under various LLC names, said they were appealing the amount they are reported to owe.

Another, who was on the Top 10 list but was not a developer, noted they are working to address totals with the City of Charlotte and Mecklenburg County, but noted the amount had been paid.

Queen City News did receive a statement from Atrium Health about an outstanding bill total associated with them and the development project known as The Pearl Innovation District, which includes the Wake Forest Medical School currently being built in Charlotte.

“We are committed to meeting our obligations to the county. Due to what appears to be mail being misdirected and this being the first-ever property tax bill for this new entity, we became aware of this bill being due for the first time earlier this week. Our team immediately reached out to the county and have submitted the payment for processing,” said Atrium Health.

In a statement late Wednesday afternoon, Mecklenburg County Tax Collector Neal Dixon said in a statement to Queen City News:

“Tax bills were due on September 1, 2023, and payable through January 5, 2024. All unpaid tax bills became delinquent on January 6, 2024, and were assessed the statutory interest charges monthly until paid.

Taxes under appeal are not relieved of delinquency. When a taxpayer whose property is under appeal pays the bill timely and their value is later reduced, they will receive a refund. If a taxpayer whose value is under appeal chooses not to pay timely, the bill becomes delinquent and accrues interest. If their appeal results in a value reduction, the new bill amount is delinquent, and interest is charged to the reduced amount due.

All tax bills are public records that are accessible online. The Top 100 subset list highlights the taxpayers with the highest delinquent bills. These taxpayers were mailed a notice requesting payment and informing them that they would be included on this list if the bills were remained unpaid, including bills under appeal.

North Carolina law prohibits tax collectors from initiating enforcement action when a delinquent bill is under appeal.”

Get breaking news alerts with the Queen City News mobile app. It’s FREE! Download for iOS or Android

The full Top 100 list includes what appear to be several developers — those who own hotel properties, townhomes and self-storage locations — all owe thousands, or in some cases, tens of thousands of dollars, according to Mecklenburg County.

THE FULL LIST CAN BE SEEN HERE

For the latest news, weather, sports, and streaming video, head to Queen City News.