The momentous event that caused Bitcoin to peak on December 17, 2017

The fall of cryptocurrency Bitcoin (BTC-USD) for much of 2018 is no coincidence, officials at the San Francisco Federal Reserve said in a recent policy analysis.

The analysts said Bitcoin’s peak in December 2017 and subsequent crash ties a bit too conveniently to the commission of trading derivatives on the Chicago Mercantile Exchange and the creation of a mechanism to short – or bet against – the cryptocurrency.

On Dec. 17, 2017, derivatives trading opened on the CME. Prior to that Bitcoin could only be bought and sold by bullish investors, while after its debut on the exchange speculators who were betting its value would fall had a way to bet on just that outcome.

“The new investment opportunity led to a fall in demand in the spot bitcoin market and therefore a drop in price,” analysts Galina Hale, Arvind Krishnamurthy, Marianna Kudlyak, and Patrick Shultz wrote in a piece published on the San Francisco Fed’s website Monday.

“With offers of future bitcoin deliveries at a lower price coming through, the order flow necessarily put downward pressure on the spot price as well,” the analysts said.

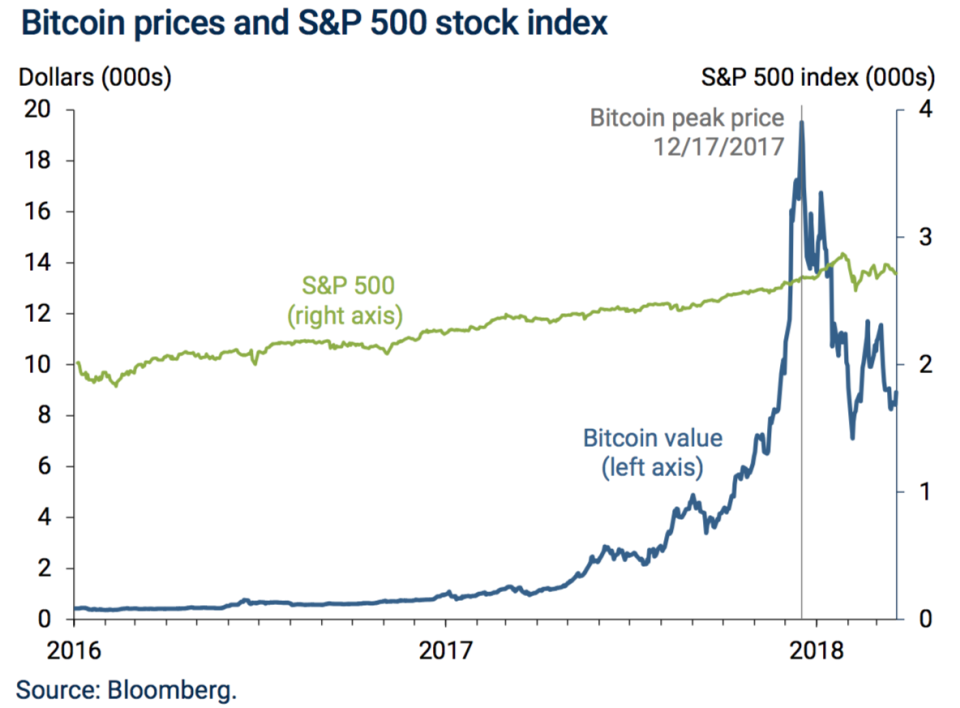

Bitcoin touched a high of almost $20,000 per Bitcoin in mid-December and fell by nearly 70% to its low in February below $6,000. It has since stabilized somewhat, rising to more than $9,000, but remains 54% below its December peak and is down 38% year-to-date.

The news comes as the New York Times reports that the parent company of the New York Stock Exchange has been working on an online trading platform that would allow large investors to buy and hold Bitcoin and after Goldman Sachs said publicly that it is seeking to open a Bitcoin trading unit.

Bloomberg reported Monday that a Tokyo attorney and bankruptcy trustee for the now-defunct Mt. Gox exchange, which sold Bitcoin, has sold about $400 million of Bitcoin and Bitcoin Cash since late September. Nobuaki Kobayashi, who is liquidating the tokens on behalf of Mt. Gox creditors, has another $1.9 billion to sell, according to the report.

On Bitcoin’s crash since December, the San Francisco Fed publication noted that the crash since December trading began on the CME derivative market has been something of a self-fulfilling prophecy.

“As with a self-fulfilling prophecy, optimists’ demand pushed the price of bitcoin up, energizing more people to join in and keep pushing up the price,” Hale, Krishnamurthy, Kudlyak and Shultz wrote. “The pessimists, however, had no mechanism available to put money behind their belief that the bitcoin price would collapse. So they were left to wait for their ‘I told you so’ moment.”

Bitcoin’s price peaked on December 17, the highest price for Bitcoin in its history.

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.