Questor: This company is delivering stellar returns in India’s stock market boom

Shares in fast growing companies have the potential to deliver stellar investment returns. One of the best places to find them is in fast growing economies.

India was the world’s fastest growing major economy in 2023 and is predicted to grow by a further 7pc in 2024. Given this backdrop, it is no surprise that the Indian stock market is firing on all cylinders and many of the world’s best fund managers are backing outstanding companies to profit from it.

Financial publisher Citywire tracks the investments of the world’s best fund managers, awarding the tenth of companies with most backing coveted AAA Elite Companies ratings. The success of Indian companies means that the Indian stock market is currently home to 49 AAA companies. This compares to just 21 AAA companies in the UK.

One of these Indian favourites is Larsen & Toubro, or L&T for short.

L&T is best described as a construction conglomerate. It designs, engineers, builds and looks after a wide range of building projects such as stadiums, refineries, power stations, grids, shipyards, bridges and transport infrastructure.

Over the last five years, UK investors owning the company’s Global Depository Receipt (GDR), which can be bought through most brokers, have seen total returns of 134pc. That compares very favourably with the iShares MSCI India ETF which has delivered 58pc.

Even after these gains, L&T looks well placed to keep on prospering. The flow of new construction contracts continues to be supported by the Indian government spending increasing sums of money on public infrastructure. This is expected to be a record $134bn (£106bn) this fiscal year.

In addition to a strong home market, L&T is benefiting from a surge in new contracts from Saudi Arabia. This is not only coming from oil and gas projects but in areas such as solar power, power grids, water treatment and transportation. Saudi

Arabia is expected to spend a whopping $3.3 trillion on infrastructure projects between 2021 and 2030.

Buoyant end markets have been reflected in L&T’s financial results. At the end of December 2023, it had an order book of $56bn which is more than twice its current annual revenues.

For the year to March 2024, order inflows are expected to grow by more than 20pc with revenues growth in high-teens percentages. Earnings per share (EPS) is expected to grow by a very healthy 27pc on a US dollar basis.

As well as strong growth, the quality of L&T’s profits has the potential to improve. Construction is typically a very low profit margin business with a large proportion of fixed price contracts. While L&T has been good at managing its costs, its profit growth is coming from strong order growth rather than fatter margins.

While this is no bad thing, management is trying to change this by targeting higher margin technology and green energy infrastructure work.

The company is investing in India’s undeveloped data centre infrastructure. The country needs to build to cope with the strong growth in cloud computing and internet connectivity.

L&T has recently made and installed its first one megawatt electrolyser at a green hydrogen facility in India. It is now gearing up electrolyser manufacturing capability to tap into the expected strong growth in green hydrogen in India over the next decade.

A more speculative investment is the move into semiconductors where India is looking to develop home-grown intellectual property. L&T has set up a separate business unit to design rather than manufacture semiconductors.

It has no intention of competing with the likes of Nvidia, but is looking at highly engineered, custom chips for automotive and industrial applications as well as ones capable of working at the extreme temperatures of the Indian climate.

L&T shares have had a subdued start to 2024. Investors were disappointed by weaker margins at its third quarter results in January and the expectation of softer contract flows due to the upcoming Indian general election.

The margin issue should prove to be short lived as the company works through lower-margin legacy contracts and newer contracts mature. A change in government looks unlikely, but if it happened, it would not be expected to disrupt the size and path of infrastructure spending.

Analysts predict profits will double over the 2023-26 period with annualised EPS growth of over 26pc expected over the three years. It is therefore no surprise that L&T’s GDRs come with a high valuation attached to them.

At $43.40, the shares trade on a very high forecast price to earnings ratio of 30 times. However, given the strong profit growth expected, this equates to a price earnings growth (Peg) ratio – a measure used by investors to compare valuations with profits growth – of just over one which looks decent value.

Questor says: buy

Ticker: LSE:LTOD

Share price at close: $43.40

Phil Oakley is a contributing journalist at Citywire Elite Companies

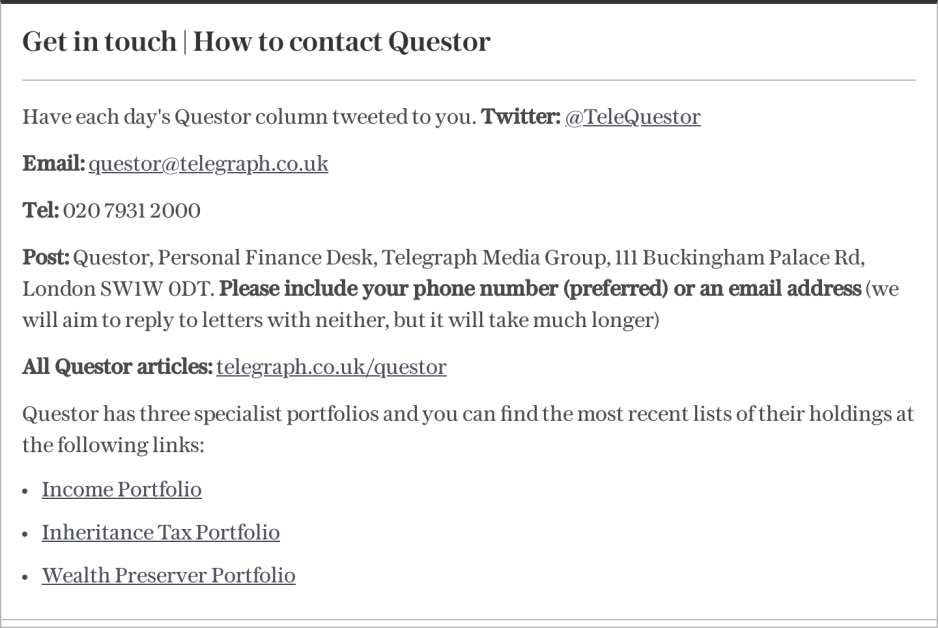

Read the latest Questor column on telegraph.co.uk every Sunday, Monday, Tuesday, Wednesday and Thursday from 8pm.

Read Questor’s rules of investment before you follow our tips