Poland Forced to Rethink Cheap Mortgage Plan in a Housing Boom

(Bloomberg) -- Poland is turning more cautious on whether it’s really a good idea to pump fresh stimulus into a booming housing market.

Most Read from Bloomberg

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

China Considers Government Buying of Unsold Homes to Save Property Market

Biden Accuses China of ‘Cheating’ on Trade, Imposes New Tariffs

OpenAI Chief Scientist Ilya Sutskever Is Leaving the Company

Dozens of Poles, mostly young, protested outside government offices this month against proposals to provide hefty subsidies to cut homeloan rates to as low as zero percent. Public reaction has been intense, according to the minister behind the idea, who said there have been threatening and abusive phone calls to the Housing Ministry.

Deputy Prime Minister Krzysztof Gawkowski said late last week that the government’s view on the program is “evolving.”

While some of the response to the government is politically motivated, there’s also opposition within the target market despite the fact that average new mortgage rates are above 7%. Many young Poles are concerned about a sting in the tail from cheaper loans flooding the market. They fear that the stimulus, rather than helping buyers, would actually push property further out of reach.

Values have doubled in the past decade, according to Eurostat, and central bank data show home-price inflation is accelerating again. The average price of a 70-square meter flat in Warsaw has soared to more than 1.1 million zlotys ($280,000) from 671,000 zloty five years ago.

Housing affordability has long been an issue in Poland, where home ownership became a status symbol in the post-Soviet era and a way to build wealth.

The 21.5 billion zloty 10-year plan is the result of political oneupmanship during last year’s election campaign. After the Law & Justice party — in power at the time — offered loans with interest capped at 2%, Donald Tusk’s Civic Platform announced it would go further with interest-free mortgages.

After Tusk and his allies won the election, he pushed ahead with the idea earlier this year. Unlike the previous stimulus, the new program has no limits on the purchase price, but sets accessibility thresholds based on income. It’s due to be launched in the fall and is still pending approval from the cabinet and the parliament.

“There is no doubt that the new plan may create additional demand on the housing market,” Kazimierz Kirejczyk, a senior adviser at JLL real estate consultancy in Warsaw. “Cash-rich investors may accelerate their purchases to get ahead of any rush, worrying that no price limits for aid poses a risk for competition for housing properties in all segments.”

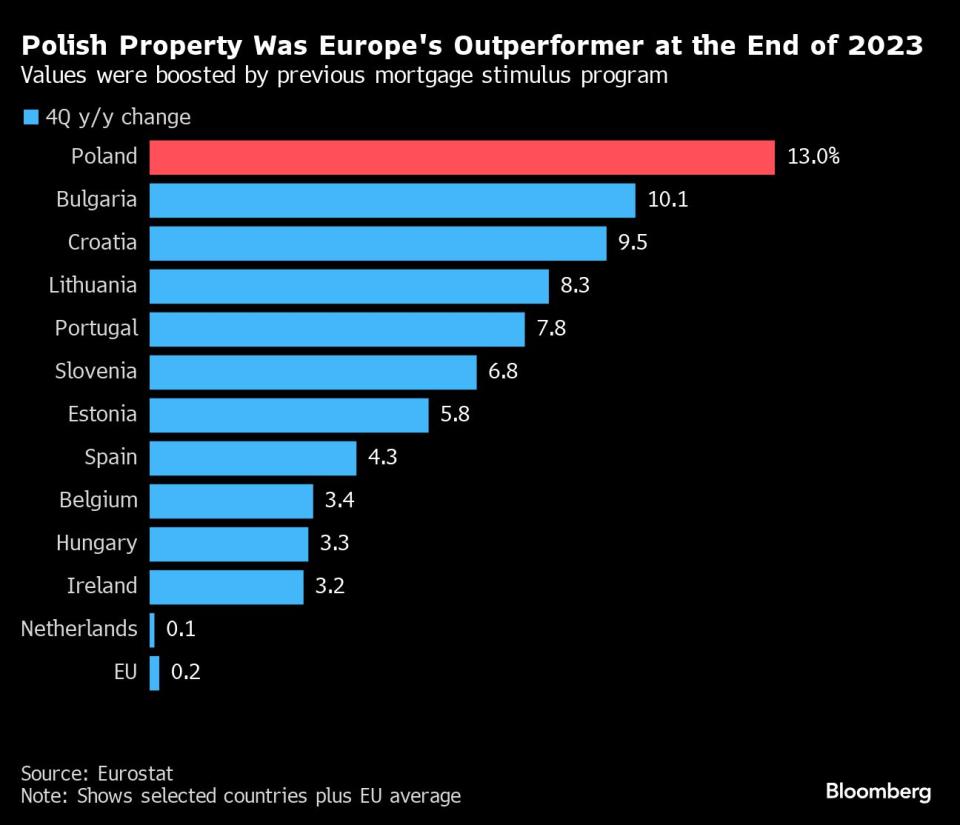

Worries about a price surge are far from overdone. When the 2% mortgage cap subsidy was launched in 2023, buyers flocked to grab cheap loans. Mortgage demand surged to a record, the state funds earmarked were wiped out in months and prices rose the most of any European country.

This time, the government plans to set quarterly quotas on the stimulus to try to prevent spikes. But there’s already been an impact.

Days after the release of draft regulations in April, asking prices for apartments on property websites soared, local media reported. Developers such as Atal SA offered reservations for customers in advance of the subsidized loans, with the number of such pre-sale arrangements rising, according to OtoDom Analytics research company.

Homebuilders have also benefited. Poland’s WIG Real Estate Index has jumped 24% already this year, more than twice as much as the benchmark stock gauge.

But some of those gains could be reversed if the government changes course. For Kirejczyk, the fate of the program will be a political decision, especially as the ruling coalition parties differ on how to tackle housing issues, which is creating uncertainty for the market. In addition, the minister in charge of the project left to become a candidate for the EU Parliament in elections in June.

“Politicians invited homebuilders and buyers to a kind of roulette in cities where there is still a limited offer — whether to accelerate construction and purchases in the wake of another price boost, or wait for the plan to be scrapped or significantly trimmed which should cool the market,” he said.

In Warsaw, most of the recent protesters blasted politicians for helping banks, developers and property owners, and called for social housing initiatives and more regulation of the rental market. Some just want less state interference.

“The fact that the government is meddling again in the housing market doesn’t help,” said Piotr, 30, who attended the protest with his spouse. “We want to get a loan and buy our own apartment, so in theory we should be grateful, but market prices are surging again.”

--With assistance from Gina Turner.

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

Cheap Prison Labor Is Keeping People Locked Up Longer, Suit Alleges

©2024 Bloomberg L.P.