NY pols push to pad teacher, cop, gov’t worker pensions — and sock taxpayers with whopping $4B bill

- Oops!Something went wrong.Please try again later.

State lawmakers are set to try to make it easier for teachers, cops and other state and local government workers to pad their pensions — and leave taxpayers footing the nearly $4 billion bill, a new analysis shows.

The proposed change — overwhelmingly backed by Albany pols under pressure from the workers’ powerful unions in an election year — would instantly hit New York City taxpayers with $163 million in added annual pension costs, according to the Empire Center for Public Policy.

“That’s a lot of cops and teachers,” said Ken Girardin, the Empire Center’s research director who wrote the report, referring to the immediate $163 million cost to the city and what it could cost in terms of staffing.

“School districts and local governments would all see their pension costs rise, which would force them to either cut programs or raise taxes.The single most harmed employer is the city of New York,” he said Monday.

Under the proposed rollback, pensions would be calculated largely on a worker’s final three years of salary instead of the current five years, presumably hiking up their pension since they would typically be earning the most in their last few years.

Democrats in the Assembly and state Senate have called for boosting the pensions for state and local governmental employees hired after 2012, commonly known as “Tier 6” members, in their spending resolutions as part of the ongoing budget process.

The proposal would retroactively increase the pensions of workers who retired in the past two years and raise the future pensions for roughly half of New York’s public-sector work force as it retires,Girardin said.

Former Gov. Andrew Cuomo advocated for and approved Tier 6 changes a decade ago to try to rein in runaway pension costs.

Lawmakers are prohibited from cutting the benefits of government workers once they’re hired, so Cuomo pushed through changes to curb pension costs and benefits for newly hired workers.

The proposed pension sweetener would add $2.2 billion in debt to New York City’s five pension plans and $1.5 billion for the New York State and Local Employees Retirement System in the coming decades, the analysis said.

Among the biggest beneficiaries: teachers with higher salaries than most government workers.

United Federation of Teachers president Michael Mulgrew, who represents New York City’s educators, is lobbying hard for the change along with other labor leaders, legislative sources said.

Mulgrew defended the proposed change as pro-worker Monday.

“While the Empire Center believes that only the rich should have a decent retirement, our members deserve real retirement security, ” Mulgrew said in a statement. “The current Tier 6 proposal will – by the city’s own estimate – increase annual city payments into the teachers retirement system by just over one percent.”

He has legislators on his side.

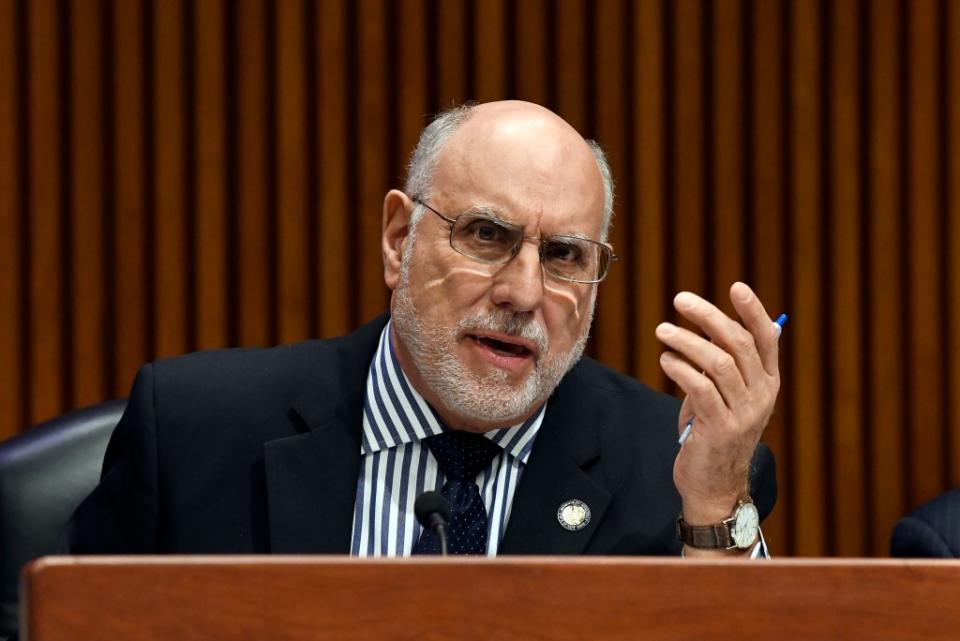

“Tier 6 is a major concern — and rightfully so. It’s not a good thing,” said Assembly Education Committee Chairman Michael Benedetto (D-Bronx) to The Post.

Benedetto blamed the pension restriction as making it more difficult to recruit and retain teachers in the city public school system.

Girardin disputed the claims that the pension-padding was needed to curb a recruiting and retention crisis in the work force, calling the plan “a give away to unions ahead of the 2024 elections.”

The proposals drafted by state Sen. Robert Jackson (D-Manhattan) and Assemblywoman Stacey Pheffer Amato (D-Queens) were included in the spending resolutions with the blessing of Senate Majority Leader Andrea Stewart-Cousins (D-Yonkers) and Assembly Speaker Carl Heastie (D-Bronx).

““Tier 6 is everywhere, I can hear it echoing through the halls,” a smiling Jackson said, referencing support for the proposal.

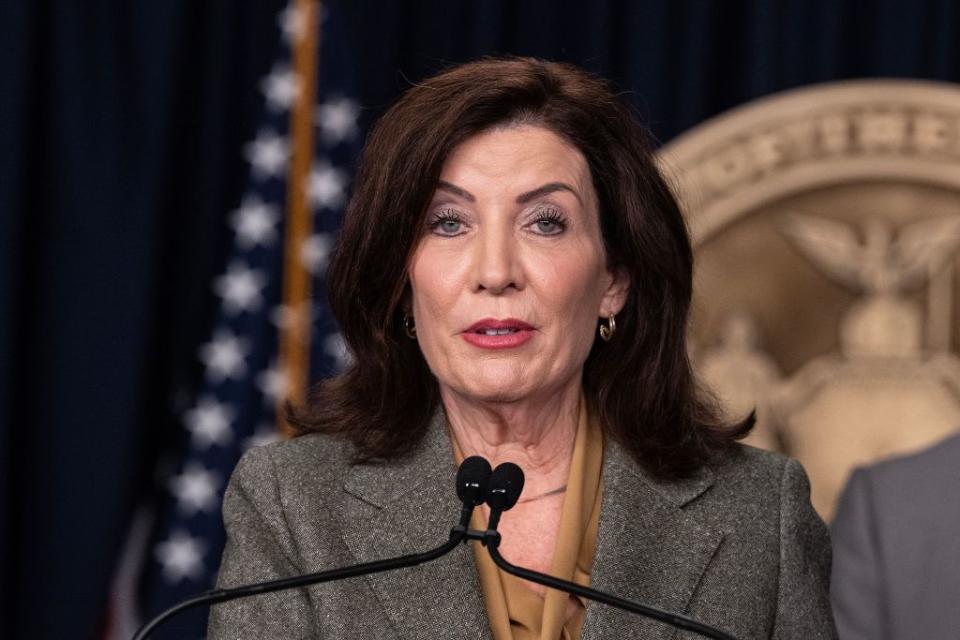

A rep for Gov. Kathy Hochul, who has the power to block the pension-padding measure in budget negotiations, issued a statement Monday that sidestepped taking a position.

“Governor Hochul’s Executive Budget makes record-setting investments in New York’s future while ensuring the state remains on a stable long-term fiscal trajectory, and she will work with the Legislature to craft a final budget that achieves these goals,” a spokesman said.

When she was up for re-election 2022, Hochul agreed to roll back some pension changes sought by the unions, reversing the laws approved in 2010 and 2012 that required new government workers to be vested in the pension system after 10 years instead of five, as is the case for previously hired employees.

New York is known for offering cushy government benefits, particularly rules that make it easier for elected officials to “double dip” — collecting a hefty pension while still working.

This is the case with Staten Island’s power couple, District Attorney Michael McMahon and his wife, state Judge Judith McMahon.