Lula’s Debt Relief Program Struggles to Boost Consumption

- Oops!Something went wrong.Please try again later.

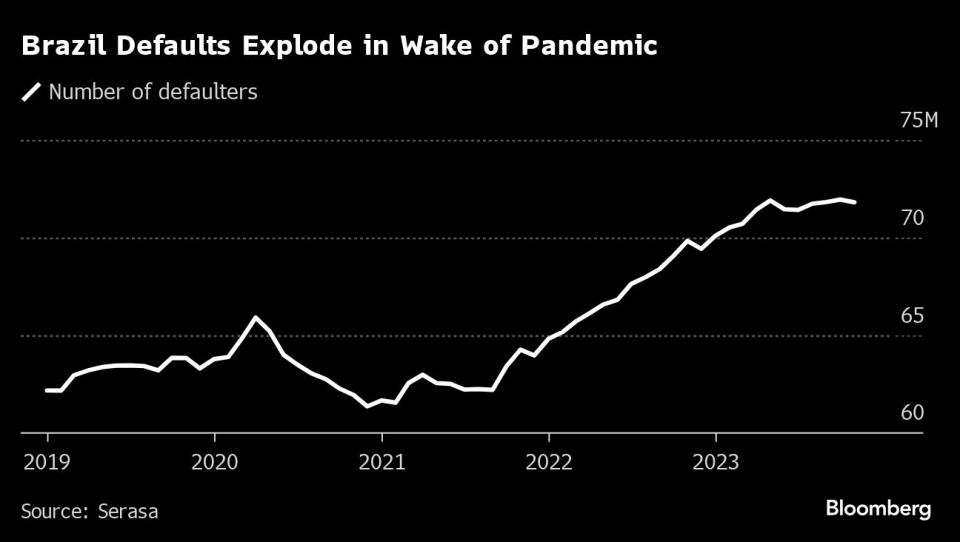

(Bloomberg) -- President Luiz Inacio Lula da Silva’s plan to help Brazilians escape the record amounts of debt they amassed during the pandemic remains well short of its targets as it approaches its March 31 expiration, denting his efforts to unleash consumer spending and boost growth in Latin America’s largest economy.

Most Read from Bloomberg

Millennium Trader Scored $40 Million Windfall in Egypt FX Plunge

A $2 Billion Airport Will Test Modi’s Mission, Adani’s Ambitions

SpaceX Starship Nears Orbit, But Is Lost Before Return to Earth

Desenrola, as the program is known, was expected to help as many as 70 million people, including 30 million with lower incomes and smaller debts. The Finance Ministry estimated it would renegotiate 50 billion reais ($10.1 billion) in bank-held debts by the end of last year. By the start of March, however, 12 million people had negotiated 36.5 billion reais in debt, according to government figures, even after the program received a three-month extension in December.

“The numbers still fall short of the program’s potential,” said Rubens Sardenberg, the head of Brazilian banking federation Febraban, adding however that its results have been “significant.”

Desenrola’s shortcomings, partly explained by technological hurdles to access the program, compound a challenging scenario for the Brazilian economy, which isn’t expanding as fast as needed for Lula to deliver on his campaign pledges.

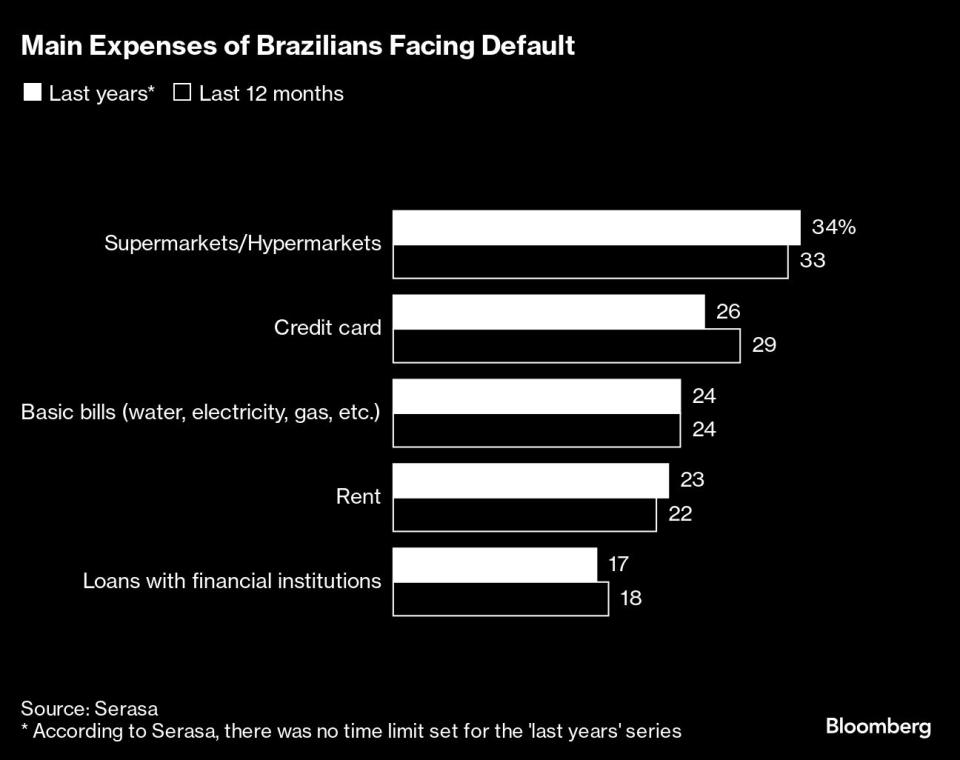

The government launched Desenrola in July, as massive amounts of household debt and sky-high interest rates threatened to choke Brazil’s economy. As the pandemic waned, outstanding debt surged to average roughly half of family income, while interest rates on credit cards skyrocketed to nearly 450%. By last May, four of every 10 Brazilian adults faced default, one survey showed.

Desenrola — which translates to “untangle” — uses a mix of tax breaks and subsidies to incentivize the renegotiation and consolidation of debt held by banks, utilities and other companies, allowing Brazilians to repay at lower rates. For Lula, it held potential to provide both relief and stimulus. It formed a key pillar of his strategy to help low-income Brazilians while also delivering the sort of economic prosperity he promised during the 2022 election.

Preliminary surveys, however, also suggest those who have benefited have been slow to start spending again, an indication that the program may not juice consumption as much as the government thought it would.

Read More: Lula Pulls Off Rare Trick Twice, Wooing Wall Street and the Poor

Lula’s administration still regards Desenrola as a success, and expects figures at the end of this month to push it closer to original goals as more people “take advantage of unique discounts, from 85% to 90%, that you can’t find elsewhere,” said Alexandre Ferreira, the Finance Ministry’s general coordinator of economics and legislation.

Febraban, too, “continues to support the program” and believes “we will see even more meaningful numbers by the end of the first quarter,” Sardenberg said.

A Break

For Silvia Santos, Desenrola provided a way out of debt she thought she may never escape. The 52-year-old housekeeper fell behind after taking out a loan to help cover basic expenses during the pandemic, but had little means of paying it back until she negotiated relief. Santos renegotiated her debt with Banco do Brasil and received a discount of almost 87% on the total amount.

Andre Bezerra, a 44-year-old businessman, racked up more than 70,000 reais ($14,060) in debt after losing his job and facing health problems in the midst of the pandemic. Desenrola helped him renegotiate with Caixa Economica Federal the total to 5,000 reais ($1,004) — a 93% discount.

“Desenrola gives a mental and financial break so that those who were in debt can rebalance themselves,” said Nathalia Rodrigues, a financial adviser who runs a popular YouTube channel.

The problem is that many Brazilians are still unaware Desenrola exists; many who do know about it are unsure if they qualify. Banks and retailers say it is overly bureaucratic. And in a deeply unequal nation, the online process has left many of the poorest Brazilians struggling to access it.

“Because the program is still heavily focused on Internet activities, it is often not as easy for low-income consumers to register or negotiate their debts,” said Renato Meirelles, the president of Instituto Locomotiva, a Sao Paulo-based research firm. “Thinking about physical solutions could make it much easier for low-income Brazilians to participate.”

Desenrola’s mix of federal funds and tax credits are meant to free up capital and make room on bank balance sheets, creating appetite for cheaper credit, according to Sardenberg.

Consumers, meanwhile, are allowed to choose which financial institution they want to use to renegotiate debts, which “encourages banks to compete with each other to see who can offer the lowest interest rate,” Ferreira said.

Financial Caution

Other positive economic developments may ultimately make up for at least part of Desenrola’s shortcomings.

The central bank started cutting interest rates in August, and household consumption expanded modestly in the third quarter from the three months prior.

Brazil’s retail sales, a gauge of the health of the consumer sector, rebounded in January from a slowdown during the holiday season.

Brazil’s overall credit situation also appears to be improving, and while the number of families in debt remains high, it has stopped increasing, according to a survey conducted by Instituto Locomotiva and MFM Technologia.

That won’t necessarily translate into more spending for the rest of the year. A January survey found that 37% of Brazilians would prioritize setting savings goals this year. Another 36% said they would seek to reduce day-to-day expenses, according to the study conducted by Serasa Experian, a financial services and credit management company based in Sao Paulo.

“The important thing is that I can sleep peacefully,” Bezerra said. “I don’t have any more problems with negativity and debt collection, so at the moment, I’m satisfied.”

--With assistance from Simone Iglesias.

(Updates with retail sales data in 19th paragraph)

Most Read from Bloomberg Businessweek

Gold-Medalist Coders Build an AI That Can Do Their Job for Them

An Influential Economics Forum Has a Troubling Surplus of Trolls

©2024 Bloomberg L.P.