Italy’s High-Debt Profile Is ‘Risk Factor,’ Central Bank Says

(Bloomberg) -- Italy’s mounting pile of debt poses an ongoing hazard to the country and its financial system especially if the economy underperforms, its central bank said in a half-yearly stability assessment.

Most Read from Bloomberg

US and Saudis Near Defense Pact Meant to Reshape Middle East

Jerome Powell Offered Markets a Reprieve. It Vanished in a Blink

NYPD Arrests Over 300 Protesters in Crackdown on College Campuses

The Ozempic Effect: How a Weight Loss Wonder Drug Gobbled Up an Entire Economy

Just weeks since the government unveiled new projections pointing to an increase in borrowings, officials cited prospects for the public finances as “a risk factor.” That’s arguably stronger language than they used in their two financial stability reports last year.

“Persistently high debt levels remain a risk factor, particularly in the event of less favorable-than-expected trends in the economy,” the Bank of Italy said in its analysis published in Rome on Tuesday.

Under Prime Minister Giorgia Meloni, the country is following a broad policy of fiscal restraint that has permitted some loosening while leaving investors unperturbed. After a surge in debt to fund pandemic policies and energy support, borrowings still ended up much lower than expected last year, at 137% of gross domestic product.

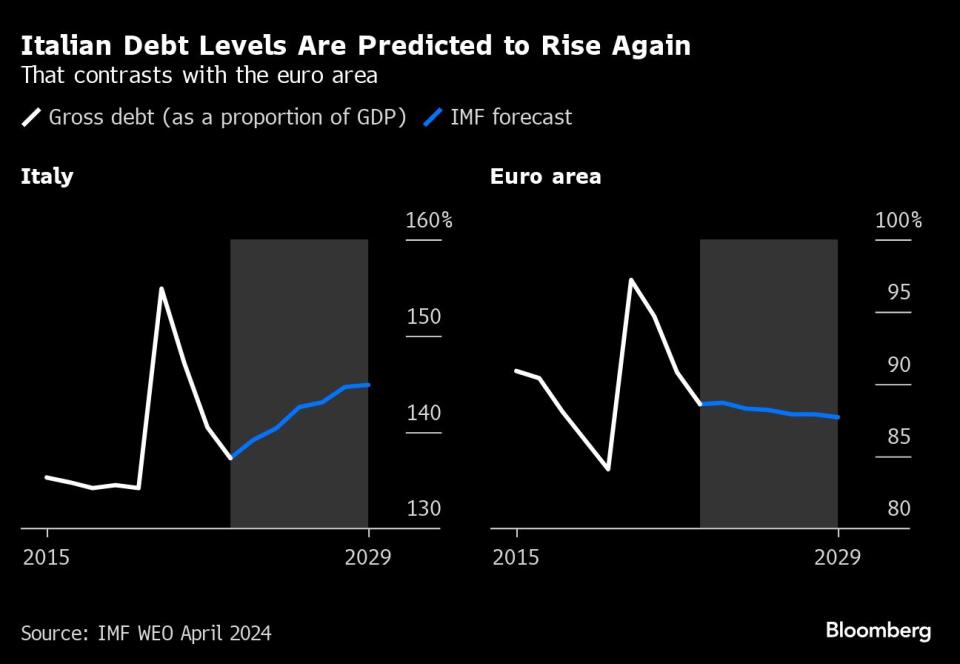

That tally is now poised to rise again and peak at 139.8% of output in 2026, according to government forecasts released this month. The International Monetary Fund’s view is less rosy, anticipating that the ratio will breach 140% as soon as next year, climbing to almost 145% in 2029.

Italy, long plagued by high public debt, has also contended with a sclerotic economy that barely expanded since the 2008 global financial crisis and took another hit with the pandemic.

The country just returned to growth with a faster-than-expected result of 0.3% in the first quarter, according to data released on Tuesday. That might bolster the government’s hope of a better-than-consensus outcome of as much as 1% this year.

“Sustained strengthening of the GDP and an improvement in the structural deficit” will be needed to get debt down again, the Bank of Italy said.

Most Read from Bloomberg Businessweek

AI Is Helping Automate One of the World’s Most Gruesome Jobs

China Launches Rockets From Sea in Bid to Win the Space Race

Modi Is $20 Trillion Short on His Grand Plan for India’s Economy

©2024 Bloomberg L.P.