Group says it’s filing petition signatures to put grocery tax repeal on ballot

- Oops!Something went wrong.Please try again later.

South Dakota and Mississippi are the only states that have a full state sales tax rate on groceries, but that could change in November.

Circulators of a petition to repeal the state sales tax on groceries said they planned to turn in enough signatures Wednesday to the South Dakota Secretary of State’s Office to place the measure on the Nov. 5 ballot. The office must still verify that enough of the signatures are from registered South Dakota voters.

The ballot initiative would repeal the state sales tax on anything sold for human consumption, except alcoholic beverages and prepared food. It does not prohibit cities from taxing groceries. Currently, the state has a 4.2% sales and use tax, and cities can tack on an additional 2% tax.

The state sales tax rate was 4.5% before state legislators reduced it during the 2023 legislative session. Legislators included a sunset clause to make the tax reduction expire in 2027, in part out of caution in case voters approve the grocery tax repeal. The reduction in the sales tax rate was estimated to cost the state more than $100 million in annual revenue, and the grocery tax repeal would cost an estimated $124 million in annual revenue.

Republican Gov. Kristi Noem promised to repeal the state food sales tax during her reelection campaign in 2022 and backed an unsuccessful bill during the 2023 legislative session to eliminate the tax. But Noem pulled her support for the potential ballot question last year. The commissioner of the state Bureau of Finance and Management told South Dakota News Watch that the ballot measure would prevent the state from taxing tobacco and medical marijuana.

Other Republican leaders, such as Senate President Pro Tempore Lee Schoenbeck, have spoken out against the initiative, saying it — along with the 2023 tax cut still in effect — could lead to a budget “train wreck.” Most recently, Sioux Falls Mayor Paul TenHaken spoke out against the measure during his State of the City address, according to The Dakota Scout.

Polling by South Dakota News Watch and the Chiesman Center for Democracy in 2023 found 60.6% of surveyed registered voters support eliminating the state sales tax on groceries.

TakeItBack, the organization spearheading the ballot initiative campaign, said it collected over 25,000 petition signatures from registered voters. Just over 17,500 are required to put the initiative on the ballot.

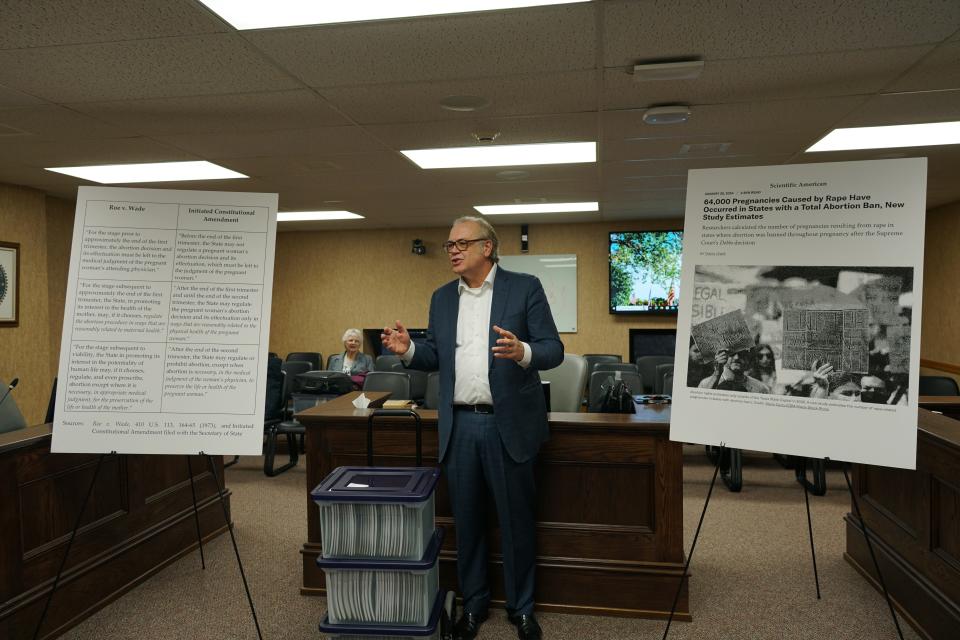

Rick Weiland, a Democrat, is co-founder of TakeItBack and also leads Dakotans for Health, which was the organization leading the petition circulation effort alongside a petition to restore abortion rights (the abortion-rights petition has not yet been submitted).

“Removing the state’s sales tax on groceries is a crucial step towards addressing food insecurity and promoting economic fairness in our state,” Weiland said in a news release.

The South Dakota State Federation of Labor AFL-CIO endorsed the ballot initiative Wednesday. The organization represents 195 unions in the state and 7,000 union members.

“Our low-income working families are struggling, with some spending up to 30% of their household income to feed their families,” said B.J. Motley, the organization’s president. “This inequality is unacceptable, and we stand ready to partner with TakeItBack to address this pressing issue.”

All ballot-question petitions must be filed by May 7. Several other citizen-initiated petitions are circulating, including a measure to switch the state from political-party primary elections to open primaries. The Legislature has already exercised its right to place two measures on the ballot: one would replace references to male officeholders in the state constitution with neutral language, and the other would ask voters to lift a prohibition against work requirements for Medicaid expansion enrollees.

This article originally appeared on Sioux Falls Argus Leader: Group filing petition signatures to put grocery tax repeal on ballot