Biden Student Debt Forgiveness Plan: What to Know, and Its Impact on 2024

- Oops!Something went wrong.Please try again later.

Irfan Khan/Getty Images

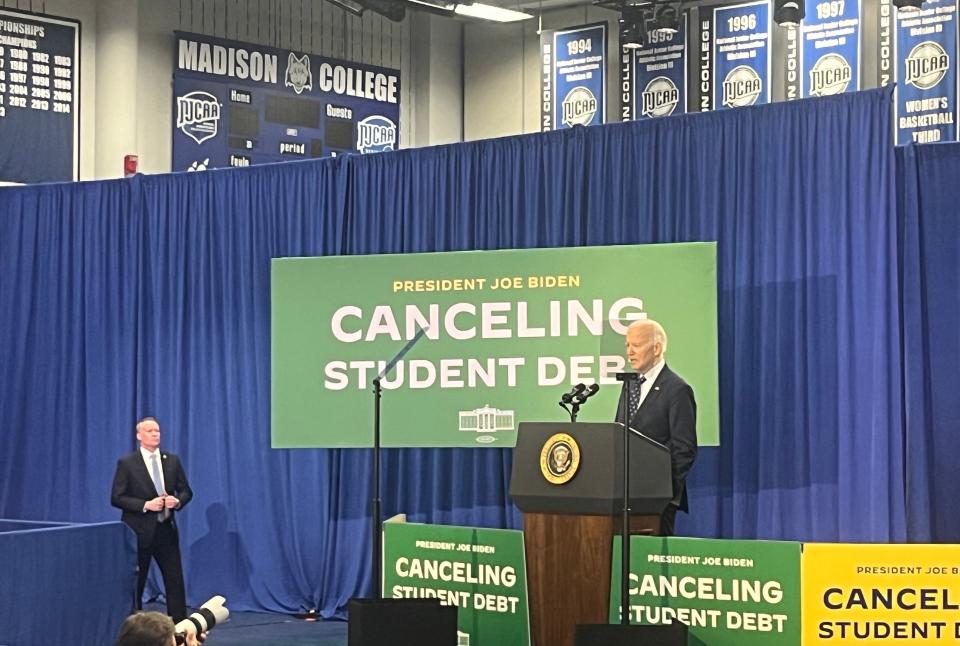

The partial solar eclipse was not the only event to bring students and community members to Wisconsin's Madison Area Technical College (MATC) campus on Monday. President Joe Biden arrived in Madison that afternoon to unveil his new student debt forgiveness plan. The Biden-Harris administration claims this new plan, if enacted, would “provide debt relief to over 30 million borrowers.”

Governor Tony Evers, who welcomed Biden to Wisconsin and the stage, said that student debt impacts more than 700,000 individuals in Wisconsin alone. Local politicians, prominent community members, and members of several nonprofit organizations attended Biden’s remarks, filling MATC’s gymnasium.

Biden supporters and multiple chapters of Wisconsin Democrats from different universities came to hear the president speak, but Biden's arrival was also met with resistance. Protesters gathered just outside the college, carrying signs that called for a free Palestine, and one that read “Joe, Stop the Gazacide.”

The plan to absolve student debt for millions of borrowers directly impacts young voters. With Biden’s visit coming shortly after nearly 48,000 Wisconsinites, many of them students, voted uninstructed in the Democratic primaries, the latest plan may be an attempt to appeal to Gen Z in the 2024 election.

What's in Biden's new student debt relief plan?

While Biden was in Madison, various leaders of his administration traveled around the country to announce the new plan, visiting other battleground states such as Arizona and Pennsylvania. Biden said he believes debt cancellation would not only benefit borrowers, but the entire economy.

This most recent proposal comes after a series of executive actions that have attempted to reduce student debt. The administration claims to have approved $146 million in student debt relief for over 4 million Americans via these executive actions. The SAVE plan, in which nearly 8 million borrowers are enrolled, is an income-driven repayment plan that works to keep students from paying interest that may accrue on their balance and to bring their monthly payment down to as little as possible.

Ashley Storck and her partner Sam Leary, Madison business owners, introduced President Biden before he gave his remarks on Monday. Storck and Leary, who are UW-Madison graduates, had recently launched their business when the Supreme Court struck down Biden’s initial student loan forgiveness proposal last summer. They turned to the SAVE plan, and now pay $0 a month, versus the $700 they were paying previously.

“We no longer have the fear of our balances increasing because of runaway interest,” Storck told the audience on Monday. “The SAVE plan empowered us to reinvest in our business, hire our first employee, and helps promote economic growth throughout the state of Wisconsin.”

Last June, the Supreme Court blocked Biden’s original student debt relief plan. Now Biden’s team is attempting student debt relief again, this time with a new, five-pronged plan that addresses different facets of borrowing.

“The ability for working middle-class folks to repay their student loans has become so burdensome that they can’t be paid for even decades after attending school,” Biden said at Monday’s event.

The administration's new proposal would cancel debt for borrowers who entered repayment over 20 years ago for undergraduate college or 25 years ago for graduate school. The plan would also work with the Department of Education to hold for-profit universities accountable and cancel debt for individuals who enrolled in low financial-value programs, or were “cheated by institutions” and left with “unaffordable loans” despite having no good job prospects.

Borrowers who experience financial hardship while repaying their loans, such as burdensome medical bills or childcare expenses, have also been included in the new plans for student debt relief.

One of the hallmarks of Biden’s new policy is the cancellation of runaway interest for millions of borrowers who currently owe more than they originally borrowed. The proposed plans, if enacted, would cancel up to $20,000 of incurred interest. Low- and middle-income borrowers enrolled in any income-driven repayment plan, such as SAVE, would be eligible to have canceled the full amount their balance has grown to since they started paying it off.

How was the plan received in Madison?

Fabiola Hamdan, co-chair of the Latino Children and Families Council in Madison, tells Teen Vogue that, initially, she did not want to attend the event due to the administration’s handling of the conflict in Palestine. “I see how damaging it is to fund military, Israeli military, with our taxpayers' money. That's not okay,” Hamdan says.

Ultimately, though, she decided to attend — and wear her keffiyeh. “I wanted to wear the symbol of Palestine…. I proudly wear that and hope that [Biden's] administration keeps in mind that people are really struggling over there and that we support them from here.”

Despite Hamdan’s frustrations, she says, she is hopeful about the plan Biden unveiled. “I work with a lot with students that are really struggling to pay their loans and all of that…. This is something that is very important for our students, for our community, to have.”

Some students on campus echo the need for student debt relief. “I thought it was a really good plan," Joey Wendtland, a member of the Wisconsin Democrats chapter at UW-Madison, tells Teen Vogue of the president's proposed policy. "It's going to really open up student debt relief to so many more Americans that desperately need it.”

Wendtland adds, “He's already done so much to benefit people with student debt relief, including people in my immediate family.”

Lorenzo Alves is an international student from Brazil. Even though the plan wouldn’t apply to him, he says, it is a benefit to American students. “I think forgiving such a big amount of debt that most American students have... it just brings more incentive when they go out to the labor force,” he explains.

How could the new debt relief plan impact the youth vote?

The Biden-Harris administration's student loan relief plan is especially relevant to young voters. A March poll from Protect Borrowers Action found that student debt relief is an issue many voters care strongly about, and a top economic priority for young people .

“I believe this would help numerous students across the country, lifting a huge amount of debt and burden on these young students…," says Isaiah Breininger, a MATC freshman. “The majority of students will have to work their entire lives to pay off these debts, depending on their careers.”

Students are hopeful about a new student loan forgiveness plan, but others say their priority remains the administration's handling of the conflict in Gaza. The US has provided billions of dollars in military aid to Israel since October 7, when Hamas attacked Israel, killing about 1,200 Israeli civilians and taking more than 200 hostages. Since then, the Israeli military has killed over 30,000 Palestinians in the Gaza Strip, according to Gaza territory health officials, as cited by the Associated Press.

Local Jewish Voice for Peace and Students for Justice in Palestine chapters protested Vice President Kamala Harris’s arrival in Madison earlier this March, demanding that she work to end the military onslaught against Gaza.

The protesters outside MATC campus on Monday were mostly students from UW-Madison, MATC and local high schools. They arrived hours before Biden’s remarks, and stayed until most attendees had left. Some just happened upon the protest spontaneously and got involved.

“I was just coming to go to class, I had to take a detour," says Aliyyah W., a MATC student. "And then I had to walk down and saw them protesting, and I don't stand for genocide. I stood here, and I showed where I stand.”

Aliyyah continues, “I don't really know if [Biden's] goal is to appeal to young voters with the student loan [plan]. I think listening to our demands would actually help him appeal to young voters — that's what would get my vote.”

Stay up-to-date with the politics team. Sign up for the Teen Vogue Take

Originally Appeared on Teen Vogue

Want more U.S. government coverage?