Australia’s Pre-Election Spending Pushes Budget Into Deficit

(Bloomberg) -- Australia plans to unleash a wave of spending from energy rebates to tax breaks for critical minerals and new warships as the center-left Labor government tries to win back voters ahead of an election due in a year.

Most Read from Bloomberg

Slovak Premier Fighting for Life After Assassination Attempt

China Considers Government Buying of Unsold Homes to Save Property Market

US Inflation Ebbs for First Time in Six Months in Relief for Fed

Flood of China Used Cooking Oil Spurs Call to Hike US Levies

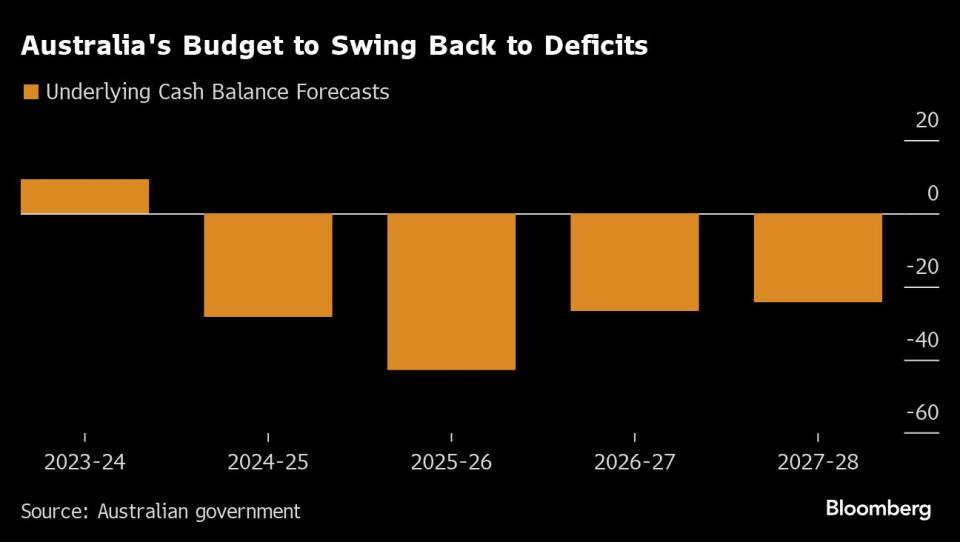

The government’s books will swing into the red to the tune of A$28.3 billion, or 1% of gross domestic product, in fiscal 2025, swelling to A$42.8 billion in the following 12 months, the budget papers showed. The 2025 deficit is more than double estimates and comes after the government posted surpluses in its first two years in office as it sought to restrain inflation.

Government bond yields edged up early on Wednesday, reflecting concern that the budget suggested Australia was joining the global trend toward higher sovereign debt issuance.

“Australia faces longterm fiscal challenges due to climate change, an aging population, regional security and rising demand for care and support services,” Treasury said. “The larger deficit is driven by the government’s cost-of-living relief and addressing unavoidable spending pressure.”

Treasurer Jim Chalmers is trying to steer a credible path by dragging down inflation in the near-term. He’s pushed major initiatives like a signature Future Made in Australia program that aims to capitalize on the green revolution, as well as support for critical minerals, out toward the end of the decade.

The budget showed the near-term deficits are driven by cost-of-living relief and A$15.4 billion for health and frontline services that were left unfunded by the previous administration.

Shadow Treasurer Angus Taylor criticized the document as big-spending at a time when curbs on government outlays were required.

“Very significant parts of this budget we think are inappropriate for the times,” the opposition spokesman said in an interview with Bloomberg Television in Canberra on Wednesday. “We need restraint, that’s how we beat inflation.”

Economists are similarly concerned that the swing back into the red implies a more expansionary fiscal impulse that could result in interest rates staying higher for longer.

“The treasurer is not making the Reserve Bank’s job any easier,” said Su-Lin Ong, chief economist for Australia at Royal Bank of Canada. “It’s going to make the job of getting inflation on a sustained basis back to target, particularly core inflation, harder. This will likely keep rates on hold for an extended period.”

Government assistance with living costs includes A$3.5 billion to help reduce energy bills, which has the added advantage of cutting forecast inflation by about half a percentage point in the 12 months through June 2025. Treasury’s estimates show inflation could return to the RBA’s 2-3% target later this year, about 12 months ahead of the central bank’s own estimates.

“The RBA is more likely to focus on the way the energy rebates mechanically lower headline CPI inflation,” said Andrew Boak, chief economist for Australia at Goldman Sachs Group Inc., who still expects easing to begin in November. “However, the risks are skewed to rate cuts being delayed.”

Rates traders are so far leaning toward the RBA’s outlook, with a base case of no change this year and pricing for policy easing beginning in early 2025. Economists expect the first rate cut to be delivered in November.

The RBA hiked 13 times between May 2022 and November 2023 to take the cash rate to 4.35% — a 12-year high — and has kept the door open to further tightening should inflation remain sticky.

What Bloomberg Economics Says...

“Cost-of-living pressures have resulted in cracks emerging in Australia’s impressive fiscal discipline.”

— James McIntyre, economist

To read the full note, click here

The surplus in the current fiscal year and the deficits ahead still leave Australia in better shape than the US and other developed economies. It’s among just a handful of economies to hold a AAA credit rating from all three agencies.

The government’s other big expenditure items include A$330 billion over the next decade for defense and A$22.7 billion for the Future Made in Australia policy that aims to ramp up investment in green mining and high-tech manufacturing.

The vast majority of this spending has been pushed out to future years: tax incentives for critical minerals and hydrogen only begin in fiscal 2028. The reason for this is the timing of production, Finance Minister Katy Gallagher said.

“People need to make the investment, actually start producing green hydrogen, refining and processing the critical minerals before they can get a tax benefit,” Gallagher said in an interview with Bloomberg Television in Canberra on Wednesday. “But in the meantime we’re also looking at a range of grants.”

The government’s coffers have been aided by revenue from high commodity prices and a fully-employed economy, with unemployment at 3.8%. The budget shows both of those strengths unwinding somewhat, with the jobless rate seen climbing to 4.5% by June 2025 and the terms of trade - the ratio of export prices to import prices - expected to drop 7.75% next fiscal year.

Another factor that boosted budget revenue was stronger-than-expected migration, which is now forecast to halve to 260,000 next fiscal year from 528,000 in the 12 months through 2023.

The budget’s swelling deficits have seen borrowing expectations rise, with net debt forecast at A$615.5 billion, or 21.5% of GDP, in June 2026, compared with economists’ estimate of 19.9%. Australia places well internationally here, too, with a developed-world average above 80%.

“The budget has added to medium term structural deficits,” said Shane Oliver at AMP Ltd., who highlighted spending as share of GDP will settle well above pre-pandemic levels. “This leaves it vulnerable if the economy weakens and sees no money put aside for a rainy day over the forecast period.”

--With assistance from Garfield Reynolds and Paul Allen.

(Adds markets in third paragraph; finance minister and shadow treasurer.)

Most Read from Bloomberg Businessweek

How the ‘Harvard of Trading’ Ruined Thousands of Young People’s Lives

US East Coast Ports Are Spending Billions to Profit From Asia’s Shifting Exports

©2024 Bloomberg L.P.