Austin disabled veteran frustrated by misplaced property tax break

- Oops!Something went wrong.Please try again later.

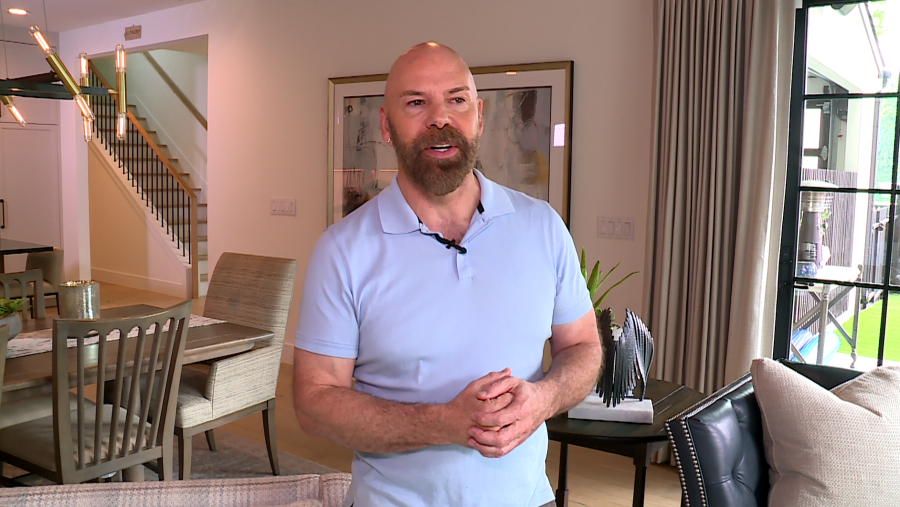

AUSTIN (KXAN) — Keith Romel’s home needs to be comforting. Not just for him, but for his clients.

Romel is a massage therapist who works out of his condo in east Austin.

“I advertise it as a luxury experience, so part of that is the environment,” he said when talking about his carefully crafted home with modern furniture, clean lines and everything in its place.

“One (client) said it looks like it came out of the Architectural Digest magazine,” he said. “I just like things neat and orderly and to look nice.”

While Romel’s condo may reflect that, there’s nothing neat and orderly about the transfer of his property tax exemption when he bought the condo last year.

Romel doesn’t have to pay property taxes on his residence because he has a 100% service-related property tax exemption.

A life-altering accident

“I was in the Army Reserves. Most of it was reserve time and some active-duty time in there,” Romel said.

In 1996, Romel said a superior asked him to drive some documents to Corpus Christi for a field training exercise.

“I had been working all day. I hadn’t planned on traveling that night,” he said.

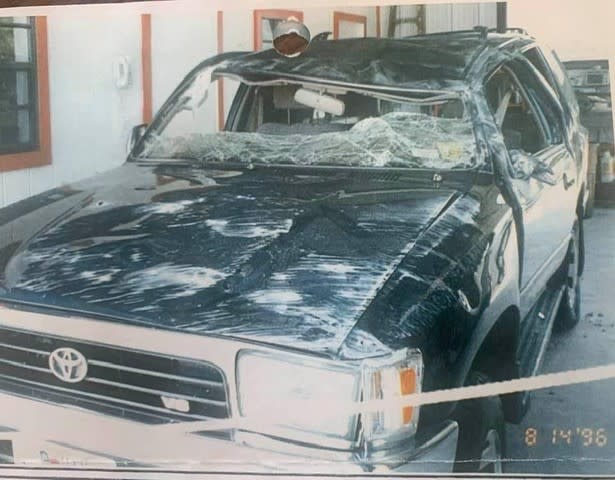

Outside of Corpus Christi, he fell asleep, he said, and his Toyota 4Runner flipped.

“I was in ICU for a week,” he said.

His injuries had life-long consequences.

Keith Romel had multiple injuries following his service-related car accident in 1996 (Courtesy: Keith Romel) Romel’s wrecked Toyota 4Runner after it flipped outside of Corpus Christi (Courtesy: Keith Romel) Romel spent a week in the ICU recovering from his injuries (Courtesy: Keith Romel)

“I’m in pain daily. I’ve got knee and back pain,” he said.

When Romel sold his previous east Austin home in May 2023 and tried to transfer his disabled veteran exemption to his newly built condo, he said the Travis Central Appraisal District, or TCAD, denied the request. It said his property did not legally exist at the start of 2023.

Property value is appraised based on its market value on Jan. 1 each year.

“I was like, ‘how does it not exist?’ Well, it was under the builder’s property ID number and when you have a condo, they don’t have separate property ID numbers until the unit is sold and then the following year it takes effect,” he said.

While Romel’s 100% tax exemption is in effect for 2024 and beyond, he was on the hook for the 2023 taxes during the months he lived in the condo.

“To come up with, you know, $6,500 that I wasn’t expecting to have to pay when I bought the house was a little hard,” he said.

Then, just a few weeks ago, he said, “I got a double slap in the face”.

The owners of his previous home contacted him, he said, saying they paid their taxes but got the check back because no taxes were due on the property.

A TCAD spokesperson told KXAN Investigator Mike Rush even though Romel could not transfer the disabled veteran exemption to his new property, he was still entitled to the benefit for the entire year.

Because the appraisal district said he did not explicitly request the exemption be removed from his previous house, it stayed. Romel said he didn’t know he had to make that request.

In a statement, TCAD’s Chief Appraiser Leana Mann told KXAN Investigates appraisal districts “depend on both the buyer and seller to provide us with this information and complete the necessary documents for us to process any changes.”

Meanwhile, Romel is relieved to find out his exemption will not be misused after the Travis County Tax Office eventually re-billed the owners of his previous home who got a refund.

Understanding property tax exemptions can be ‘tricky’

Lorri Michel is a property tax attorney in Austin.

“Managing and handling of the exemptions can kind of be a tricky issue,” she said.

Michel is used to challenging TCAD and other appraisal districts on behalf of property owners.

She disagrees with TCAD’s interpretation of the tax code and believes Romel’s exemption should have covered him for all of 2023 even if his home wasn’t complete at the start of the year. It’s an issue she thinks state lawmakers should address.

“There really needs to be a little bit more of a balance here because we do see these situations, such as with this disabled veteran, where they just get caught right in between the cracks,” she said.

Romel said he wants to work with state lawmakers to close the loophole that made him pay.

“If there’s any kind of bill that can be drafted or formed and law created to prevent this from happening to someone else in the future, I’m happy to be part of that,” he said.

There are several types of exemptions, including general homestead exemption and 65 or older. Michel suggests reviewing the appraisal notice you got from your appraisal district to make sure your exemptions are there, and protest, she said, if they aren’t.

She also recommends contacting your appraisal district’s exemptions department before moving or making changes to your property to see how your plans would impact your exemptions.

Copyright 2024 Nexstar Media, Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

For the latest news, weather, sports, and streaming video, head to KXAN Austin.