Analyzing Ohio’s two $15 minimum wage proposals

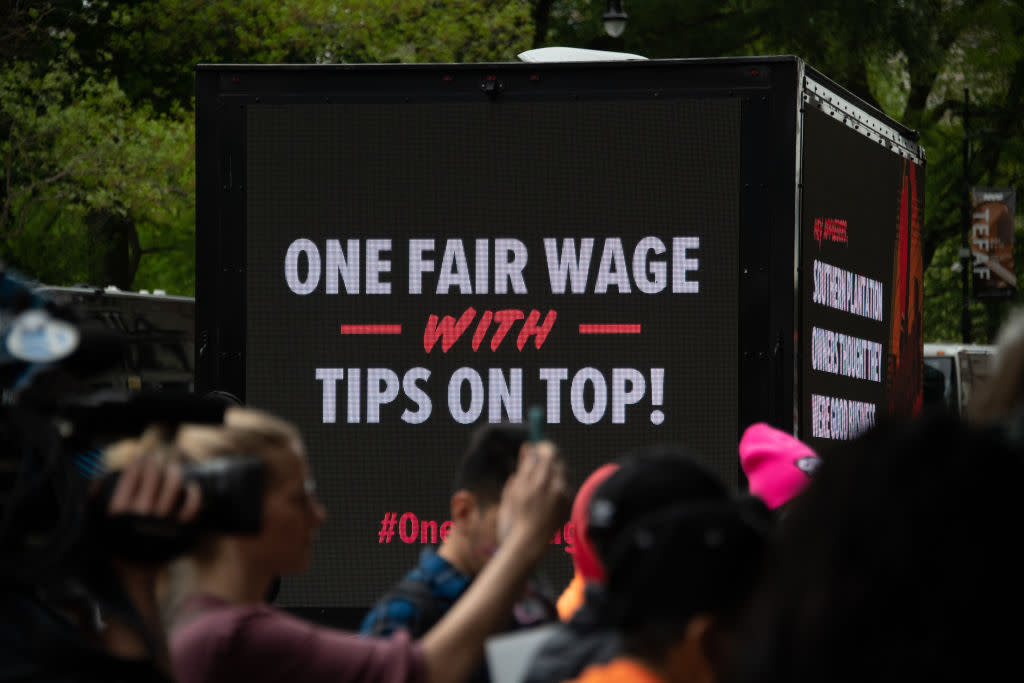

Protestors rally against subminimum wages. (Photo by Noam Galai/Getty Images for One Fair Wage)

Last week, Senate Bill 256 was referred to the Ohio Senate’s Ways and Means Committee.

At a time when momentum is growing to increase Ohio’s minimum wage via ballot initiative, this new bill puts forth an alternative to increasing the minimum wage.

Senate Bill 256 has a few key differences from the proposed ballot initiative.

While the ballot initiative would raise the wage to $15 an hour by 2026, Senate Bill 256 would raise the wage to $15 by 2028. Both proposals index the new wage to inflation.

If inflation rises at 2% per year (the federal reserve’s inflation target), that means the minimum wage will be about 60 cents lower in 2028 under Senate Bill 256 than the ballot initiative. This gap will be larger if inflation is higher.

Under the current minimum wage of $10.45 in 2024 indexed to inflation, the minimum wage in 2028 would be $11.31 if inflation increases at the reserve target over the next four years. So the Senate Bill is calling for a $3.69 minimum wage hike in 2028 compared to a $4.29 minimum wage hike from the ballot initiative. Effectively, the senate bill is calling for 86% of the minimum wage hike as the ballot initiative is.

Tipped workers would be covered by the ballot initiative, but not by the Senate bill. A long-term goal of minimum wage advocates has been to bring tipped minimum wages in line with overall minimum wages. Tipping culture has been linked to sexual harassment and wage theft and making workers less reliant on tips could help stem both of those issues in the restaurant industry.

A third difference between the two measures is legal. The ballot initiative is being proposed as a constitutional amendment. This shields it from modification by the legislature before or after it is passed. The Ohio Constitution can only be amended by a statewide vote, meaning that the ballot initiative would be the law of the land until another ballot initiative is passed to change it.

Senate Bill 256 could be modified in the Senate or in conference committee before the House. It also could be subject to line-item veto by the governor, changing the effect of the final bill before it becomes law.

A final difference between the two measures is that Senate Bill 256 includes a provision to expand the state Earned Income Tax Credit, a credit that provides tax relief to low-income families. The current tax credit is structured so that cash does not reach some of the most needy families. The change in Senate Bill 256 would expand eligibility for refundable credits, putting cash in the pockets of low-income workers.

When evaluating the two options, a clear tradeoff emerges between the two. Senate Bill 256 favors a less generous minimum wage increase in favor of a work subsidy targeted toward low-income workers. What this amounts to is a policy that will likely be less beneficial for workers at or near minimum wage with job security and much less beneficial for tipped workers with job security. On the other hand, it will benefit workers at risk of unemployment (especially tipped workers) and low-income workers not currently eligible for the earned income tax credit.

Both policies are likely to lead to more income for low-income people at the cost of some jobs compared to the status quo.

This may not matter in the scheme of politics. Voters are likely not paying enough attention to evaluate the bill as an alternative to the ballot initiative. That is, unless the General Assembly passed the bill and it was signed by the governor before a November vote. In that case, the ballot initiative would be about constitutional protection, date of phase-in, and tipped minimum wages.

That would be an interesting place to be in November.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX SUPPORT NEWS YOU TRUST.

The post Analyzing Ohio’s two $15 minimum wage proposals appeared first on Ohio Capital Journal.