Analysts say Michigan’s overall revenue continues to grow, while School Aid Fund shrinks

Michigan Capitol | Susan J. DemasMichigan Capitol | Susan J. Demas

Updated, 5/17/24, 8:55 p.m.

Despite no longer having the cushion of federal COVID funding, Michigan should still see modest growth in net tax revenues for Fiscal Year (FY) 2025 that will leave a higher-than-anticipated bottom line in the state’s General Fund.

That was the takeaway Friday from the state’s final Consensus Revenue Estimating Conference (CREC) for 2024 as leaders of the State Treasury Department and House and Senate fiscal agencies met with economists and their partners at the Michigan Capitol.

“This conference reflects a strong and stable foundation for the budget process,” State Treasurer Rachael Eubanks told reporters after the conference. “In fact, compared to previous conferences, today was a little bit boring, which is good when forecasting revenues and finalizing a budget.”

The bottom line is that Michigan’s overall revenue forecast is $188.1 million higher than it was estimated at January’s CREC.

At that point, the General Fund was expected to close out Fiscal Year 2024, which ends on Sept. 30, with $13.6 billion. Friday’s estimates upped that to $13.95 billion, a $351.4 million increase from what was projected in January.

While that equates to a $351.4 million increase, it was offset by a dip in the forecast for the state’s School Aid Fund (SAF). Its forecasted revenue for FY 2024 is $17.78 billion, a $163.3 million drop than the January estimates of $17.95 billion.

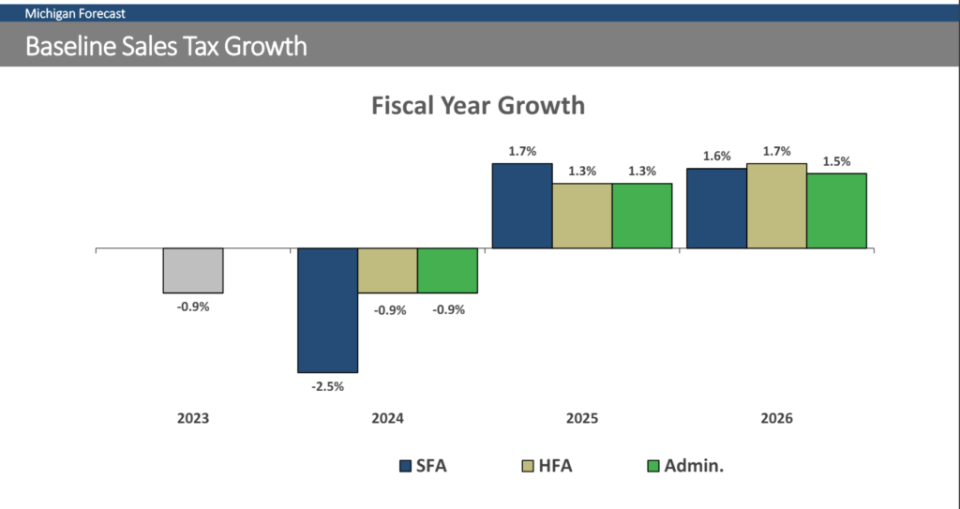

That decline in the SAF is largely being driven by slower than expected sales tax revenues, according to Ben Gielcyzk with the House Fiscal Agency, who noted that about three-quarters of the sales tax goes to the SAF.

“Year to date, sales tax is a little over 3% lower than last year, and we had forecasted 1% growth in sales tax for Fiscal Year ‘24,” he said, “Therefore, current year to date figures do suggest a larger downside adjustment for the School Aid Fund based on those current trends.”

Meanwhile, Friday’s consensus set net revenue estimates in 2025 to $32.4 billion – $75.5 million more than estimated in January. By 2026, the group estimated the net revenue will be $33.46 billion, a $45.4 million increase from its January estimate.

The revenue estimates will now be utilized to craft out the final budget plan for the upcoming FY 2025, which begins Oct. 1.

Gov. Gretchen Whitmer proposed a $80.7 billion budget in February, while the House passed an $80.9 billion spending plan last week and the Senate’s $81.9 billion version was completed on Wednesday. Those bills will now go to conference committee where negotiations will take place, utilizing Friday’s numbers, to reconcile the three plans into a final budget.

“What we’re seeing is that Michigan’s economy continues to be strong and stable,” said Budget Director Jen Flood. “And at this point, we’re ready to roll up our sleeves and get to work with our partners in the legislature to finalize a budget for Fiscal Year ‘25 that will make a real difference in the lives of Michiganders across the state.”

When asked about criticism of the governor’s budget from Senate Minority Leader Aric Nesbitt (R-Porter Twp.) in which he blasted a proposal by Democrats to divert a $632 million payment to the state’s pension system for teachers and other school workers, Flood reiterated that the money in question was not needed in the pension system, as it is secure, and instead will be used in the K-12 budget.

“The minority leader has a newfound support for teachers and retirees it seems, because his votes earlier on in his career cut funding for schools and taxed seniors,” she said. “So we are grateful that we’ve been able to address that issue and also invest in schools at a historic level. This proposal does not touch teacher retirement, their benefits are secure, [and] continues our record of investing in schools at historic levels.”

Meanwhile, Michigan League for Public Policy Fiscal Policy and Government Relations Director Rachel Richards said Friday’s CREC demonstrates that now is not the time to shy away from making investments that will have real-world impact on Michigan families.

“These investments need to be bold and enduring, building on the successes of our current budget, as undoing decades of disinvestment will take time to rectify,” said Richards. “And today’s estimates, showing a stable economy and a stable revenue forecast, allow Michigan’s policymakers to do this. The needs of Michiganders — especially those with low incomes–should remain a central part of all budget decisions, with dollars prioritized toward things like basic cash assistance, child care, housing support, healthy food access, equity-focused school funding and health care.”

State Sen. Sarah Anthony (D-Lansing), who chairs the Senate Appropriations Committee, concurred that the numbers coming from Friday’s conference should not deter lawmakers from crafting a budget that focuses on Michigan residents.

“As budget negotiations now ramp up, I remain dedicated to responsible budgeting that supports, strengthens and uplifts our communities,” she said. “Regardless of revenue fluctuations, I look forward to continuing to collaborate with our colleagues, both across the aisle, across the hall and in the executive office to finalize a budget that truly builds up the people of Michigan.”

The Legislature has until July 1 to pass a new state budget; however there is no penalty if lawmakers fail to meet the deadline.

Michigan’s economic outlook

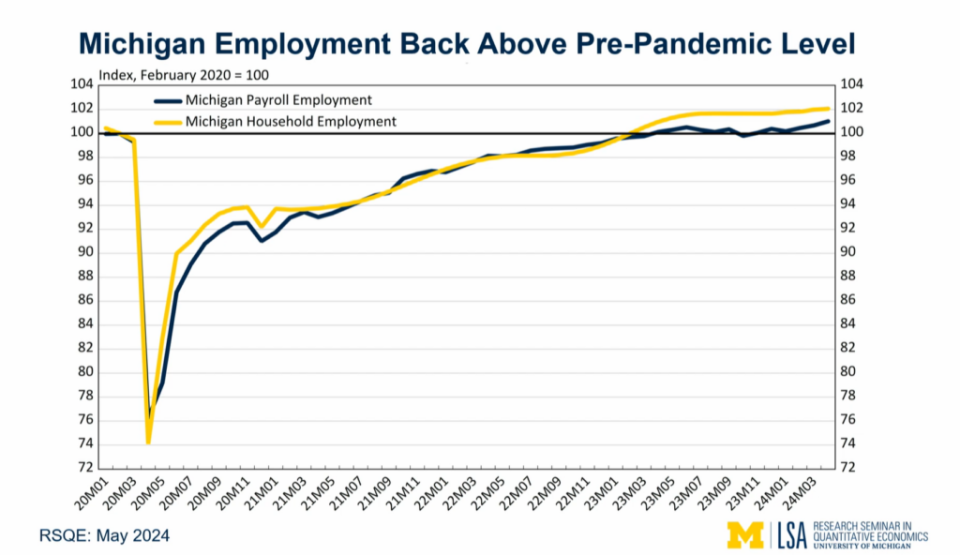

Prior to the revenue estimates, a forecast from University of Michigan economists predicted declining inflation, along with steady job growth and low unemployment over the next two years, although they cautioned that those modest gains would be tempered by sluggish income growth.

“Michigan’s personal income per-capita grew by 4.7% last year to just shy of $60,000,” said Gabriel Ehrlich, director of the Research Seminar in Quantitative Economics. “The picture doesn’t look as rosy after adjusting for inflation and taxes. High inflation in 2022 took back nearly all of the gains in Michiganders’ real disposable incomes that they had seen during the pandemic years.”

However, Ehrlich said while they expect real disposable income per capita to dip “just a little bit” this year, it should return to an average growth pace of about 1.3% per year in 2025 and 2026 and finish almost 4% higher than before the pandemic.

Overall, Erlich said employment should grow at a healthy pace over the next few years, while the unemployment rate in Michigan is expected to remain below 4% through 2026. Additionally, inflation will continue to slowly decline.

Correction: This story was corrected to reflect that it was the criticism of Senate Minority Leader Aric Nesbitt, who Budget Director Jen Flood was responding to about the pension system. The story originally named the incorrect person.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

The post Analysts say Michigan’s overall revenue continues to grow, while School Aid Fund shrinks appeared first on Michigan Advance.