What 8 Women Learned From Tracking Their Spending

Some people feel better with a strict budget. Other people prefer the time-honored practice of just not thinking about it. Whichever category you may fall into, chances are you still might be surprised if you took a closer look at what you spend money on day to day. I asked eight women in their 20s to track how much they actually spent in a normal week to see how well they knew their spending habits.

Once the week was up, eight distinct spending categories - beyond recurring monthly expenses - emerged among the women: restaurants, groceries, drinks, entertainment (such as movies, concerts, and wine tastings), transportation (including parking, gas, subway fare, or taxis), gifts for other people, health (like yoga or fitness gear), and, of course, coffee. A ninth category, miscellaneous spending, was also included for random expenses, like makeup, laundry detergent, a surprise car insurance fee, and a new dog bed after a pup puked in hers (😩).

All of the women were met with unexpected expenditures - there was the woman who realized she didn't contribute much to household costs, and the woman who realized she spent the same amount on her commute to work as she did on food. For more insights, read on:

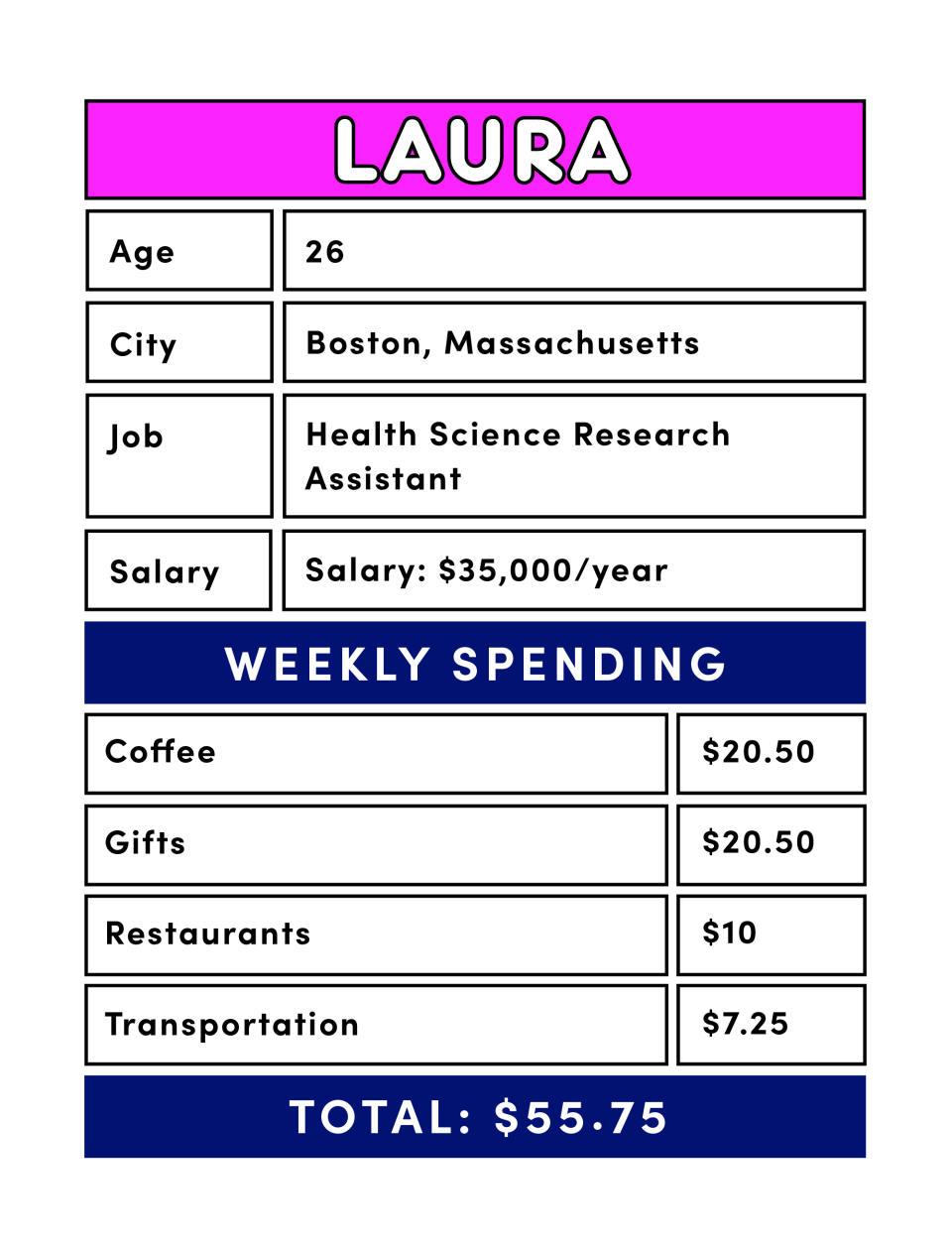

1. Laura

Monthly Payments:

Rent: $350

Utilities: $50

Therapy: $120

Medication: $50

Estimated Weekly Spend: $100

Actual Weekly Spend: $55.75

Takeaway: I came out under prediction but the knowledge that I was tracking my spending might have made me spend less subconsciously. I don't think it affected the little things I bought - like, it didn't make me buy a different breakfast with my brother or gift for my cousin's baby shower - but I feel like I didn't make any impulsive buys because I knew I was tracking. Sometimes I do make impulsive buys, like clothes or shoes I like, but know I won't actually wear (like my 3-inch platform oxfords) or food that is not part of my usual weekly grocery list (Häagen-Dazs ice cream, a $10 wedge of specialty cheese, etc.).

Also, I spend 36 percent of my budget on coffee. Coffee doesn't feel like an expense to me because I got it free at my old job, but clearly, it's a major expense now, and I need to reframe it in my mind.

Another thing I noticed is that I often argue with [my boyfriend who I live with] about how often/much I contribute to gas/groceries/laundry/household items, etc. I feel like I do contribute, but he wins this one based on the data! I would say he spends about $100 per week more than me. I have been trying to pay for more stuff though, especially since he is going to grad school next year and won't have as much money.

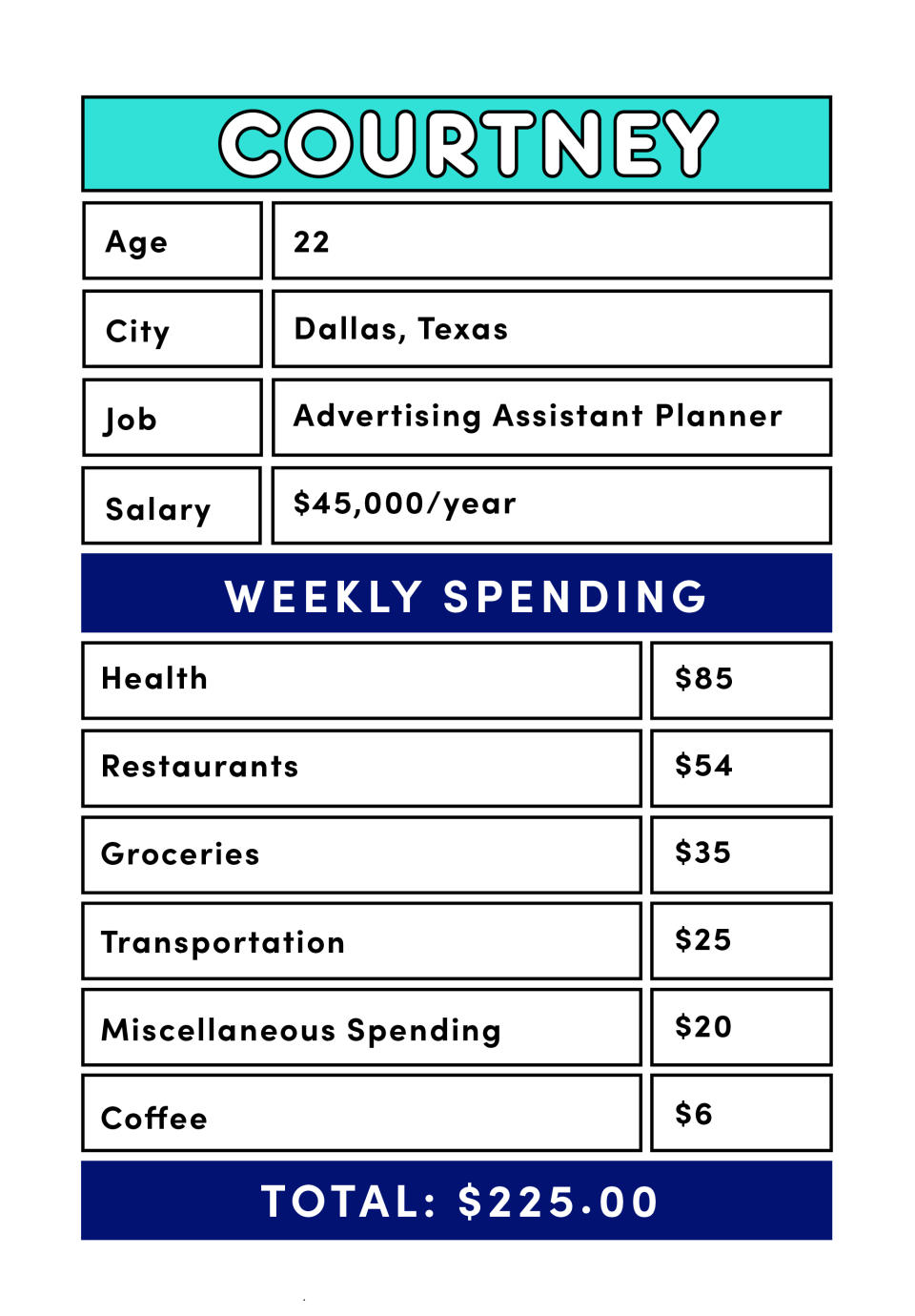

2. Courtney

Monthly Payments:

Rent and utilities: $1,100

Gym: $40

Spotify: $10

Birchbox: $10

Estimated Weekly Spend: $200

Actual Weekly Spend: $225

Takeaway: I follow a monthly budget because saving is really important to me, and following a monthly budget allows me to not live beyond my means. Knowing how much I typically spend and how much I should spend allows me to usually stay close to my budget throughout the month. But after doing this exercise, it made me a little bit more aware that every week and month is different, so I should try and check in more frequently with my bank account - flexibility and making small adjustments are key for me to stay on budget.

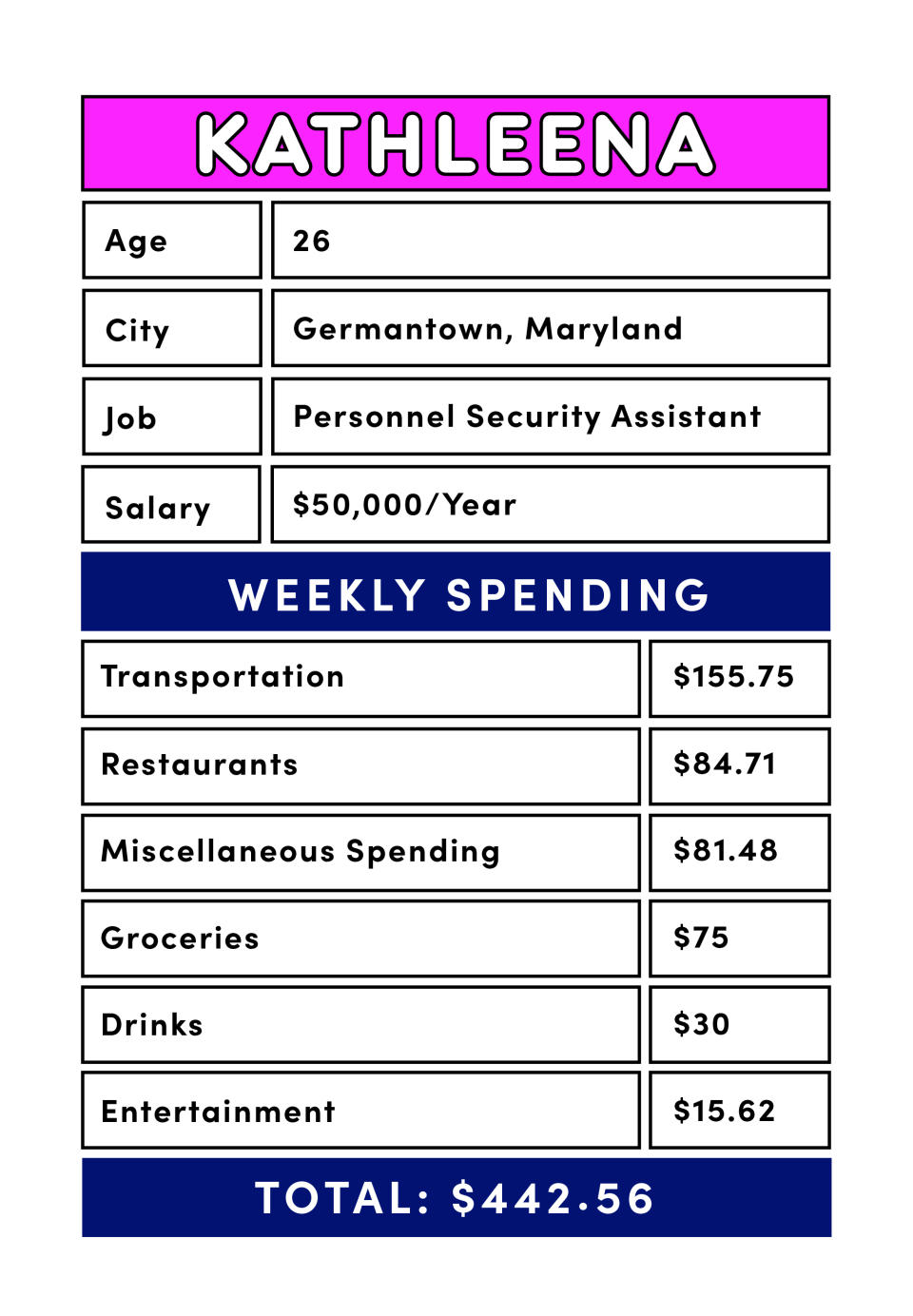

3. Kathleena

Monthly Payments:

Mortgage: $400

Internet: $46

Utilities: $110

Gym: $89

Estimated Weekly Spend: $300–400

Actual Weekly Spend: $442.56

Takeaway: I definitely underestimated how quickly my expenses add up! Overall, I'd say that the two biggest expenditures I have are my commute and food. For the commute, I usually drive and pay to park my car in a nearby garage, so the cost is typically just for parking (it's terrible). Note to self: Eat out less, so I can save money for more important things.

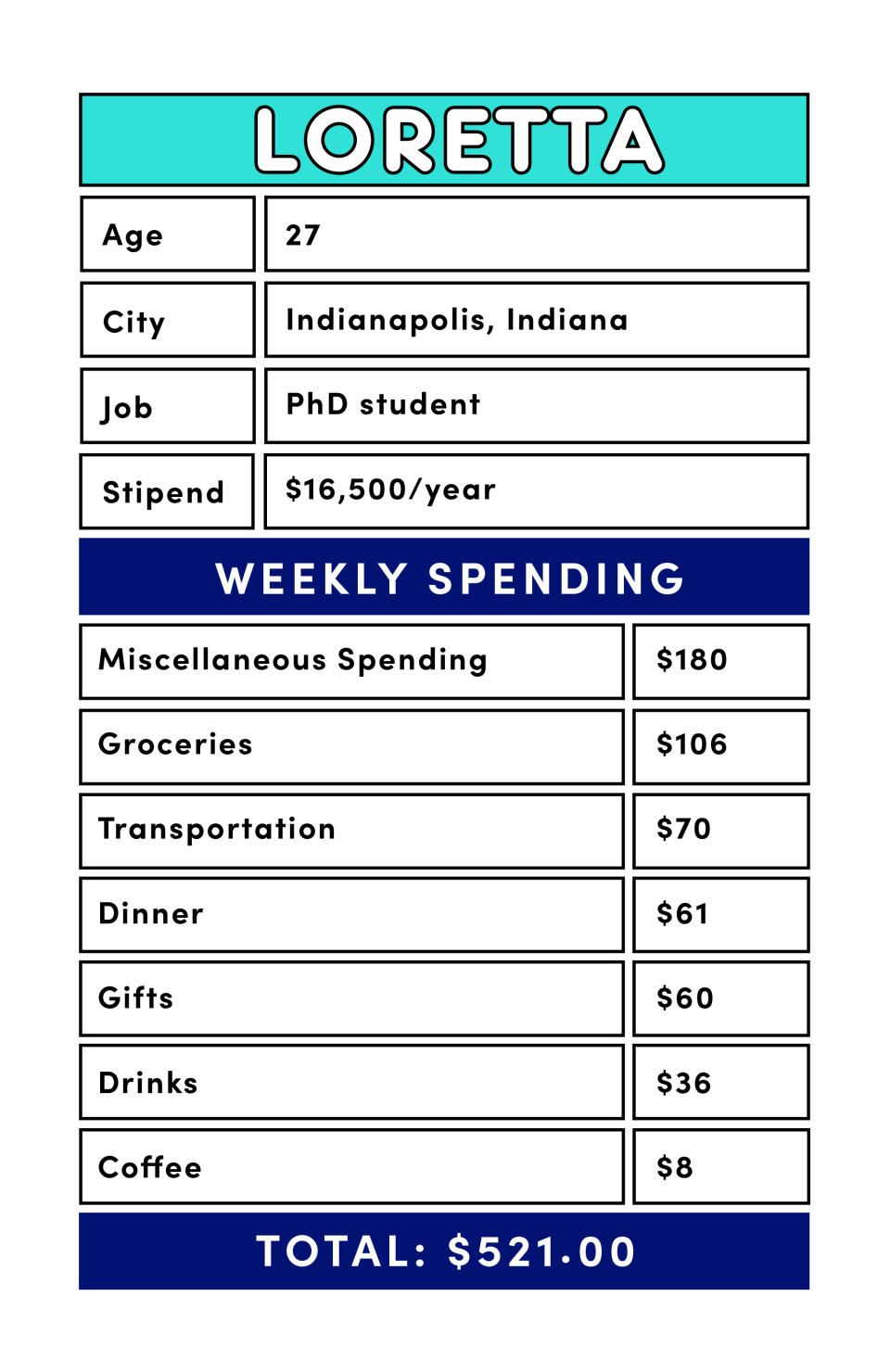

4. Loretta

Monthly Payments:

Rent: $910

Internet: $40

Utilities: $80

Gym: $39

Yoga: $59

Hulu: $10

Amazon Prime: $9

Spotify: $11

Estimated Weekly Spend: $250

Actual Weekly Spend: $521

Takeaway: Relationships are expensive, including the one with my dog. A lot of my money goes toward doing things with people or for people - birthday drinks, hair stuff for my mom, new dog bed for the dog ... [Tracking my spending was] just a lot of soul-searching I wasn't ready for!

I definitely dip into savings and then try to go on "money fasts" where I don't spend anything for a week. A lot of it also goes on my credit card, in hopes that over the course of a month, things balance out. This past year, that's been a little more difficult to do, because my income went down, and maybe I'm still adjusting to that.

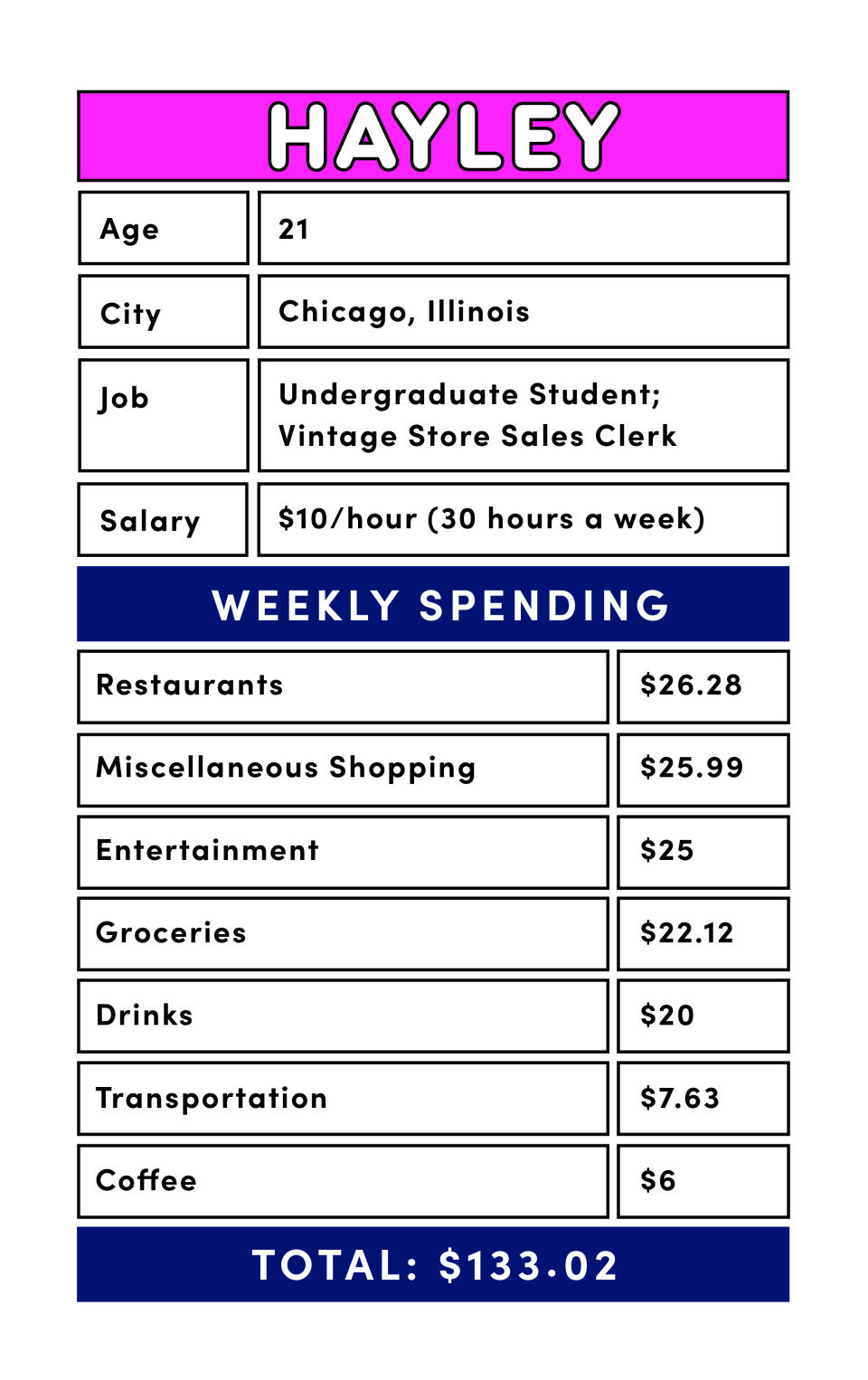

5. Hayley

Monthly Payments:

Rent: $450

Internet: $20

Utilities: $70

Phone: $28

Spotify: $4.99

Estimated Weekly Spend: $60

Actual Weekly Spend: $133.02

Takeaway: Overall, I spent a lot more money in a week than I thought. I often think of my bills being separate from my everyday expenses, but I realized that the money I use for food is the same money I use for my [monthly] bills. I'm so quick to spend money on food, thinking I can treat myself to this and that because I know I make enough money to pay my bills - but I should be considering that all the money I spend on meals and snacks could be going toward my bills. When the bills come every month, I'm always scraping together pennies, and it's because I choose to ignore their existence throughout the month. Just because I "make enough money to pay my bills" doesn't mean I can buy whatever I want. It still requires budgeting!

[Tracking my spending] pushed me to look at my finances with a more frugal eye than I'd like … I'm definitely someone who thinks splurging on experiences is always a good idea, but I might be able to live more comfortably (and buy healthier food - ha!) if I paid more attention to my cash flow and how it affects my purchases. I'll definitely be paying more attention to my spending habits post-experiment, however painful it may be (...very painful).

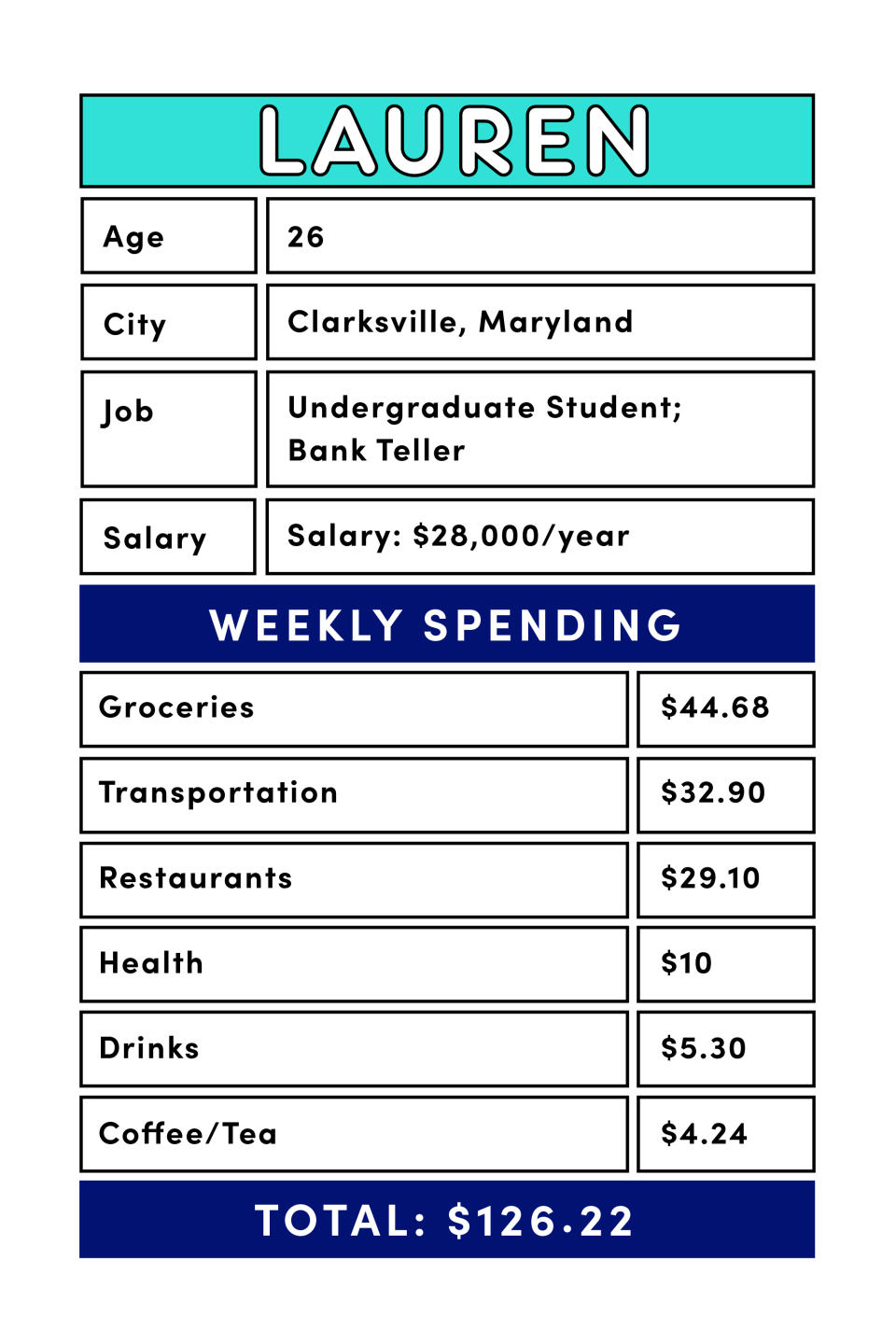

6. Lauren

Monthly Payments:

Rent: $650

Phone/internet: $80

Student loans: $415

Car payment: $280

Car insurance: $130

Gym: $25

Medicine: $7

Estimated Weekly Spend: $200

Actual Weekly Spend: $126.22

Takeaway: This experience provided me with a lot of insight as to how I prioritize my budgeting. I recognize that I may be on the tighter side of the budgeting scale, and I've learned ways to provide for everyday needs at home. I cook more at home, I use yoga books from the library to teach myself different sequences to practice at home. Also, I've found ways to create cheaper bulk personal care products like bar soaps, sugar scrubs, homemade face masks, etc.

The spending money I do put aside each week can be distributed between when I am short on time or in emergencies, or an experience (community yoga, comedy show, gas to go hiking, etc.). I think it's really important to challenge yourself to [come up with] healthy alternatives to mindless spending. But it's also really huge to be good to yourself, and treat yourself when you're emotionally stressed or when you accomplish something really rewarding.

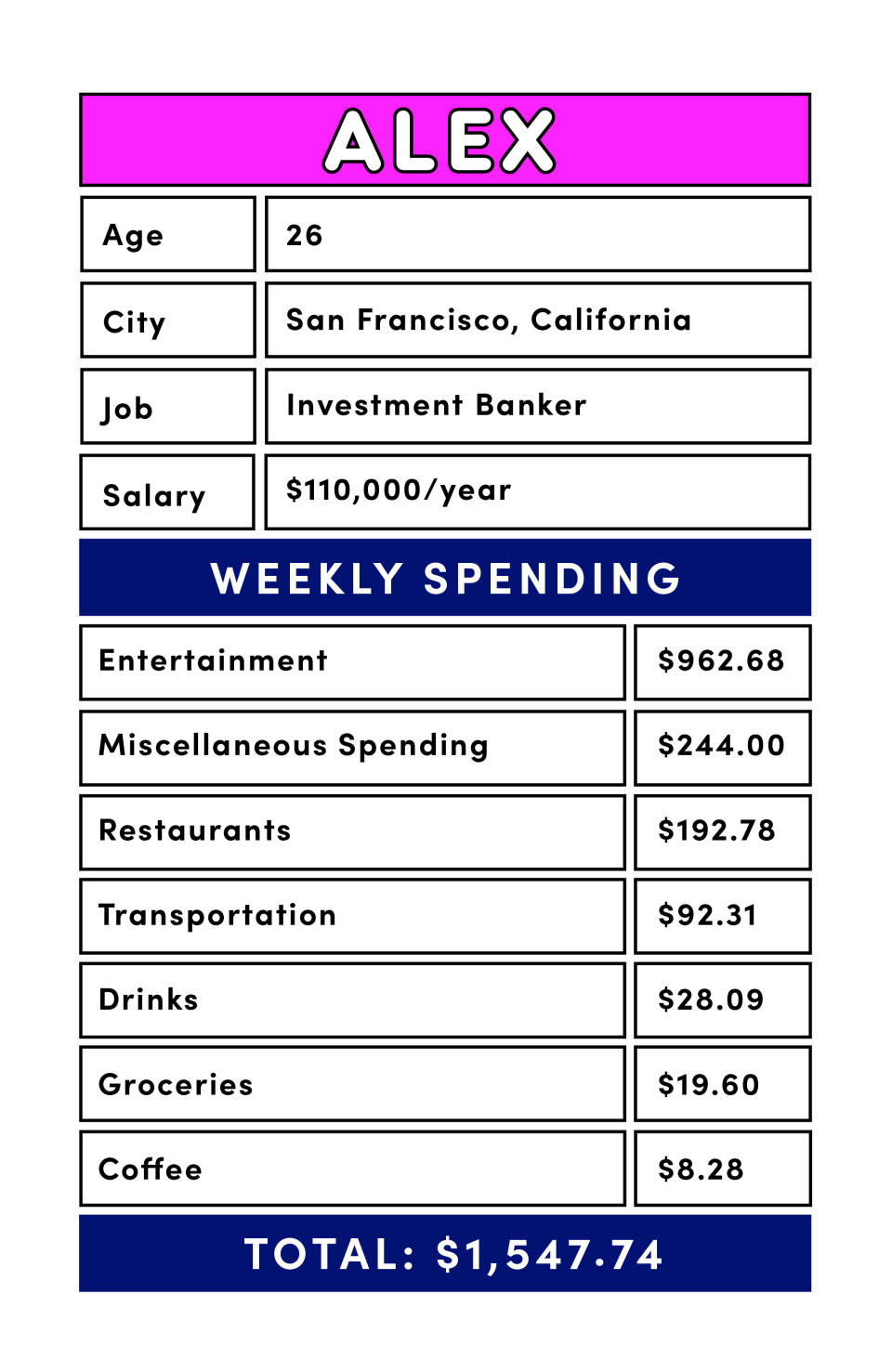

7. Alex

Monthly Payments:

Rent and utilities: $1,200

Gym: $175

Estimated Weekly Spend: $1,000

Actual Weekly Spend: $1,547.74

Takeaway: I spent way more than I thought [I would] and way too much for me personally to afford (after I already thought I stretched with [my estimate of] $1,000 per week). A lot of me wants to write this off as being on "vacation" (I was in Napa for a three-day weekend) and not indicative of my normal spending habits. Also, my boyfriend popped the tire of his car, so we had to pay to get it towed and the tire replaced, so I would write this off as not a normal expense. But I think I need to realize I do this more often than I think and "things come up" more often than I think. I need to be more conscious about looking at things as a whole versus [thinking,] Can I pay for this one thing? Spending $100 on wine at a winery doesn't seem that bad but when you remember [you went to three wineries and] that would be $300 for the day, it does ... So this was really good for me but also really frightening!

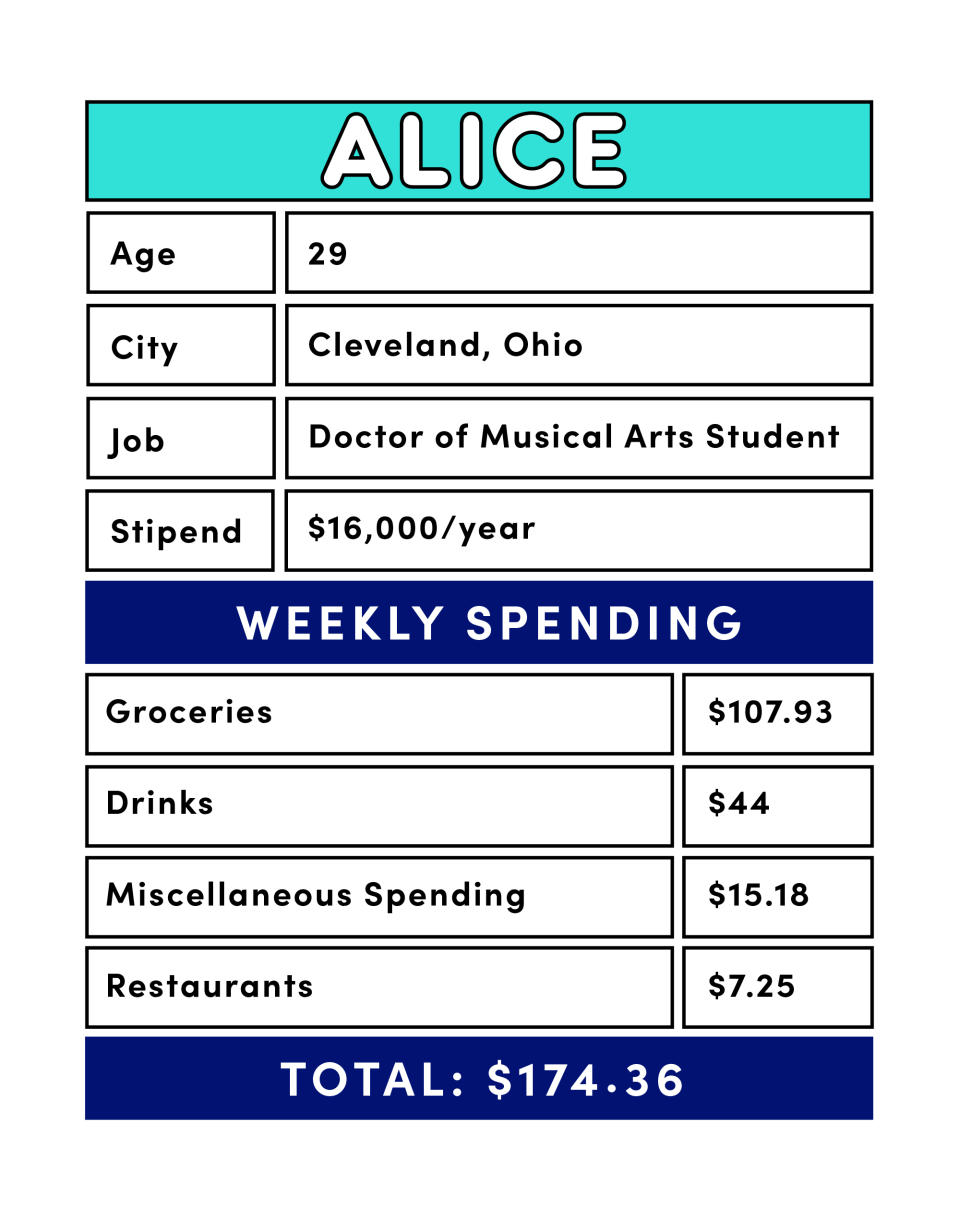

8. Alice

Monthly Payments:

Rent: $400

Utilities: $70

Phone: $80

Gym: $20

CSA: $30

Estimated Weekly Spend: $70

Actual Weekly Spend: $174.36

Takeaway: I learned that I have gotten better about making and taking food [to school], especially weeks where I have time to cook. I try to make extra and freeze it for weeks when cooking isn't an option, but sometimes I'm not sure if I will be home for dinner, and it is hard to take two meals to school when I don't have time to go home. I walk to school, so I carry everything with me that I will need for the day. It is hard to carry two meals and think that far in advance.

Being temporarily on a weird restrictive diet ordered by a doctor also helped me not spend money since I can hardly eat at restaurants anyway. I also was more aware of how I was spending my money because of this exercise, and I think that helped [with how much I spent]. I am also inspired to figure out all of my recurring expenses that I may have forgotten about...

I [still] think on average I probably spend $70 a week. The weeks I go grocery shopping (maybe once every two to three weeks) I end up spending more. I buy all organic, local when possible, so that is more expensive. Also, the Friday night drinking outing is very unusual for me. It just happened to fall in the week I reported!

Follow Heeseung on Twitter.

You Might Also Like