Economist: 'It’s pretty shameful' that more coronavirus stimulus hasn't happened yet

The global economy is potentially facing its worst recession since World War II because of the coronavirus pandemic.

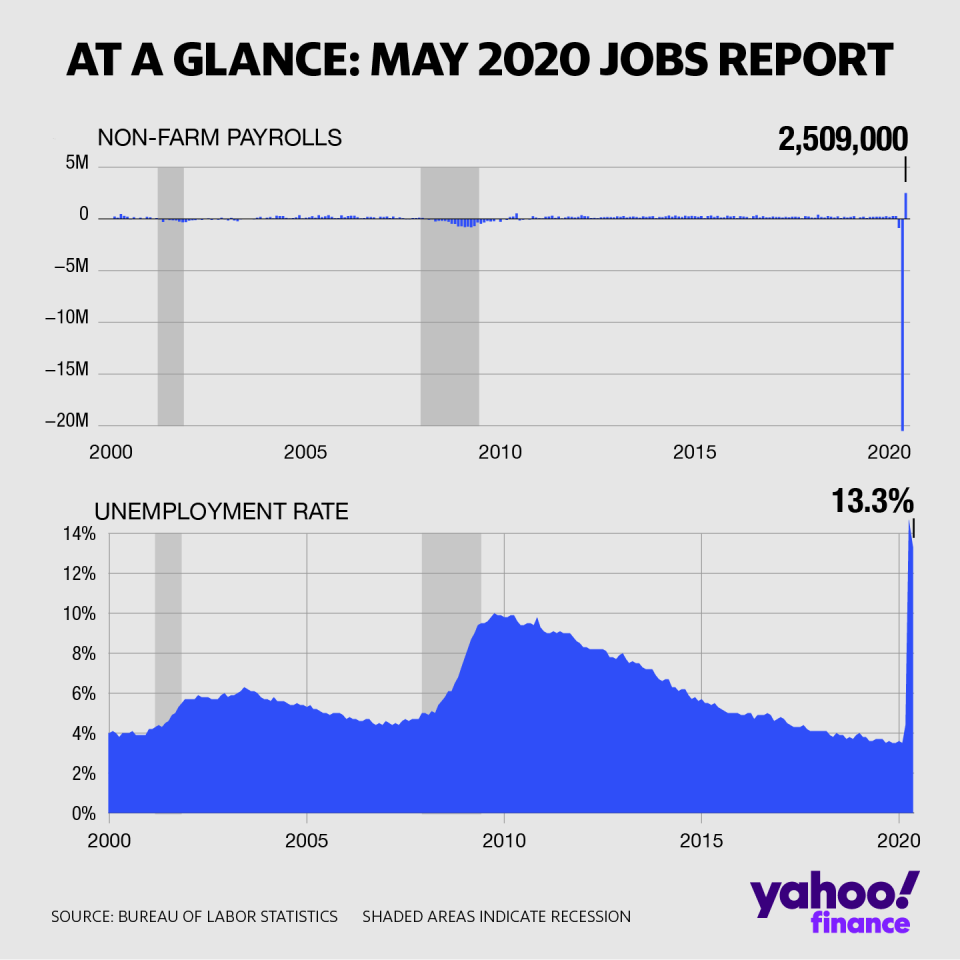

In the U.S., the unemployment rate stood at 13.3% in May, slightly better than April, but far worse than the high reached in the Great Recession. Since the pandemic began, more than 44 million Americans have filed for unemployment insurance, including the 1.54 million Americans who filed for the week ending June 6.

While Congress already passed the CARES Act that provided much-needed economic stimulus for jobless Americans, some experts said more is warranted before the aid expires at the end of July.

Read more: How to file for unemployment insurance

“States actually can’t solve this on their own — the federal government can. And so, it should be stepping in and providing state governments with a ton of aid.” Heidi Shierholz, director of policy at the Economic Policy Institute (EPI) and former chief economist at the Department of Labor, told Yahoo Money. “They could do it very, very easily. And it’s being debated. It should be happening already. It’s pretty shameful that it’s not.”

‘People will still get their benefits’

For those unemployed, not only are they able to get regular unemployment insurance benefits through their state, but also an extra $600 per week from the federal government. However, these payments expire on July 31.

Once that happens, the onus falls to the states to provide economic relief to its residents if the federal government doesn’t come up with new legislation.

Benefits are financed by unemployment insurance taxes that are stored in a trust fund. This fund is built up during economic expansions and then used during recessions, Shierholz explained. Even if the trust fund dries up, people will still be able to receive their benefits, she said.

“If those state trust funds run out, what the federal government should do is just provide the state with direct aid. But if they don’t do that, the states will borrow from the federal government,” she said. “So, people will still get their benefits, but it does point to the fact that the feds should be stepping in and providing more relief to states.”

‘Over our dead bodies, this will get reauthorized’

Gary Burtless, a labor economist at the Brookings Institution, said he isn’t sure what Congress will do once the supplement to regular unemployment insurance benefits ends, but he had some ideas.

“Republican senators and the president do not seem inclined to extend this generous top-up,” he told Yahoo Money. “They may either let the supplement lapse on July 31 or agree to a reduced supplement — say, $200 or $300 a week, assuming the unemployment rate remains very high.”

But, he noted, it’s “not necessary” to pass another comprehensive stimulus package, as Congress often extends or expands unemployment benefits in standalone bills.

“However, GOP senators or the president may not allow a standalone unemployment benefit extension, and they may insist on a bigger package that includes components that many in the GOP favor,” Burtless said, “for example, exemptions from civil liability for employers who place their employees’ health at risk by failing to provide a COVID-safe workplace, a cut in the capital gains tax, or some other measures that’s favorable to the employer/investor community.”

Because the most recent jobs report showed the unemployment rate declined in May, Republicans have indicated that they want the next stimulus package to be different in key ways. They want financial incentives for people to return to work, because some see the unemployment stimulus as a disincentive.

Read more: What to do before you lose your job

“July the 31st is when this expires and I promise you, over our dead bodies, this will get reauthorized,” Sen. Lindsey Graham (R-SC) said.

Although some are making more on unemployment than in their normal jobs, Shierholz’s suggestion is not to reduce the $600 weekly check, which she described as “well-targeted money getting injected into the economy.” Instead, those who return to work should be able to keep some of the UI benefits, so that they don’t see a big decline in their income.

“The thing that will make the recession worse and weaken the recovery is if people have to cut their spending back if their incomes decline,” she said.

Shierholz added that living off of unemployment benefits isn’t sustainable in the long term for those who get less than their incomes from unemployment. It’s also bad for the macro economy, because people start to curb their spending.

“When I cut my spending, that means that I’m not demanding the things I would have spent that money on,” she said. “And then the people who make those things that provide those goods and services, they lose their jobs. And so, that’s the vicious cycle you get in. And so, if the federal government gets me enough benefits that I don’t have to cut my spending, then you don’t have this ripple effect that brings the whole macro economy down.”

‘Huge layoffs’

Leaving it all to the states won’t work for long. Many states are already seeing massive declines in tax revenue, even with balanced budget requirements.

And according to a recent Bloomberg analysis, almost one-third of unemployment benefits still haven’t been paid out yet.

Americans across the country are caught in limbo as they wait for checks to arrive while still having to pay other bills, like rent or car insurance. And getting through to their state’s unemployment office over the phone has been a nightmare for many — one man previously told Yahoo Finance he estimates he made over 1,000 calls.

Without federal aid, Shierholz said, the states may not have to cut unemployment benefits but they will have to make the cuts elsewhere.

“They’ll be doing huge layoffs of workers, cutting other essential services,” she said. “It’s just not at all the time we want that to be happening.”

Adriana is a reporter and editor covering politics and health care policy for Yahoo Finance. Follow her on Twitter @adrianambells.

READ MORE:

'It’s a freaking circus': Unemployed Americans share tales of an overloaded system

Reopening economy 'will have a much smaller-than-expected impact,' experts argue

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

money

money