Zulily IP Assets Go Up for Sale, Giving Flash Sales Site a Second Chance

Whatever kind of phoenix-from-the-flame moment that’s left to Zulily, it’s coming soon.

Founded in 2010, the once-buzzy fashion darling was a leader in the flash sale phenomenon that took hold after the Great Recession, parlaying its blink-and-you-miss-it approach into an initial public offering and, in 2014, a market capitalization of $7 billion.

More from WWD

But that was the peak. QVC’s parent company bought Zulily for $2.4 billion in 2015 and then sold it to investment firm Regent last May. By December, Douglas Wilson Cos. had been brought on board to wind down and liquidate the business and give the money to its creditors.

As part of that process, Hilco Streambank is shopping around the company’s intangibles, including more than 200 trademarks, zulily.com and other domain names, customer data, social media accounts with more than 6.4 million followers and the code behind the brand’s app.

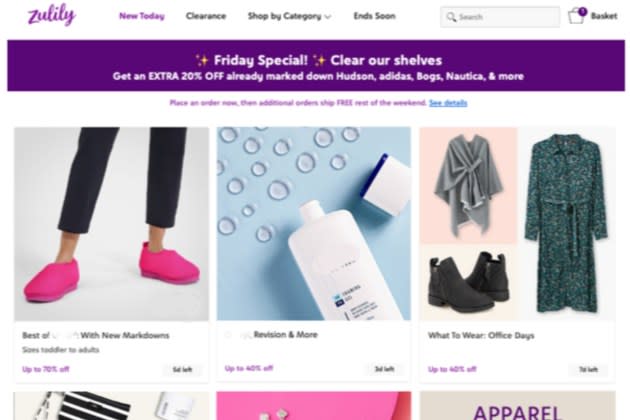

Zulily might not be what it was, but that is the IP that still helped power $666 million in sales last year — women’s apparel accounted for about 40 percent of that with the next two biggest categories being home and footwear.

Richelle Kalnit, who is senior vice president at Hilco Streambank and is managing the sale, said the IP includes information on the 20 million people who signed up to access Zulily’s flash sales, as well as data on the more than 2.5 million people in that group who made a purchase last year.

“There is a real opportunity to use new technology to further connect with this particular customer and offer her more of what she wants,” Kalnit said.

“Once you present her with these really good flash deals, the cost of customer acquisition is really low,” she said. “That’s the challenge that I think all these e-commerce companies have right now — the cost of customer acquisition is so high. You can’t market to them using social media in a way that you could before. So being able to reach these customers at a significantly lower cost is a huge opportunity.”

Flash sales are, well, sales, and can attract younger shoppers who are both keen on the latest thing and looking for a deal.

“Those are the customers that you want to reach,” Kalnit said. “And there’s the opportunity to reach those younger people at a substantially reduced cost because of what you’re offering them. Every other brand that’s out there, they may have great product offerings, but you need to spend a ton of money in order to be able to acquire that customer. So here you’re starting with a great customer base and then you’re going to expand on that.”

If it all works, Zulily might just help change the shopping world, again.

Hilco is looking to see who’s interested in buying Zulily’s intellectual property by March 13, but a deal could be struck sooner.

Best of WWD