Zara Parent Inditex Accelerates Sustainability Targets, Continues to Expand in U.S.

PARIS — Zara parent company Inditex revealed new sustainability goals, including cutting emissions.

Chief executive officer Óscar García Maceiras laid out some of the company’s new goals during the retailer’s annual general meeting Tuesday, which include speeding up its emission reductions.

More from WWD

Related Articles

Sustainable Retailer Amour Vert to Open New Store

An A-Z Guide to the Next-Gen Materials Taking a Step Forward for Sustainability

Inditex updated its 2030 reduction strategy by targeting scope 1 and 2 emissions, with the aim of reducing them by 90 percent from a 2018 baseline. Its value chain emissions, or scope 3, will be cut by 50 percent of 2018 levels.

The company previously revealed the goal of getting to “net zero” emissions by 2040 and in order to meet that target will rely on offsets as “10 percent of our greenhouse gas emissions are hard to eliminate.”

The company will only use “preferred fibers,” those considered fibers or raw materials with a smaller environmental footprint as defined by the Textile Exchange.

It has also added biodiversity to its checklist of concerns, and has vowed to restore, regenerate or otherwise improve biodiversity across 5 million hectares. Inditex, which generated 8.6 billion euros in gross profit in the first half of 2023, will donate 15 million euros to Conservation International’s Regenerative fund to scale up regenerative farming, and has pledged 10 million euros to restoration projects through the World Wildlife Fund.

New materials will come into play as the company seeks to reduce its emissions and overall footprint. Thirty percent of company emissions come from “the extraction and processing of raw materials,” and the company admitted that has a negative impact on natural resources such as water and soil. So the retailer has made moves to up its intake of organic and recycled cotton, European linen and viscose, which is made from trees, in textile sourcing.

The company will fully integrate materials that are “lower impact” by 2030, breaking down into 40 percent coming from conventionally recycled textiles and 25 percent from organic or regenerative farms. Inditex is betting on tech, with the aim of 25 percent to come from next-gen materials “that do not yet exist at an industrial scale.”

With its investments in start-ups such as Circ and purchase commitments from Infinited Fiber, it hopes it can reach these goals. The remainder will come from “preferred fibers aligned with the yardsticks set by benchmark organizations.”

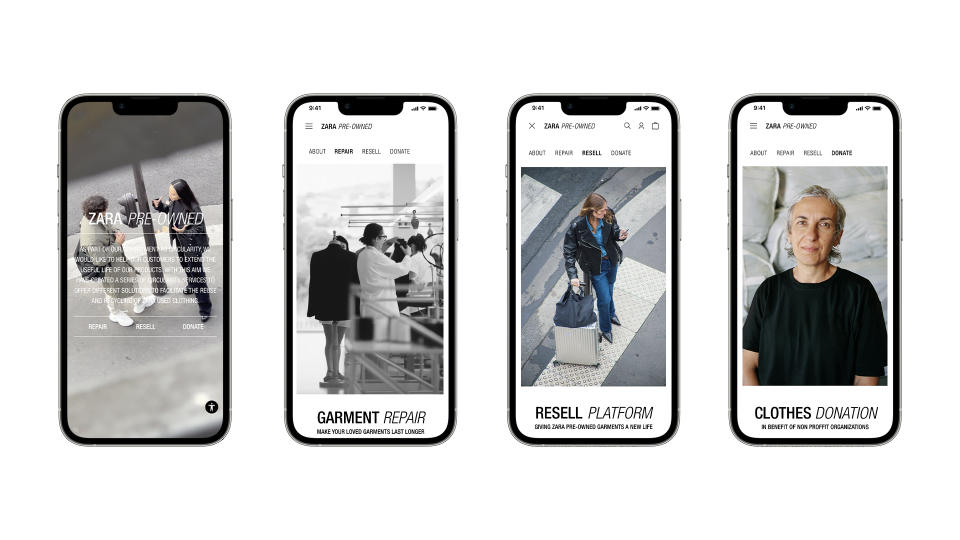

On the circularity front, the company’s Zara Pre-Owned resale platform, launched in the U.K. last October, will roll out across all key markets by the end of this year.

Turning to labor justice, the company will seek to improve the welfare of 3 million workers in its supply chain through a strategy called “Worker at the Center” to “focus on the more vulnerable sectors, health care and mechanisms that will guarantee safe and discrimination-free work environment.”

“Over the past few months, we have successfully tackled many challenges together; some of them were completely unexpected,” said non-executive chair of Inditex Marta Ortega Perez in brief opening remarks. “We will continue developing our sales and logistics capabilities; we will continue incorporating the necessary technology to carry out our future projects.”

“We’ve continued maintaining financial discipline to improve our operating efficiency. And this has allowed us to achieve a real leverage, which has been a fruit of comparison of our sales,” said Maceiras.

Maceiras focused on the company’s radio frequency identification initiatives at Zara, which are being rolled out in the second half of this year. The new tech will enable the company to track any item “in all of our stores, at any place, at any time, ever since it enters the logistics unit until it is in the hands of our customers.”

The brand also revamped its website in May, launching new dynamic results based on purchasing history. The Zara app has been downloaded by 166 million people worldwide, he added.

The company, which also operates upscale Massimo Dutti, young concepts Pull&Bear, Bershka and Stradivarius, as well as lingerie and loungewear brand Oysho is expanding into new markets. Zara just opened in Cambodia, Oysho in the U.K. and youth-oriented brand Stradivarius is slated for Germany in the second half of the year.

It has fully exited the Russian market, following the sale of its operations to UAE-based Daher in April, and those costs are accounted for, Maceiras said, but he did not rule out a return.

“We could at any point in time recover operations, if we see and believe that these are the right conditions, and we would be operating by means of a franchise,” he said.

Inditex is continuing to pay its leases and wages in Ukraine throughout the war, and continues to monitor the conditions there. “We hope in the future to be able to, again, run our activities there in accordance with our group standards,” he said.

Maceiras downplayed questions about China, where Inditex shuttered many of its brands and stores in 2022 after a decade-long growth effort in the territory. “China’s still a strategic market, a relevant market for the group,” he said. The company has “adapted” its fashion offer with Zara, Massimo Dutti and Oysho still operating in the country. “We’re going to continue investing in promoting our presence in the Chinese market.”

Still, he focused on growth in the U.S., where the company has 30 projects including revamping stores in New York, Boston and San Francisco with its new design concept, as well as opening in Baton Rouge, Louisiana, this fall. He framed it as Inditex taking 50 cents of every $100 spent on clothing in the country, adding that the U.S. is “where we’re still seeing enormous growth opportunities.”

Best of WWD