If You're Not Sure How to Teach Your Kids About Money, Start Here

If you purchase an independently reviewed product or service through a link on our website, SheKnows may receive an affiliate commission.

For a lot of us growing up, money was a taboo topic — or at the very least, something that wasn’t brought up much (if at all). We may have had the odd unit on balancing a checkbook or making a budget during a home economics class, but teaching personal finances and money management didn’t seem to be a primary concern for either our parents or our educators … especially for girls, who historically were not expected to even care much about finances, let alone be the primary breadwinner or money manager (thanks, patriarchy). Things are different these days, though, and money is a topic to be explored and explained, not swept under the proverbial rug. Through podcasts, workshops, and self-help books, we can learn how to make our finances work for us — and in turn, teach our kids how to do the same.

More from SheKnows

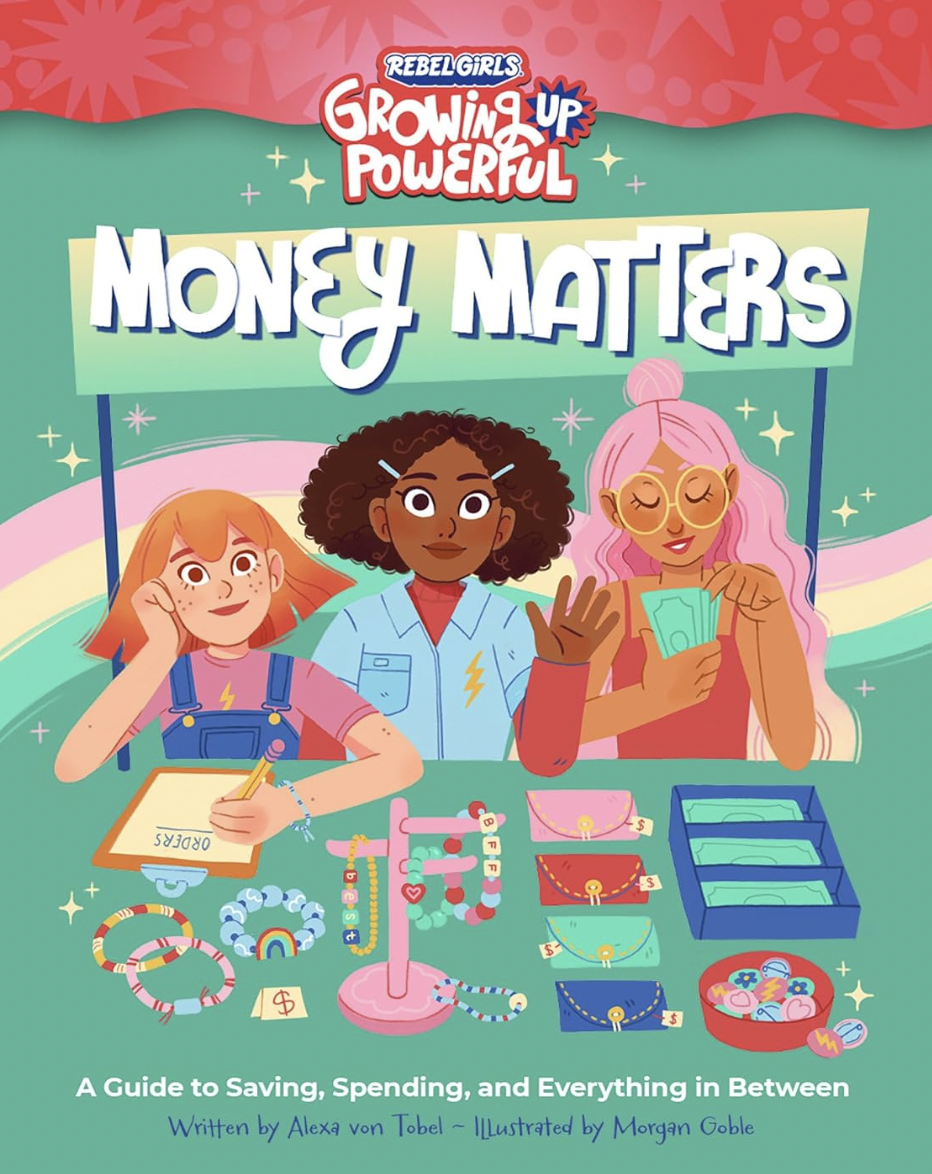

One financial-literacy advocate leading the charge for change is Alexa von Tobel, founder of Inspired Capital and financial planning company LearnVest. She’s the host of The Founders Project podcast. She’s the New York Times bestselling author of Financially Fearless and Financially Forward. And now she’s extending her expertise to a new audience: girls. Her newest book, Rebel Girls Money Matters: A Guide to Saving, Spending, and Everything in Between, was just released today — and it aims to teach tween girls (ages 8-12) the basics of a strong financial foundation, addressing budgeting, investing, credit, even the pay gap!

Rebel Girls Money Matters: A Guide to Saving, Spending, and Everything in Between

SheKnows had a Q&A session with von Tobel, where we asked for her best advice on talking to kids (boys and girls!) about money. Here’s the valuable info she shared.

SK: What’s the most important thing for kids to learn about money?

AvT: It’s so critical that we teach our kids that money is a tool. How we feel about money throughout our lives is heavily influenced by our associations with money as a kid, so now is the perfect time to set your kids up for a healthy mindset.

As you start to teach them how money works, keep it tangible! At only four years old, we gave my oldest daughter (who’s now nine) a variety of different-sized piggy banks so she could visually see the act of earning money and saving it for items she wanted — big and small. For instance, the smaller piggy bank was used for short-term goals: things she wanted within a month and were smaller cost items, like an ice cream cone or lemonade. The larger piggy bank was for things way out into the future — like a new bicycle or college savings.

When you give your kids actual coins and bills to handle and count, they can see their savings grow, which can be very motivating! You can even think about creating a visual representation of their goal by printing out a picture of the item, attaching it to the piggy bank, and helping them track their progress towards it.

SK: What’s one thing that parents don’t teach their kids often enough, money-wise? Is there any way in which you frequently notice parents are getting it wrong?

AvT: One of the best lessons to teach our kids is how to make your money work for you. While compounding interest might seem too complex, it’s something you can start to instill at a young age. If we delay gratification — like putting money into a bank account that earns interest — we’ll have even more on the other side.

Sometimes many of the money conversations we have focus on the immediate fun of spending or giving allowances for chores. But it’s just as important to talk about the future too. What are your family’s budgeting and saving goals? Budgeting isn’t about restricting spending, it’s about empowering our kids to shape their financial choices. It gives them agency and accountability, building a positive relationship with finances and money.

Once they have a clear goal in place, help them set up a bank account that actually pays interest and show them how compounding interest will help them reach their goals even faster.

SK: What are some practical ways to infuse financial education into our kids’ daily lives?

AvT: It’s really important to make money feel real. This is especially true in such a digital world where things magically appear at the door (without them ever seeing money exchange hands). Literally put bills and coins on the table and make it a topic that you talk about and work through so they can start to learn about money early on.

Maybe you start with a piggy bank, and then when your child is older, take them to the bank and let them physically see the money being taken out to go buy something – they will start to very quickly connect the dots.

You can also encourage entrepreneurism at a young age — whether it’s a lemonade stand or volunteering to do more chores around the house for some extra money. My daughter has a bracelet business. She sells them for $5 and quickly sees the value of her hard work and how her earnings add up toward her goals.

SK: As an expert, what (and how) do you personally teach your kids about money — what’s the best financial advice you’re passing on to your own children?

AvT: I’ve learned that starting with the basics is key! I like to start with how to prioritize essential expenses, like food and transportation. This skill will help them make informed choices and avoid impulsive spending later in life. Starting young and developing the complexity of how you explain this will make it so much easier for them to understand and apply these skills!

No matter the specific lesson, I make sure to talk about money in front of them, and I do so in a positive tone. I never want them to associate money with something too complicated or too scary to learn about. It should be a topic they feel empowered in and eager to learn more about as they grow.

SK: What’s the best way to discuss money with young kids? How about teens?

AvT: When talking to your kids about money, ground it in things they can understand. How many times does your kid ask you for something, and your response is “No way, that toy costs $200?” To a young child, they can’t conceptualize what $200 is — but if you said, “Wow, that would be 800 quarters!” it puts things into perspective for them.

And most importantly, watch your tone. It’s hard, but critical. The tone of how money is talked about matters. If it’s a source of stress, then it creates an overwhelming association. But, if you are matter-of-fact when discussing money with your kids, especially with teens, it goes a really long way and sets your kids up for success.

Keep it tangible. Be matter-of-fact. Make it fun!

SK: Should you be honest with your kids about your family finances? Are there financial topics you shouldn’t discuss with them?

AvT: Yes! We need to move on from this outdated view on money being secretive. It’s so important to talk to your kids about finances so that they can have a healthy relationship with money when they’re older. There is new research that shows if you grew up in a house where money is not talked about and is kept behind the scenes — maybe because it was a stressful topic or socially you were taught not to talk about money — it will create a dissociation with money later on. How will your kids ever learn about money and get good at saving and budgeting if it’s never talked about? We should think about talking about money as a critical part of our hygiene.

Before you go, check out this list of celebrity parents who won’t spoil their kids with huge inheritances.

Best of SheKnows

Get Some Ink Inspo From These Celebrities Who Have Tattoos Honoring Their Kids

Recent Baby & Toddler Product Recalls Every Parent and Caregiver Should Know About

Lea Michele, Ashley Tisdale, & All the Other Celebrity Pregnancy Announcements of 2024

Sign up for SheKnows' Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.