What to Watch: Contemporary Brands Flocking to Secondary Markets to Open Freestanding Stores

Contemporary labels, which have always liked to have their own freestanding stores to show their true brand vision and the collections in their entirety, have been opening more stores outside the top major metropolitan cities and will continue to do so through year-end.

“What we’re all doing is starting to expand outside the major cities where the population has moved to such as Nashville, Scottsdale, Denver, Charlotte, Naples and Tampa,” said Andrew Rosen, who invests in contemporary brands.

More from WWD

Zimmermann, for example, opened a new store in Sawgrass, Florida, on Aug. 14, and has two more planned in upcoming months: The Mall at Millenia in Orlando, Florida, on Sept. 30 and Fashion Square in Scottsdale, Arizona, on Oct. 7.

Veronica Beard has been aggressively opening its own freestanding boutiques, and just opened permanent stores this month in the Miami Design District and St. Helena in Napa, California.

Coming up for Beard this fall will be a doubling in size of its Madison Avenue store in September; Beverly Hills in late September; Naples, Florida, in October; Tampa, Florida, in November, and Fashion Island in Newport Beach, California, in December.

This comes on the heels of earlier store openings this year in Charlotte, North Carolina; Toronto; Charleston, South Carolina; Marin Couny, California; Nashville, Tennessee; and Bethesda, Maryland, bringing the grand total in 2023 to 11 new stores. In addition to the brand’s new Toronto store, it’s planning to launch a Canadian website this fall.

“We’ve been looking at secondary markets for quite awhile,” said Stephanie Unwin, president of Veronica Beard. Earlier this year, the brand had a Southern focus, and now for the back half of the year, it is opening several stores in California. At the end of September, it will open a flagship in Beverly Hills on Beverly Drive and a store in San Diego in the first half of 2024. Another region that’s important for the brand is Florida, where the company will open new stores in the fourth quarter.

To decide where to open stores, the brand evaluates the data to see where its customer is coming from, or from what other retail locations, and studies the results from wholesale partners and uses that data to pinpoint target regions. The company also likes to be in the path of its customers, and near its customers’ favorite coffee shops, restaurants or gym. The company also looks for the right size of store, and of course, location.

“In a lot of these secondary markets, many of them are underserved. They’re really thrilled to have Veronica Beard and this interest and choice. We’ve been very well received in all the markets. None of them have under-performed. They’re all over-performed in their first-year plan,” said Unwin.

The Beard stores have averaged around 1,800 to 2,000 square feet, but now some of the flagships are in the 3,000- to 3,500-square-foot range.

Unwin said the Beard stores perform better “when they’re in the mix of high and low,” and that reflects the way the brand’s customer shops since she has a lot of designer accessories in her closet. The best example of that is in Highland Park Village in Dallas, which is a mix of all the best luxury brands, as well as food and beverage. The brand recently signed a lease in Austin, Texas, which will open next year.

Unwin said the company has a store in San Francisco on Fillmore Street, which does a good business “but it’s more challenging.” While some of the Beard stores in the country are growing double digits, Fillmore Street is not growing like the rest of the fleet.

It is no secret that San Francisco’s downtown commercial and shopping district has been faced with homelessness, drug use and shoplifting, and many stores have decided to leave the city.

“We run a very profitable retail business,” said Unwin. She noted that this year direct-to-consumer will account for 60 percent of the business, up from 50 percent last year. “It’s been a focus for us to have a very robust e-commerce business,” she added. “We want to be wherever she is shopping.”

In general, Unwin said the company prefers a street location to a mall. “We tend not to go into large malls,” she said. She noted that the towns like Palm Beach, Florida, which has a combination of tourism and local traffic, tends to be a winning formula for those markets. The brand also does well in resort towns such as the Hamptons in New York and Nantucket, Massachusetts.

La Ligne is planning to open a store in Marin County in September, and Loeffler Randall will be opening a store in Charleston for its ready-to-wear, accessories and bridal offerings in October.

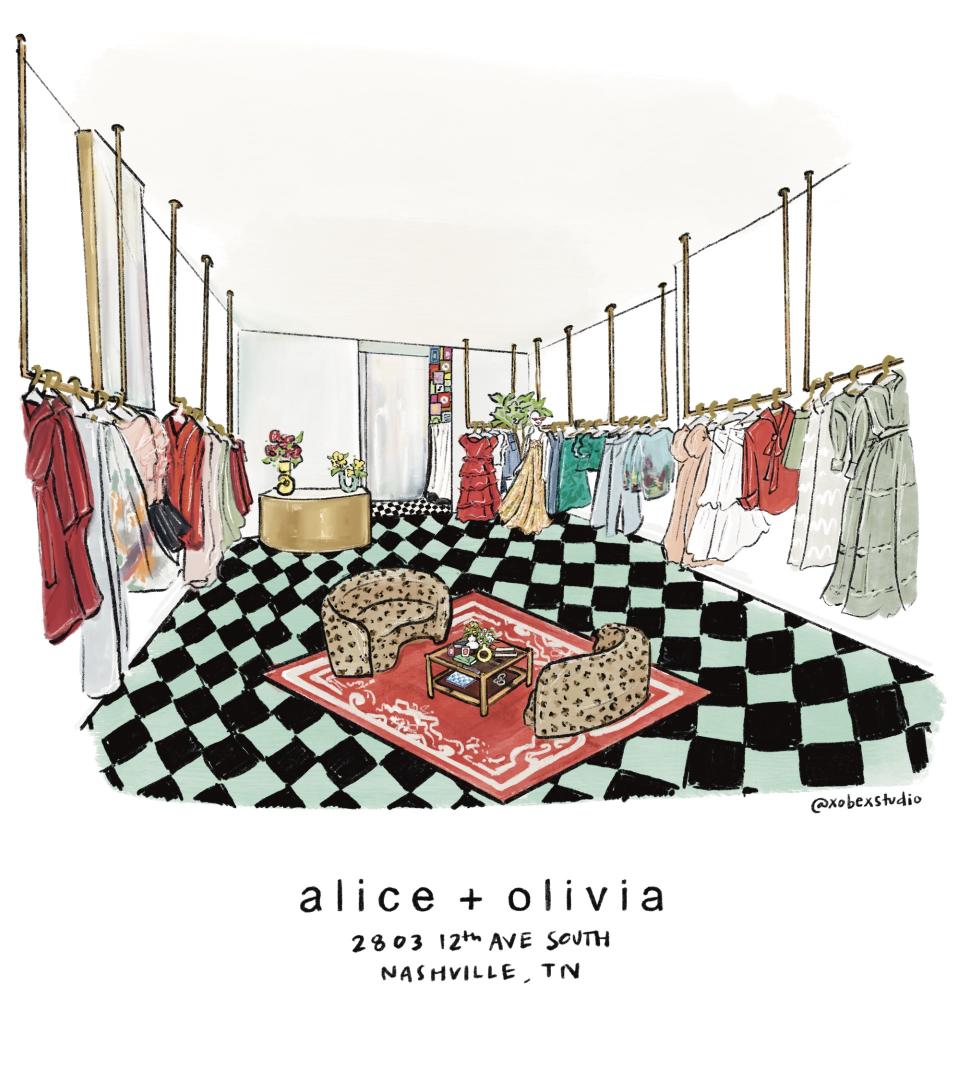

Alice + Olivia will be opening new stores in Charlotte, Nashville, Tampa, Coconut Grove in Miami, San Diego and Scottsdale within the next few months.

Stacey Bendet, chief executive officer of Alice + Olivia, said, “I think those areas have just become younger and cooler and more year-round. Nashville used to be a place you visited, now it’s a place people live. Stores like Aspen [Colorado] and Palm Beach, we’ve seen such growth there and we have such a year-round customer there.”

She said in the areas that the stores are opening, such as Charlotte and Nashville, “we have huge wholesale businesses there and we can track our e-comm businesses there, so we know there’s a customer there.” She said there’s been a large exodus of wealthy customers who are leaving major cities and moving to these secondary markets, “which are becoming year-round destinations and places to live.”

Asked how the brand determines where to open a new store, she said it works with certain developers such as Stephen Summers, the real estate developer. “You know if he’s building something out, it’s going to be great.” In other places, the brand can see where it has a big business with wholesale accounts or e-commerce and there’s a shopper it’s shipping to.

“It kind of gives a good indication that the customer is there for you. Some of these cities right now have an amazing energy. People are there shopping, going out, there are new restaurants. Retail isn’t singular. Retail in these locations have new experiences, new centers, new development, real estate happening. Places like New York don’t have a lot happening anymore. There’s not a lot of development. Where people shop has become less centralized. You go to towns like Aspen or Dallas, you’ve got these amazing blocks where people are vacationing, shopping, living,” said Bendet.

As for whether the company’s retail expansion is as aggressive as it was pre-pandemic, she said, “I think we’re a little more aggressive now. I think there are more exciting, experiential developments happening in these other markets.” Before, the emphasis was on cities with a lot of tourists.

“There’s not as much international tourism now. Tourism has become a little more domestic, and I think we’ve seen the biggest growth in some of these markets like Aspen, Dallas, Palm Beach, where you still have that vacation customer and a lot of people who have moved out of New York and L.A. to these places. I think we’ve become a lot more optimistic about these markets.

“In these cities, I would call them the success cities in our country. You’ve got governors and mayors who are really pushing for economic development and real estate growth. And it’s working. They’re creating new and exciting centers for locals and tourists,” added Bendet.

She makes each store unique to the individual area. “I think it’s really important to us that we feel like part of a local community and not like a chain store. We really try to design and curate and do something that feels authentic to the local community.” Generally the stores range from 1,200 to 2,200 square feet. “Our goal isn’t to have a giant space. It’s to have something intimate and kind of homey and have people come in and feel they’re discovering something new, and have our clothes and feature local designers. We’ll have a weekend shopping day with a local baker or pasty chef, or we’ll have a trunk show with a local jewelry designer,” she said.

Bendet said the company has a store in San Francisco. “We closed it during the pandemic and we re-opened it. It’s not as busy as it once was, but it’s doing OK.”

Overall, she said Alice + Olivia’s freestanding stores are all up substantially compared to last year.

Asked about the movement of brands in secondary markets, Laura Pomerantz, vice chairman of Cushman & Wakefield, the real estate firm, said fashion companies are flocking to locations such as King Street in Charleston, or at Fifth and Broadway in downtown Nashville, which feels more like a street than a mall. “Nashville has definitely been a city where people have been having success because there’s been so much migration and also the music scene there is enormous and you have corporations there too,” said Pomerantz. She said on Fifth and Broadway, there’s a mix of shopping, entertainment, restaurants, and the National Museum of African American Music.

As for what cities she considers the most desirable for contemporary brands, Pomerantz said, “Hot cities are Nashville, Austin, Miami, Dallas, and Fulton Market District in Chicago.” The Fulton Market District, for example, has seen a lot of demand from contemporary and cool brands. Stores such as Warby Parker, Madewell, Free People, Billy Reid, Allbirds, Beyond Yoga, and Love Sac are all there, said Pomerantz.

“Real estate owners who are developing the streets in collaboration with other owners to create density and co-tenancy are definitely having some success, and retailers are considering that as alternatives to just malls,” said Pomerantz.

Best of WWD