Want the S&P 500 to gain 10% this year? A Super Bowl win by the Philadelphia Eagles may be your best bet

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

The Philadelphia Eagles and the Kansas City Chiefs will face off in Super Bowl LVII on Sunday in Arizona.

An analyst said historic data suggests a win by an NFC team will produce a 10% return for the S&P 500 this year.

That means the NFC champ Eagles would drive bigger stock gains than the Chiefs.

A win by the Philadelphia Eagles over the Kansas City Chiefs in this Sunday's Super Bowl LVII may result in a beefier return from the S&P 500 this year after stock investors were dragged into a bear market last year.

Using the NFL's marquee matchup to predict the upcoming performance of equities has its roots in the Super Bowl Indicator, originated in 1978 by then-New York Times sportswriter Leonard Koppett. At the time, he found that stocks rise in the full year when the NFC's precursor won but fell when the AFC's precursor won.

This year's battle for Super Bowl rings will take place at the State Farm Stadium in Glendale, Arizona, with the Eagles led by quarterback Jalen Hurts and the Chiefs fronted by 2020 Super Bowl-winning quarterback Patrick Mahomes.

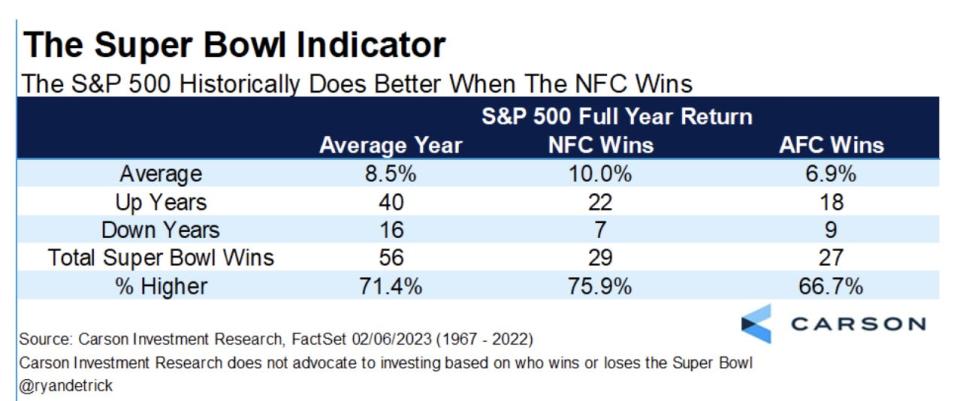

Taking a page from the Super Bowl Indicator, Ryan Detrick, chief market strategist at CarsonGroup, sought to answer the question "Do Stocks Want the Eagles or Chiefs to Win?" in a recent note.

The S&P 500 has gained 10% on average during the full year when a National Football Conference team has won, he said. That trumps a 6.9% return when a team from the American Football Conference wins.

For the game played in 2023, that would mean a victory by the Eagles – the NFC champions – would produce a bigger return for the benchmark stock index.

Regardless of a victory by the Eagles or the Chiefs, many stock investors are hungry for a win in equities this year after the asset class plunged in 2022. Swift and large interest rate hikes by the inflation-fighting Federal Reserve and recession worries were major factors that yanked the S&P 500 into a bear market last year. The index managed to finish above its worst levels but still ended with a loss of 19%.

"So, it is clear-cut that investors want the Eagles to fly high and win, right? Maybe not," Detrick wrote about this year's Super Bowl.

He said stocks have gained the full year in 10 of the past 11 times when an AFC team has won the NFL championship. "In fact, the only time stocks were lower was in 2015, when the full year ended down -0.7%, so virtually flat."

From that viewpoint, stock investors may want to see the Chiefs win their third Super Bowl. In addition to the 2020 win, the team captured the NFL's big title in 1970.

Before Sunday's game, the S&P 500 has risen about 6% in 2023, and there's been a rotation in market leadership since 2022's dismal end. The communications services group has swung to the best-performing sector from the worst-performing last year. But some analysts, including Fairlead Strategies cofounder Katie Stockton, are warning that recent stock gains may be upended by a macro shift, including a jump in Treasury yields.

For what it's worth, the Eagles are favored to win over the Chiefs, according to Caesars Sportsbook.

"Of course, this is totally random, but it turns out that when looking at the previous 56 Super Bowls, stocks do better when an NFC team wins the big game," Detrick said of the Super Bowl Indicator. "But as Yogi [Berra] playfully told us … sometimes things don't always add up, and investing on this isn't going to add up."

Read the original article on Business Insider