Wait, Health Care Costs HOW Much Without Insurance?!

You might think the financial benefit of having health insurance is mostly tied to major moments—your appendix bursts, you break a leg snowboarding, you’re having a baby—but that’s really just the tip of the bill-lowering iceberg.

Having insurance can also help bring down what you have to pay for everyday: things like that flu shot you’ve been meaning to get or the throat culture you need to rule out strep. Ready for the most surprising part? This is true even if you’re nowhere near hitting your deductible and have to pay the entire bill yourself.

The behind-the-scenes sale

Here’s how it works: “Every hospital and doctor’s office has something called a charge master, which is a list of rates they charge for every single procedure,” says David Johnson, CEO of 4 Sight Health, a thought leadership and advisory company based in Chicago. “But those amounts are somewhat made up, and almost nobody pays them.”

That’s because insurance companies negotiate with the hospitals and doctor’s offices in their network to come up with their own lower rates for literally every procedure. It’s why you tend to see a discount on any doctor’s bill you get—even if you’re responsible for the whole thing because you haven’t hit your deductible yet.

One thing to keep in mind: Those discounted rates are only for in-network doctors and hospitals. Even if you have health insurance, you’ll end up paying the higher master charge rate if you go out-of-network.

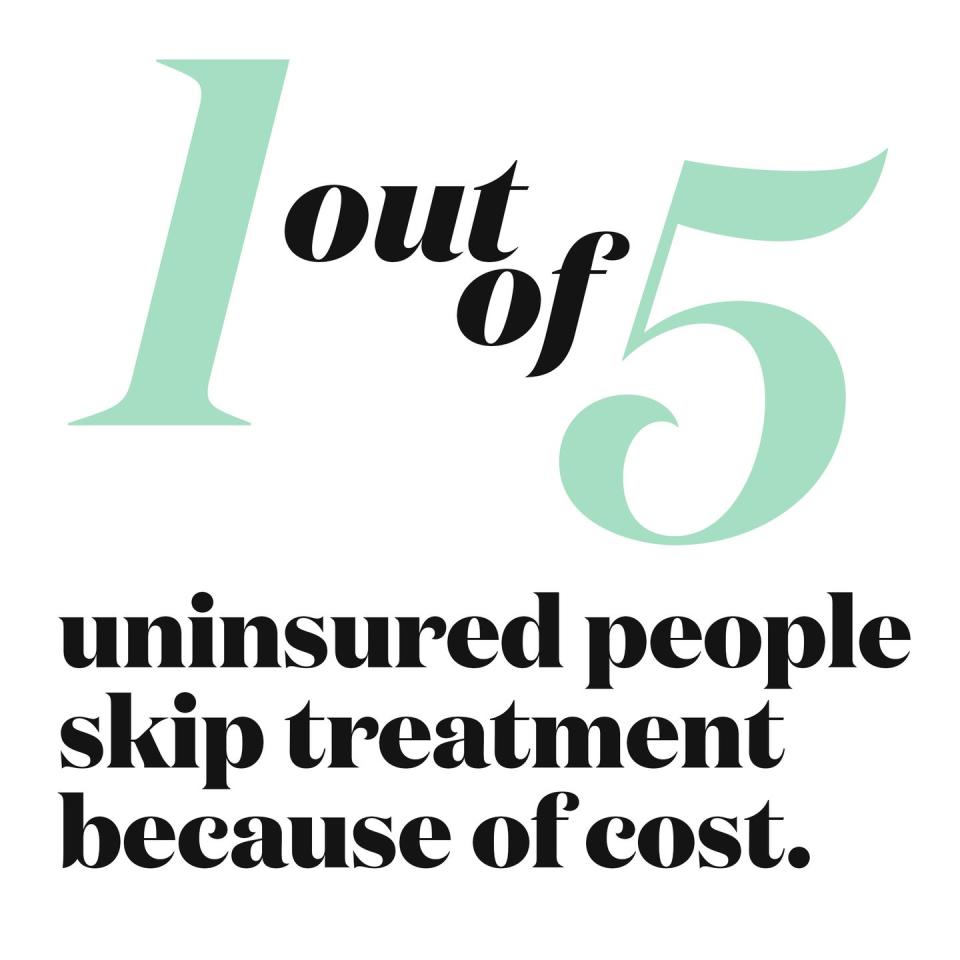

While the price the insurance company negotiates can vary (they tend to be about half of the charge master cost), one thing tends to be certain: Anyone who doesn’t have insurance is going to end up paying a ton more. “If you don’t have coverage, it defaults to the charge master rate,” says Johnson. It’s no wonder one out of five uninsured people skip treatment because of cost.

Watch your wallet

All of this can add up quickly, even if you aren’t getting anything too major done. While it’s impossible to say what your cost for different procedures would be with insurance (that changes based on everything from where you live and who your insurer is to your deductible and co-insurance rates), here are some of the average charge master rates for common procedures in the U.S., according to an International Federation of Health Plans report:

MRI: $1,119

Cataract surgery: $3,530

Day in the hospital: $5,220

Giving birth: $10,808

Appendix removal: $15,930

Knee replacement: $28,184

Did someone say free?

On top of the discount you get just for having an insurance plan, there are some procedures and visits that are absolutely free if you have insurance. That’s right: They don’t cost a dime. These services fall under the umbrella of preventive care, and after the Affordable Care Act was passed, they became fully covered for anyone with insurance.

Unfortunately, if you don’t have coverage, you’re stuck paying for them. Here’s how much these otherwise-free services might run you:

Flu shot: This life-saving vaccine will run you about $40 at your local Rite-Aid pharmacy.

Screenings for diabetes and cholesterol: CityMD, a chain of urgent care facilities in New York, New Jersey, and Washington, offers these services for about $125 to $200, plus additional lab fees.

Annual wellness visits: On average, this costs $160, according to a John Hopkins study.

HPV vaccine: You need this shot twice, and it will cost ya about $250 each time, according to Planned Parenthood.

Birth control pills: The monthly packs will add up to $240 to $600 a year.

The bottom line: With the average employer-sponsored plan costing you $119 a month, that $1,400 or so a year will pay for itself in just a few doctor’s visits or prescriptions. And if something serious happens—like a sprained ankle or a suspicious mole your dermatologist wants to remove—you know you’re covered.

You Might Also Like