Victoria’s Secret’s ‘House of Victoria’ Hit on Wall Street

Wall Street seems satisfied with Victoria’s Secret’s latest performance.

Shares of the lingerie and beauty company shot up more than 12 percent at the start of Wednesday’s session, ultimately closing up 8.93 percent to $44.89 apiece, a day after the retailer revealed quarterly earnings.

More from WWD

Courtesy Photo

“VSCO has showed us the brand turnaround remains on track despite navigation of the external environment,” Ike Boruchow, senior retail analyst at Wells Fargo, wrote in a note. His firm rated the stock “overweight.”

But the results were mixed. While the firm met the Street’s expectations, it fell short on top- and bottom-line results, thanks to continued supply chain headwinds — an issue plaguing much of the retail industry, as consumers decide how and where they will spend their money.

“Clearly, there was some shift going on at retail as to where the customer was focused on her spending,” Martin Waters, chief executive officer of Victoria’s Secret & Co., told analysts on Wednesday morning’s conference call, referring to macro inflationary pressures, such as increased gas prices. “So we were not going to be immune to that. The customer goes out with a notional idea of how much money they want to spend on a given day when they make a trip [to a store]. And it’s a contest. When in the venue — call it a mall or other venue — it’s a contest to see who gets that share. It could be a pair of jeans, or it could be a lipstick, or it could be some intimates from Victoria’s. And that’s the wonderful thing about the retail market. We’re all competing for share of wallet. It’s not just a category-by-category approach and probably that feels intuitive to people listening on the call that don’t always divide up the money we have to spend by category. We just have an amount of money that we’re comfortable spending and then we go play.

“We’re in the merchandise business,” he added. “So our results are fundamentally based on how good we are at generating new product that resonates well with the consumer. And I think we have done a very good job in the category that’s most important to us. And that is bras. We have arrested the decline in market share [in bras] and actually built market share within the last period, according to NPD data. So that’s really good.”

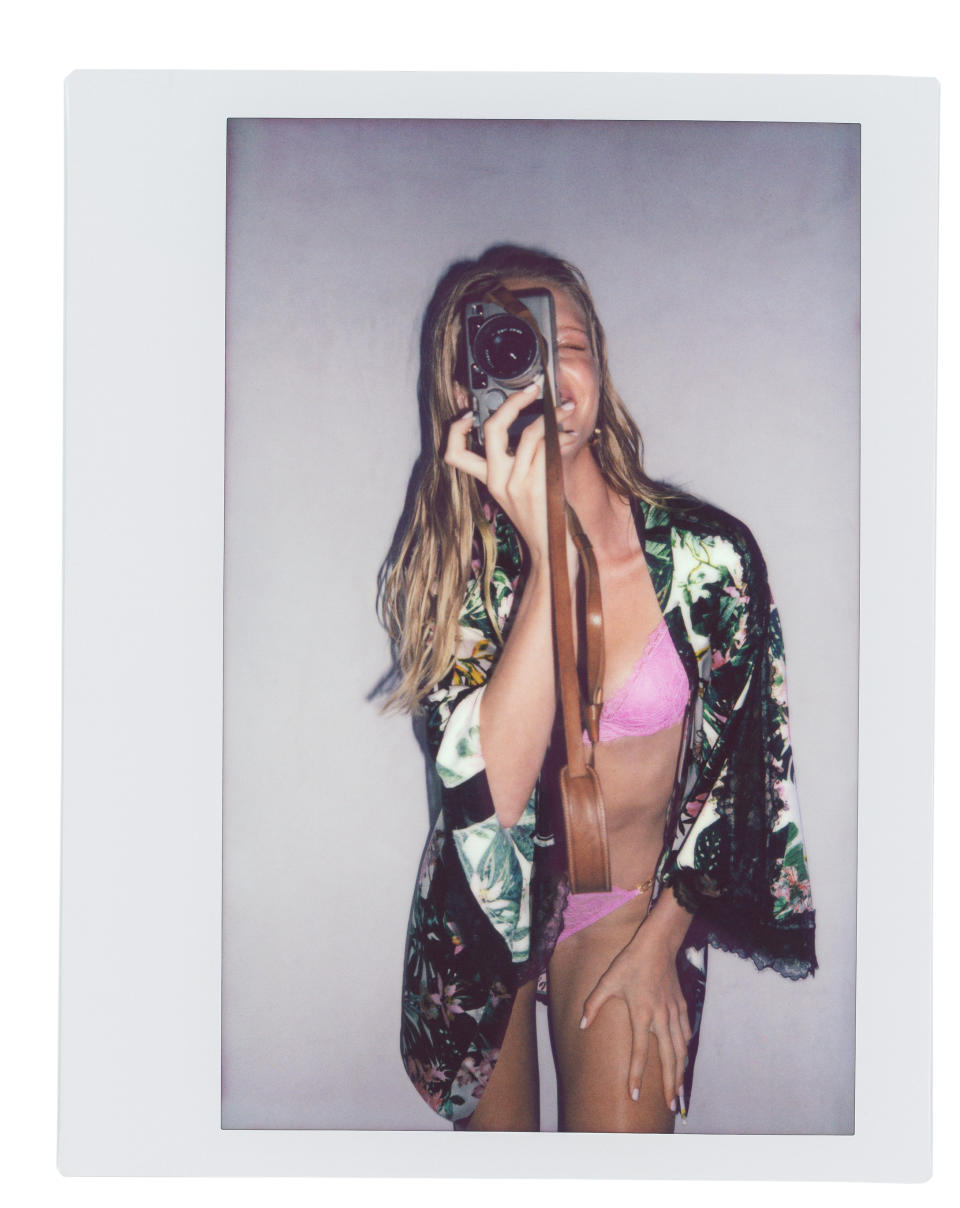

Courtesy Photo ZOEY GROSSMAN

Executives on the call added that while inventory levels were up at the end of the most recent quarter (37 percent, year-over-year), the numbers were less about inventory carry-overs from the previous quarter — which would indicate a need for increased promotional activity in the future — and more a byproduct of switching from air to ocean freight, as well as assortment shifts with a greater emphasis on size inclusivity and sustainability across the portfolio.

Courtesy Photo OLIVER HADLESS PEARCH

Waters added, however, that in the future the retailer will continue to evaluate the need for promotions with the need for higher margins.

“Are we anxious about being overly promotional in the business? For sure,” he said. “We know that we can — we and other retailers — train consumers to wait for sale periods. We get it. It’s not healthy for the long-term positioning of the brand to be permanently discounting. The best retailers out there, the best fashion-forward retailers are less promotional, not more promotional. So we get it. We understand.

“And at the same time, we balance the fact that the customer responds well to promotionality,” Waters continued. “We’re battling for share of wallet. And so it’s a balance. It’s not one thing or another. It’s a little bit of everything. So we’re very, very focused on it. We’re very conscious of it. It’s less about the mathematical calculation and more about the overall health of the brand. And we feel good about the health of the brand based on the repositioning work that we continue to do. The business — kind of middle of last year — began to execute profit improvement actions to help offset some of the inflationary headwinds that we were experiencing.”

Courtesy Photo

Those strategic adjustments include launching tween brand Happy Nation, partnering with Amazon to sell Victoria’s Secret Beauty on the e-commerce website and acquiring minority stakes in third-party businesses, such as Frankies Bikinis and For Love & Lemons.

In terms of the minority stake acquisitions, Waters said the benefits are threefold. They allow Victoria’s Secret to gain new customers, while expanding its assortment in categories that the company is underweight in.

“But more important, it rounds out our customer experience,” Waters said. “An affinity with that brand overall brings a halo to the House of Victoria. And I think there’s potential for Victoria’s Secret & Co. to do more of that style of investing in third-party brands. We would anticipate building a pretty significant business there.”

There’s also Victoria’s Secret Beauty’s new wholesale partnership with Amazon. Waters said the beauty business is a billion-dollar business in its own right.

“And that’s from only distributing that product — those products through 800-plus points of distribution and a single website,” he explained. “How much more business could we do if we partnered with other people who are in the category? And is that business if we were to access it going to cannibalize what we already have? That’s the question. We think it makes sense to test the proposition.”

Other growth drivers continue to be panties and physical stores, with softness in sleepwear and apparel.

“Categories like lounge and sleep are lapping good performance during COVID[-19] times and are now competing with outerwear and wear-to-work and celebration wear and that kind of stuff,” Waters said. “Swim has been mixed. Very strong swim performance in Pink with near 20 percent comp, but less strong in Victoria’s [lingerie brand], where we feel less good about fit and fashion, year-over-year.”

Courtesy Photo

In terms of stores, the CEO said the company will likely have about 15 Victoria’s Secret Store of the Futures, up from three now, by the end of the year.

“Stores are roaring back and that’s helping our business considerably,” Waters said. “Digital has declined and that’s not entirely unexpected given that stores have rebounded in the way that they have. Our most productive customer is the customer who shops both channels. That customer is three times more productive for us than a single-channel customer. So the focus is on the customer, primarily, rather than which channel she wants to shop in. I think you should expect to hear us talk less about channels in the future and more about the customer.

“We’re one year into that transformation of the brand, which for us in the business feels like a long time,” he added. “But we know from our research that most consumers are only just beginning to notice the transformation of this brand. So we have a lot more to do. We have to get our voice louder. We have to amplify our message of diversity, equity and inclusion, of being a brand for all women and of being on a mission to improve the lives of people around the world.”

Sign up for WWD's Newsletter. For the latest news, follow us on Twitter, Facebook, and Instagram.