Vetements’ Guram Gvasalia, Buyers Say Highsnobiety Story Is Fake News

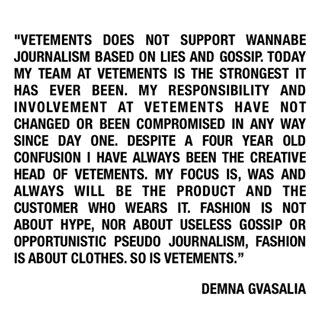

According to buyers and Guram Gvasalia, Vetements’ chief executive officer, the idea that the brand’s popularity is waning is, well, fake news.

On Thursday, Highsnobiety published a piece with multiple unnamed sources claiming that the brand, which is designed by Demna Gvasalia, who is also the creative director at Balenciaga, is losing favor with consumers and retailers. The variety of unnamed sources, who were identified with nebulous descriptions such as “one buyer” or a “former shop manager,” contributed the lack of sales to Vetements moving its headquarters to Zurich, lack of newness and inflated pricing.

In a statement sent to WWD, Guram Gvasalia said the independent company is outperforming market expectations and showing over 50 percent growth in comparison to the previous year.

“It is sad to see the state of journalism today. In the era of click-baits, using the name of our company in the article is a click-bait itself, and even more so when it’s mentioned in a negative headline,” he wrote. “To the disappointment of all the haters, we would like to declare that Vetements is in the strongest creative and financial state it has ever been. We are definitely not going out of business and the speculations about our sales figures are not only false and defamatory in its nature, but also simply ridiculous.”

He continued: “Sadly some journalists today are more concerned with writing fake news and reposting shocking headlines rather than checking facts to show the full picture. It is especially upsetting to see some fashion writers, fueled by their personal agendas, attacking young independent brands while sucking up to big conglomerates for their advertisement budgets. Serious news outlets seem to be turning into tabloids and gossip blogs that impose somebody’s opinion and made-up stories as true facts.”

Highsnobiety sent WWD the following statement, but didn’t confirm whether the writer checked the validity of the sources or reached out to Vetements for comment before publishing:

“Vetements isn’t immune to the struggles faced by modern independent labels, but what we’re analyzing is their ability to sustain marketing hype and relevance to our young, trend-conscious audience as it grows. While it’s impossible to quantify street cred, we have noticed a sharp decline in Vetements in our global street style coverage, and the buyers we spoke to, many of whom work at smaller, independent retailers, often rely on a brand’s strength to help curate their offer, and cater especially to the type of discerning consumer we speak to. The moment a brand like Vetements ends up in larger, more mainstream retailers, it’s a hit to their perceived authenticity. While Vetements is far from dead, to many in the industry — especially the selective market we cater to — it is ‘over.'”

Highsnobiety posted the story with a picture of Tiffany Hsu, the fashion buying director at MyTheresa who was wearing Vetements in the image, and she responded, via an Instagram Story with a steam-through-the-nose emoji, that she is still buying the brand, which MyTheresa has been carrying since 2015, and it’s still an important part of the business. Other buyers had a similar sentiment.

Jeffrey Kalinsky, the owner of Jeffrey New York, said the store sells around $350,000 to $450,000 worth of Vetements product in a year. The sock booties, the horoscope T-shirts and the rain coats have done well in addition to the collaborative product with Tommy Hilfiger. He added that the store is selling a lot of the product at full price.

“Sell-throughs at full price is what determines if you go forward with a brand, and we’ve been very happy with how it’s been selling,” said Kalinksy.

Helen David, the chief merchant at Harrods, who picked up the men’s and women’s collections last year, said customers are very excited by the brand and in terms of turnover and expectations, Vetements sold four to five times better than what she had planned. The unicorn hoodie sold so well that the retailer attempted to order more but wasn’t able to. She added that she is selling pieces at entry-level pricing and higher price points.

“I don’t think in fashion today there is anything that one could say is overpriced or underpriced,” said David. “It’s all about price perception and how much the end client is willing to pay that determines the correct value of the product. And given that it’s flying out at Harrods, it’s not overpriced. If it was, people wouldn’t’ be wiling to pay the prices. Price is the index of desire.”

When asked if Demna Gvasalia’s post at Balenciaga had impacted sales, David said no.

“They run relatively concurrently. And I think what he does for Balenciaga is quite different than what he does for Vetements.”

Rodolphe Nantas, the head men’s buyer at The Webster, which has been carrying Vetements since its second season, said they do sell more quantities of Balenciaga because of its lower price point, but the store still does very well with Vetements, which the company carries at its Miami store, picked up for its recently opened New York store, have added to its South Coast Plaza location this season and did a bigger buy for its Houston shop.

“These aren’t the kind of decisions we make if a brand isn’t performing,” said Nantas, who noted that at the Miami store, Travis Scott and Kylie Jenner were shopping together and recently bought the Vetements x Tommy Hilfiger hoodie. “It sells above the average for all of our brands.”

As far as pricing, Nantas said he hasn’t received complaints from customers regarding quality or the cost of the collection.

Lack of new product hasn’t been an issue for Saks Fifth Avenue customers, according to Yumi Shin, Saks’ senior vice president and general merchandising manager of women’s designer ready-to-wear, handbags and accessories.

“Saks has supported Vetements since fall of 2016 and we are constantly impressed with Demna’s influence on the industry and creative vision,” said Shin. “Our customers are drawn to the individuality of the brand and the product, like horoscope T-shirts and unicorn sweatshirts, continue to be coveted.”

Over at Hirshleifers, the Manhasset, N.Y.-based luxury store, David Sills, the owner and buyer, is also happy with the brand.

“We really don’t disclose sell-throughs on any individual brands, but we’ve had very high sell-throughs with Vetements,” said Sills. “It’s from a combination of sale and full price, but for the past season we have had virtually nothing left to put on sale, and if it does, it goes on sale much later in the season.”

Sills also noted that the exaggerated sizing has shifted, making the collection even more sellable to its customers.

“Now they understand that people want to wear it a lot and they want a medium to fit like medium as opposed to an XXL,” said Sills.

Sarah Stewart, the buying director at Maxfield in Los Angeles, which drew large crowds last year with a Vetements fashion show and a dry cleaning-inspired see-now-buy-now event, said the brand continues to be a hot commodity and hasn’t declined in sales. She added that last season they put very few units on sale.

Despite its popularity, particularly in the luxury segment, the sustainability of streetwear-leaning brands that are creating hype continues to be questioned, even by sites that exhaustively cover the category, but David feels Vetements has staying power.

“I think it is a brand that can sustain simply because if you look back a few seasons, although it’s been a disruptive brand since it first started, it’s evolved quite a bit since the first collection,” said David. “They need to get credit for putting street on the map or for being one of the first movers to put street on the map. When a brand is a first mover and goes against what is going on in the industry and succeeds, I believe that brand will always be relevant.”

Related stories

Balenciaga to Open Store on Milan's Via Montenapoleone

EXCLUSIVE: Jeffrey Is Expanding Into California

Kentucky Countess Mona Bismarck's Couture Wardrobe, Designer Friends and Artist Admirers

Get more from WWD: Follow us on Twitter, Facebook, Newsletter