Valentino Reports Profitability, Sales Growth in 2022

- Oops!Something went wrong.Please try again later.

MILAN — A rebalancing of its retail and wholesale channels contributed to Valentino’s gains in revenues and profits last year.

In the 12 months ended Dec. 31, sales at the Rome-based couture house reached 1.42 billion euros, climbing 15 percent compared with 1.23 billion euros in 2021. At constant exchange, revenues rose 10 percent.

More from WWD

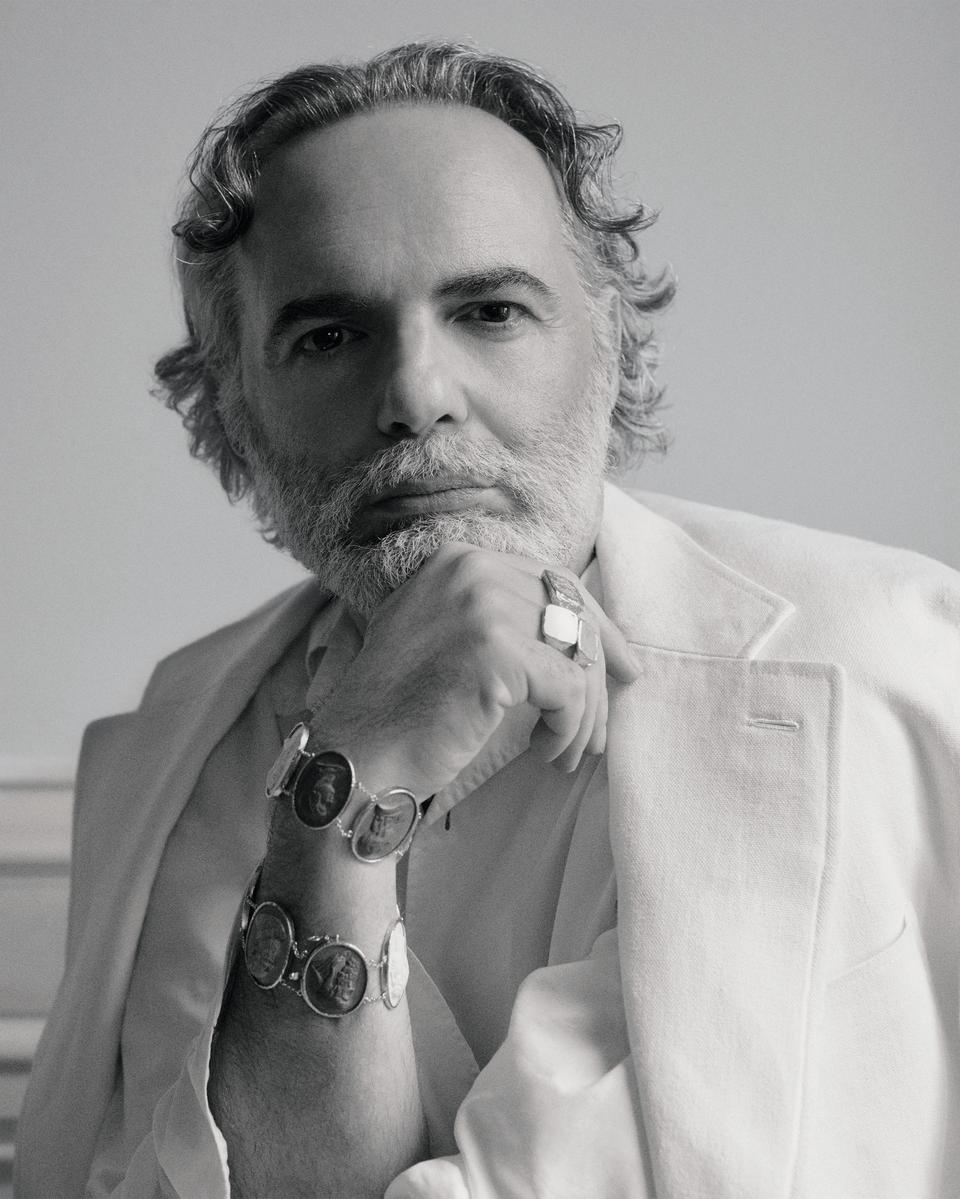

“After years of single-digit growth, we succeeded in going beyond,” said chief executive officer Jacopo Venturini proudly.

He attributed this to a change in the company’s business model. Valentino reported 21 percent growth in its directly operated stores network, including e-commerce, while the wholesale channel registered a 6 percent decrease.

“These results are fully in line with our strategy of rebalancing wholesale versus retail by increasingly reducing the wholesale activity to focus only on working with selected partners that reflect our brand values and sustain our business strategy and vision,” explained Venturini, who is not forsaking wholesale entirely. “An external eye and opinion remain important, a dialogue is always interesting and we don’t want to give that up.”

Directly operated retail generated 62 percent of sales in 2022 compared to 54 percent in 2019. Now, retail accounts for 67 percent of sales, and the goal is for that channel to represent 80 percent of the total by 2025 or 2026.

In 2022, the company opened 24 stores, and relocated seven units. In 2023, Valentino plans to open 23 directly operated stores and relocate 15 doors. At the end of the year, the number of directly operated stores will total 221, said Venturini.

In the 12 months ended Dec. 31, earnings before interest, taxes, depreciation and amortization, including the IFRS 16 impact, amounted to 337 million euros, up 18 percent compared to 2021. Operating profit totaled 121 million euros, climbing 30 percent compared with 2021.

Venturini said a conscious decision to focus on the repositioning of the brand, streamlining the company’s wholesale channel; ending the Red Valentino brand with the fall 2023-24 season, and the decision to go fur-free in 2022 resulted in a reduction of 100 million euros in sales — the amount derived by the two segments together in 2019.

In September, Valentino introduced a new store concept in Jeddah, at the Al Khayyat Center, followed by Geneva, a new market for the brand.

While retail expansion is in the pipeline, the executive underscored that “the goal is to grow in a granular way, in cities where we are not present, as we are not after an expansion for the sake of it.”

In May, the brand’s flagship will be relocated on Avenue Montaigne, with the new store covering 12,150 square feet and carrying women’s and men’s collections, accessories, fragrances and eyewear, and including two VIP rooms.

In November, on Madison Avenue, Valentino will take over the space formerly occupied by Calvin Klein’s iconic flagship at 654 Madison Avenue at the intersection of 60th Street, which has been vacant for four years. Valentino will relocate from its existing store at 821 Madison Avenue. The new store will cover 12,150 square feet and carry men’s and women’s ready to wear, accessories, fragrances and eyewear, in addition to including two VIP rooms.

In Florence, in March, the boutique relocated from Via de’ Tornabuoni in the medieval Palazzo Spini Feroni that houses the headquarters, to Piazza della Signoria, the city’s main square.

In 2022, Valentino focused on a retail strategy in China, opening three stores between September and December at SKP in Chengdu, for menswear, ready-to-wear and bags, and shoes, respectively, and in September a new store was unveiled in Shenzhen Bay MixC.

Although Europe and the U.S. are Valentino’s main markets, followed by the Middle East, Venturini said he is seeing “an important growth” in Southeast Asia and Greater China.

Valentino will relocate in Shanghai’s Plaza 66 in the summer, while new stores will open in Wuhan at Mix in August; in November in Shenzhen at MixC, and at IFC in Nanjing in December.

The new store concept, conceived internally, takes into account Venturini’s human-centric strategy and the “invisible service” necessary to cement the relationship with the customer, with a small stock at the floor.

Venturini underscored that the size of the stores is not necessarily an essential element, while the right location is more important. The idea is to promote “a more dynamic concept that evolves depending on the location. You recognize the codes, but you see the difference in each store as it is integrated with the city.”

Floors are defined by iconic geometric motifs rendered in Botticino and Sahara Noir marbles and elements in onyx and wood contribute to the sense of warmth and discreet luxury.

Valentino has been working with local artists and specialist craftsmen to produce bespoke objects for the spaces. In Jeddah, Massimiliano Pipolo created handmade ceramic door handles, characterized by organic shapes suspended between functionality and abstraction.

Alexandre Logé created delicate chandeliers made of sculpted plaster, white objects with extending branches hanging luminously in the space. Fabio Cinti was tasked with creating geometric compositions as decorative objects in brass.

Valentino’s e-commerce internalization program kicked off in early 2022 in Japan, followed by the U.S. and the rest of the world, allowing the company to accelerate its omnichannel integration to exploit new opportunities, achieve more effective planning and local adaptation and boost client interaction in consolidated and new markets.

While admitting uncertainties loom in 2023 due to macroeconomic issues, Venturini said he has seen “good signals” so far, expressing confidence in the choices made over the past few years since his appointment in 2020, and in the resilience of the company.

Valentino’s beauty and fragrance business, licensed to L’Oréal, jumped 40 percent compared with 2021. Licensed to Akoni, the brand’s eyewear continues its repositioning in the luxury market segment through a select distribution and Valentino’s global store network, Venturini pointed out.

Accessories are expected to represent 63 percent of sales in directly operated stores in 2023, compared with 68 percent last year.

Menswear last year represented 14 percent of sales. The year before, the category accounted for 18 percent of the total.

Venturini sees “great opportunities in menswear,” and when asked about a potential shift in the market away from the gender-fluid designs embraced by creative director Pierpaolo Piccioli, the executive did not see any comparison.

Venturini did not elaborate on the reorganization of Piccioli’s design team following the exit of Sabato De Sarno, who in January was named creative director of Gucci, succeeding Alessandro Michele. His first collection for Gucci will bow in September. De Sarno joined Valentino in 2009, where he held positions of increasing responsibility, finally being appointed fashion director overseeing men’s and women’s collections.

There are 75 Valentino stores that carry men’s and women’s collections, and 25 menswear-dedicated boutiques. Of those, 21 are shop-in-shops.

The distribution of menswear will be further extended next year in stores in cities such as Paris and Shanghai, Nagoya, Wuhan and New York, to name a few.

In 2022, the house launched the Maison Valentino Essentials, a selection of timeless yet continuously evolving staples, as codes of Piccioli’s creative vision and the project will continue through this year.

The executive also spoke of a number of activities connected to sustainability. In January, Valentino became a member of the Textile Exchange nonprofit organization, whose goal, among others, is to support the industry to reduce greenhouse gas emissions from raw materials production by 45 percent by 2030.

In December, the house collaborated with Tissu Market on the “Valentino Sleeping Stock” project aimed at the creative reuse of its stock of fabrics.

The Lights Off campaign was launched in October, whereby lights in Valentino boutiques on a global scale were turned off every day starting at 10 p.m., extended to involve around 95 boutiques, predicting a daily decrease in energy consumption of more than 800 kilowatt hours, equal to the hourly consumption of more than 13,000 traditional light bulbs.

Since September, the house has also been collaborating with the Karma Metrix Energy Efficient website, an Italian search marketing and AI company that helps quantify the energy performance of web pages and websites. The algorithm quantifies the CO2 emissions produced by the brand’s website, now equal to 2.56 grams per page view.

Best of WWD