UN Trade Body Has ‘Profound Concerns’ Over Panama Canal, Red Sea Disruptions

Global supply chain disruptions throughout the Red Sea, the Panama Canal and the Black Sea have drawn the attention of the United Nations’ trade and development body.

On Friday, the United Nations Conference on Trade and Development (UNCTAD) said it expressed “profound concerns” over the escalating disruptions, estimating that weekly transits through the Suez Canal decreased by 42 percent over the previous two months as of Jan. 23.

More from Sourcing Journal

Vietnam, South Korea Exporters Get Government Help Amid Red Sea Crisis

Red Sea Disruptions Spell Danger for Bangladesh Garment Manufacturers

Container Ships Shrug Off Perils of Panama Canal Restrictions

And while fewer ships are traversing the Suez due to ongoing Iran-backed Houthi missile attacks on commercial vessels sailing through the Red Sea’s chokepoint, the Bab el-Mandeb Strait, the Panama Canal is enduring historically low water levels. The months-long drought has forced the Panama Canal Authority (ACP) to restrict the amount of ships that can book a reservation through the waterway from a typical 36 in normal conditions, down to a current 24 per day.

However, the Suez and Panama Canal disruptions have had vastly different impacts on the container shipping industry, which is the prime ocean transportation mode of soft goods including apparel and footwear.

The Suez Canal has seen the majority of container shipping firms including MSC and Maersk divert their vessels away from the gateway and around Africa, with Project44 estimating Friday that container vessel volume in the canal has fallen 71 percent to an average of 4.25 vessels per day compared to 15 vessels per day prior to the start of the Houthi attacks in mid-November.

The Panama Canal backlog has been kinder to container ships despite the wider concerns, with the ACP saying that per-day transit totals for container ships averaged 7.4 ships in November and December. But considering that these vessels get priority in the canal’s booking system, the daily average isn’t far from the prior-year numbers of 7.7 ships in 2022 and 7.6 in 2023.

Both bottlenecks have contributed to higher ocean freight rates as carriers increase prices amid the lengthier transit times. As of Thursday, ocean spot rates jumped 5 percent week-over-week to $3,964 per 40-foot container, according to the Drewry World Container Index (WCI), which measures rates across eight major global trade lanes.

The escalation in the wake of the attacks from the Yemen-based Houthi rebels, who claim they have been engaging in strikes in protest of the Israel-Hamas war, thrust the rates up rapidly in a two-month span. Costs per container are estimated to have skyrocketed 187 percent since Nov. 30, Drewry data says.

“The cumulative effect of these disruptions translates into extended cargo travel distances, escalating trade costs and a surge in greenhouse gas emissions from shipping having to travel greater distances and at greater speed,” the organization said. “Avoiding the Suez and Panama Canal necessitates more days of shipping, resulting in increased expenses. The price per day of shipping and insurance premiums have surged, compounding the overall cost of transit. Additionally, ships are compelled to travel faster to compensate for detours, burning more fuel per mile and emitting more CO2, further exacerbating environmental concerns.”

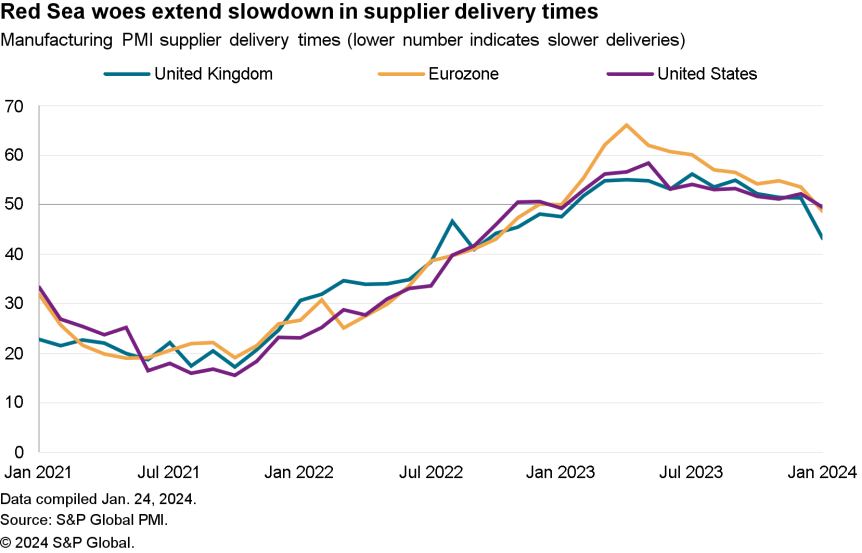

A tangible sign of the impact of longer shipping times can be seen in manufacturers’ observations of supplier delivery times impacted by the Red Sea skirmishes. S&P Global PMI data for January shows delivery times in the U.K. and Eurozone increased to their longest since 2022, while those of the U.K., Eurozone and U.S. all dropped below 50, indicating delays.

The UNCTAD, which supports developing countries in its goal to help them access benefits of a globalized economy more fairly and effectively, said that these countries are “particularly vulnerable” to the ongoing supply chain disruptions. The trade body says it remains vigilant in monitoring the evolving situation.

“The organization emphasizes the urgent need for swift adaptations from the shipping industry and robust international cooperation to navigate the rapid reshaping of global trade dynamics,” the trade body said in a statement. “The current challenges underscore trade’s vulnerability to geopolitical tensions and climate-related challenges, demanding collective efforts for sustainable solutions especially in support of countries more vulnerable to these shocks.”

While global apparel and footwear industries have been largely unaffected by the Ukraine-Russia war, the UNCTAD shared its concerns around how the conflict impacts shipping in the Black Sea, which borders both countries and lies between Eastern Europe and Asia.

The organization pointed out that the two-year confrontation has triggered shifts in oil and grain trades, reshaping established trade patterns. Additionally, disruptions in grain shipments from Europe, Russia and Ukraine pose risks to global food security, affecting consumers and lowering prices paid to producers.