I Tried The Viral No-Buy January Challenge And Saved $1600

Hi, I'm Hannah, and I live in New York City — one of the most expensive cities in the world. This year, one of my New Year's resolutions was to be more intentional about budgeting, spending, and saving. I'm already someone who always looks out for a deal, but in order to challenge myself, I decided I'd try something new out to save money — No-Spend January.

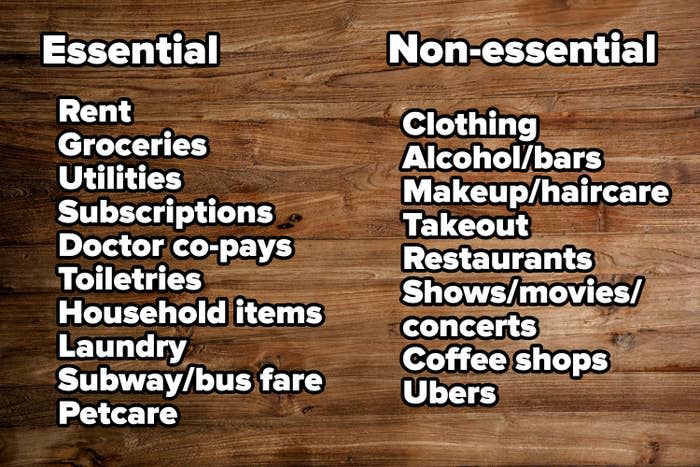

Now, I have no idea if "No-Spend January" is actually a thing (it doesn't quite roll off the tongue), but it's based off the "No-Buy Year" Angela Szot (@vomitgrocery on TikTok) did last year, which went viral! Essentially, I decided I would go an entire month without spending money on anything but essentials. Here is what I deemed as essentials:

If you're wondering what I counted as toiletries vs. makeup/haircare, essentially, I counted body wash, shampoo, face wash, and soap as toiletries, and anything else as makeup and haircare. As for household items, I'm talking about paper towels, sponges, etc., not new appliances, furniture, or decor.

This month was INCREDIBLY difficult, and — spoiler alert — I ended up breaking a few rules. BUT I did learn a lot, and came away with some habits and tricks I'm going to use moving forward. Here's what I learned!

1.Apps like TooGoodToGo (where you can buy food from grocery stores and restaurants that would otherwise be thrown out at the end of the day) are a fantastic deal — if you're not picky.

Since I was only allowed to spend money on groceries, and not restaurants, I limited myself to TooGoodToGo orders from grocery stores. The only store that offered it near me was Morton-Williams, and I ended up buying two bags from them over the course of the month. Both times, it was an amazing value.

The first time, I received three separate pasta meals that retailed around $12 each, two salads that were originally about $8–10 each, and two large bags of iceberg lettuce. All for $5. The second time, I received far less (though I came later in the pickup window and I think I overheard them saying they hadn't been expecting more people to pick up), but it was still a great deal, as I got three salads for the $5.

The catch is that I didn't like or want some of these things. There was a blue cheese salad in my first pickup that I wouldn't eat, along with the iceberg lettuce. Luckily, as I live near both a Community fridge and have a local Buy Nothing group, it wasn't hard to get rid of these, but I'm ashamed to say I did think I would eat one pasta dish that I ended up throwing out. I still ate the other two and a salad, which was a good deal for me, especially considering one of the pasta dishes lasted me two meals. And the salads I got the second time were all types I liked and worked well with the soup I had just purchased for lunches.

Now, none of these were incredible – I'm not a huge fan of pre-packaged grocery meals in the first place – but they were edible, and as a wildly broke New Yorker who spends too much on groceries, these few-dollar-each meals were just too good a deal to pass up, and I'm definitely going to continue getting them.

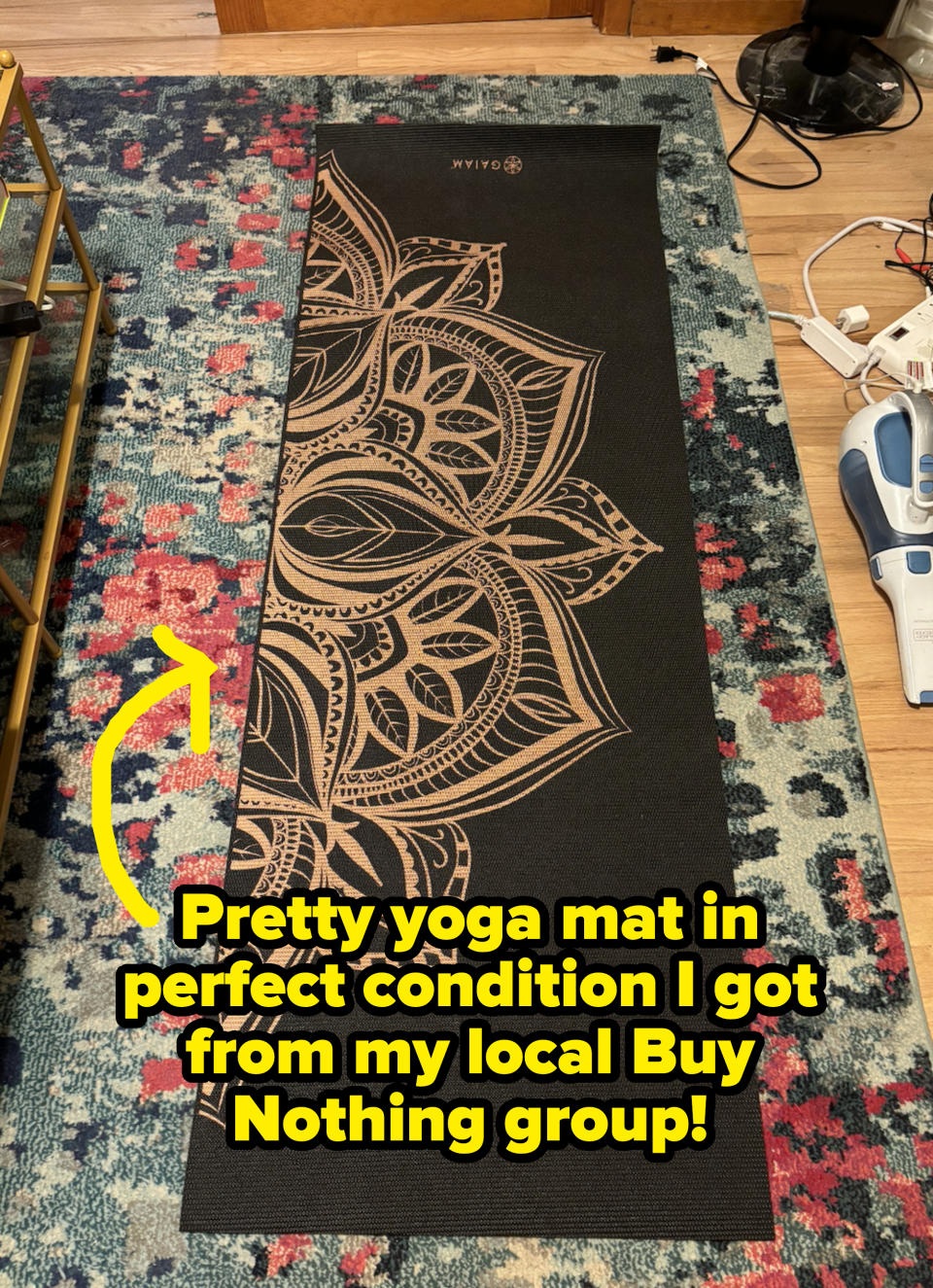

2.Buy Nothing groups — where neighbors post items they're giving away or in need of, often on Facebook — are absolutely life-changing.

I'll be honest, I joined my local Buy Nothing Facebook group a while ago, but I love it more and more every month. Not only is it super helpful for getting rid of clutter, but you can find almost anything on there, from clothes to decor to food to massive pieces of furniture. Last month, when I redid my room, I got a bunch of the items from Buy Nothing (and gave just as much away!). I love being able to give back and build community with my neighbors, and Buy Nothing groups are a great way to do that, beyond just getting free stuff. They're definitely having a moment right now, too, so definitely search if there's one in your area!

They're also great when you just need something close by and quickly and don't have time or money to go to the store — for example, I realized I needed to wrap a gift for my sister but had no wrapping paper. I posted asking if anyone had any leftover X-mas paper (I knew my sister wouldn't care if her birthday present was in Santa wrapping paper), and I got three responses immediately. I ended up going down less than two blocks to grab paper from someone (whom I'd gifted to multiple times before, so I didn't feel too bad) who had rescued free wrapping paper from the curb themselves, so they hadn't even spent money on it. It was such a great neighborly moment and reminded me of being a kid, when my mom would send me to the neighbor's house for a cup of flour because we'd run out. And it was great to just get exactly what I needed rather than spending money on a full roll at the store.

Beyond that, I was able to pick up items like a perfectly good yoga mat, which had been on my list for a while, lights for my room, and Nespresso pods (which are expensive!!). I didn't end up posting an ISO ("in search of"), but that also would've been a great idea for this month if I had ended up needing something specific. I'd definitely recommend finding some sort of "buy nothing" or "free/trade" group on Facebook if you live in any major city, or even in a suburb. It's a great way to meet neighbors, reduce waste, and save money.

3.There's nothing wrong with things you find on the street!* Also, there are a ton of Instagram accounts and Facebook groups dedicated to items found on the street if you live in a major city.

I found a bed frame on the street, which was amazing because I had been looking for a simple black bed frame that I could store extra clothes and linens under (I previously had the IKEA Malm bed, but could only fit one drawer with the way my bed is positioned). And I found one literally only a few blocks away! If you live in a major city like New York, Buy Nothing groups often post photos of items on the curb, and there are also usually a ton of Instagram accounts dedicated to "stooping" — aka, seeing perfectly good stuff out on the stoop. I actually got my coffee table this way as well, though that was last month — and when I looked it up online, it was $150!!! Definitely keep an eye out at the end of each month and peak moving times. Back when I went to UCLA, people would leave entire apartments of furniture on the street by the college apartments, though the quality wasn't always great. But in New York, the items are often extremely nice, or at least functional, if in need of a bit of a spruce-up.

*I would never take a mattress, rug, or couch off the street — except, fine, that one time I allowed my roommate to bring a recliner home because she literally saw the people take it out to the stoop — because of bedbugs and flea concerns. We can't have a repeat of the 2018 rug from hell — but that's a story for another post.

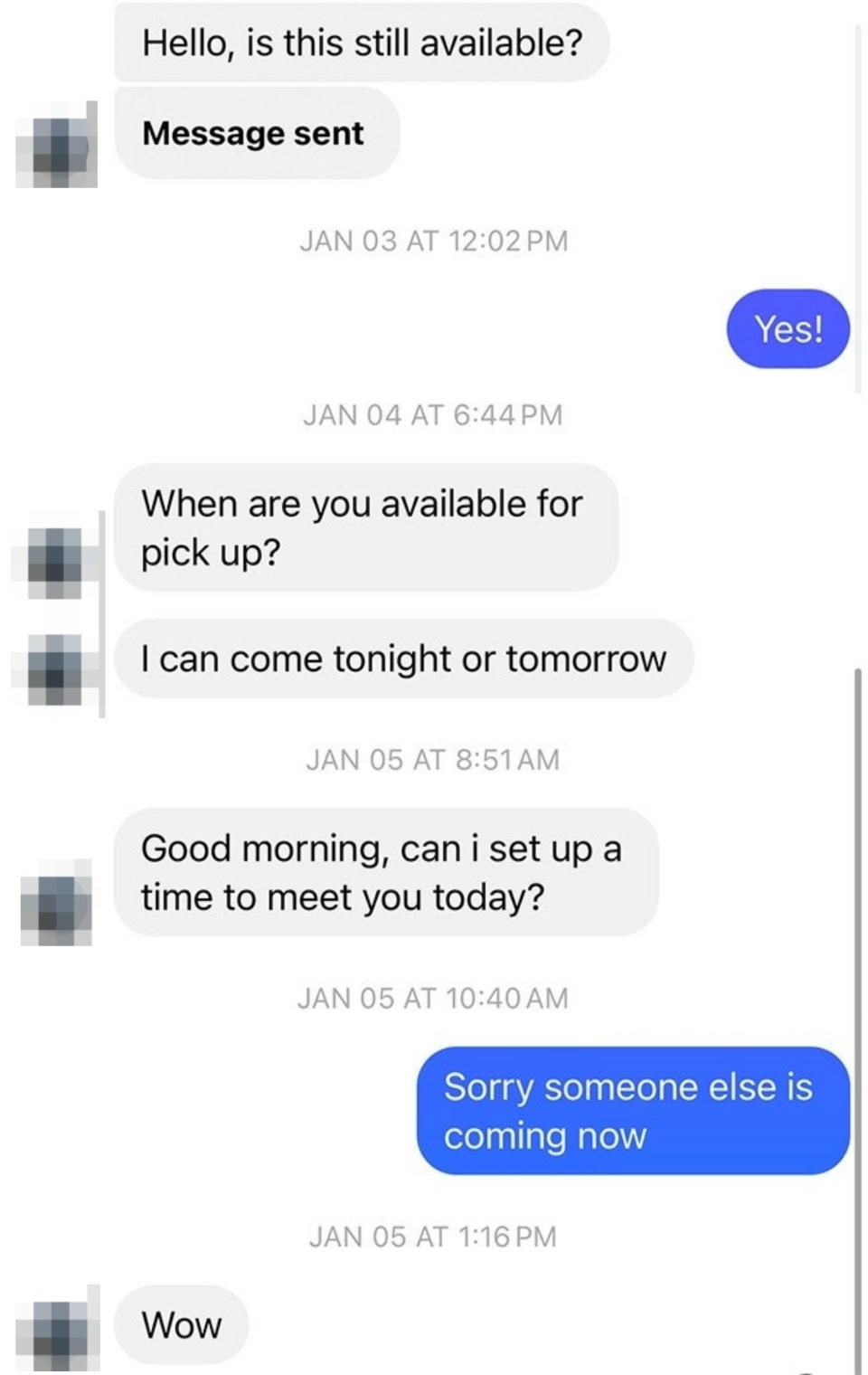

4.Facebook Marketplace is also a good place to find free items — and to make money selling things. Though compared to the above options, I'd rank it last, as it's a major pain in the butt, and people can be pretty entitled. For example, in selling my old bed, I was flooded with messages, many simply asking if it was available or asking questions that were already answered in the description. The below interaction just made me laugh.

It's the "I'm not angry, I'm just disappointed" energy for me (especially since they took over a day to respond to my message). I replied "yes" to all the messages asking if it was available, and then sold it to the first person who actually set up a time to pick it up. I guess I could've alerted every person who had asked if it was available that it wasn't anymore, but so many of them didn't even reply to my "yes" anyways, and I feel like that's the equivalent of calling up everyone who even looked at an item at a store to tell them it's sold.

I didn't pick up any free items from Facebook Marketplace this month, but I did "save" a ton of cheap items. Some of them were gone when February started, but a bunch of them are not only still available, but also marked down!

5.Impulse buying is a thing, even when it comes to functional items or "necessities." If I identify that I *need* something — for example, I "needed" plastic storage bins for under my bed — I usually just buy it right away from Amazon. This month, I couldn't do that, and I ended up being able to repurpose items I already had in my apartment for a solution I ended up liking even better.

Basically, there's a lot that I didn't actually *need* — and even out of the things I did "need," I could often fulfill those from Buy Nothing, curbed items, and my own apartment. Ordering the item from Amazon should be a last resort, and mulled over for at least a week to see if I really "need" it. Yes, this all sounds obvious, but I think it often gets forgotten in a culture where you can order something with a couple of taps and get it the next day.

I'd recommend keeping a running list of things you "need" to buy, and then checking the next month to see if you really need it. I'm not even talking about stuff like clothes or things that are obviously not needed, but even practical things like, in this case, storage bins.

6.The library is a beautiful, magical thing, and strongly aided me in my book-buying addiction. In fact, I read more books this month — 12 — than I've ever read in a month before, and I didn't buy a single book. I have a New York Public Library card, which I use via the free Libby app to check out e-books straight to my phone.

If you have a ton of books that you own but still haven't read, like I do, a no-buy month was perfect, because I was actually encouraged to read these books. But overall, my massive uptick in reading came from the Libby app. I still prefer reading hard copies, but there's just something about the convenience of an entire (free!!!) library in the palm of your hand on the subway or as you're going to bed that is just unmatched. I also forced myself to start listening to audiobooks (which I normally don't like), and this was a great way to push myself to do so without investing in any kind of subscription service. (I ended up discovering I don't mind audiobooks if they're memoirs!)

Also, having a New York library card and the Libby app opened up other opportunities for me, as well. While some of them I couldn't partake in (like discounts, since I'm not supposed to spend money at all), other ones were super cool. For example, I have free access to Mango, a language-learning app, which I can use to prepare for my upcoming trip to France.

Moving forward, I'm probably not going to stop buying books, but I do think I'll implement some sort of system where I have to have read a certain percentage of books I already own before I buy more. Along with using the Libby app, this should massively curtail book spending.

7.The absolute hardest part of this month was the isolation, because as I learned, it's extremely expensive to have a social life.

This challenge would've been a LOT easier if it was warmer outside. I love to go on walks and go to parks, and New York actually does have a lot of free outdoor activities in the summer! But it was SO COLD this month; I didn't much want to leave the house. And I didn't have much reason to. I couldn't go to a restaurant or bar, or board game cafe, or off-Broadway show, or even a movie. I was incredibly bored this month (hence why I read 12 books), and when I asked my roommate why I was being so strange around people one of the few times I was around them at a social event, she reminded me I'd had little social interaction in the past week (I work from home and my job is largely independent).

I blame a lot of this on New York. Apartments here are small, and social life is mostly limited to outside of your home. And there are just so few free places to meet up with friends, especially non-outdoor ones. But as I don't plan on moving anytime soon, this is one aspect of No-Spend January that I will absolutely never be doing again. Ultimately, I realized it's always worth it to spend money on activities and experiences with friends (obviously within reason). This isn't an area of my life where I can eliminate (or massively decrease) spending, though moving forward, I want to focus on finding ways to make it cheaper.

8.Another huge struggle this month? Most hobbies are also extremely expensive, leaving me with little to do when I was at home by myself besides reading, writing, and watching TV. However, I did try to do some creative things.

I picked up a bunch of hobbies from quarantine I'd abandoned while I was lonely and at home, including hand-knitting (luckily I already had some yarn) and drawing on my iPad. I really enjoyed both of these! But as I was getting passionate about artistic and creative projects again, I really wanted to get even more involved. I wanted to take classes and meet others I could do projects with, and I wanted to learn more about the activities themselves and how to do them. AKA, I needed to find a class — and I did not find any free in-person classes in January, though I am sure some exist.

There were also solo hobbies I really wanted to try out that required an initial investment (even knitting quickly had to stop due to a lack of yarn). I've always wanted to try working with resin, or beading, but those obviously required money to buy supplies for (turns out you also need ventilation and a gas mask if you're working with resin).

While not being able to take classes or invest in supplies made me sad, it did keep me from spending money on something I would bore of in a week. And more importantly, the lack of time spent at restaurants, bars, and concerts/musicals/comedy shows (my usual social activities) made me realize how much I really wanted to widen those social and creative horizons. While this is a realization that will actually lead to me spending more money, I still think it's an important one to make, and actually one that's similar to the realizations of my friends who went through Dry January — aka, wanting to get more creative with the ways we spend our time than just going to restaurants and bars.

9.One unexpected benefit of the month was that it was much easier to get an idea of how much I specifically spent on these "essential" categories when I took away everything else. And reader — turns out I spend WAY too much on groceries. Like, I don't even want to tell you the number. This is one of my biggest takeaways of the month, actually: as I'm never going to be able to go *without* groceries, I need to find a way to basically halve what I'm spending on them. Here are some problems I identified:

—I buy a ton at once and inevitably, something ends up going bad. I could solve this by shopping more often, even if it's a pain.

—I spend a lot on high-quality snacks like almonds, good quality all-natural peanut butter, dark chocolate, and cheese. This is something I'm probably not going to change, TBH.

—The gourmet market downstairs is going to be the death of me. I love their pre-made soups and oftentimes it's just so much quicker and easier to go there than to another grocery store. I think I'm going to have to limit it to maybe a couple of times a month, though.

—I spend an exorbitant amount on oat milk, coffee, and La Croix. Especially coffee. Nespresso pods are expensive, and due to their patent, there aren't even generic options, though I am going to see if there are reusable options.

—I tend to spend more on packaged, pre-cooked meat rather than raw meat because I don't like cooking raw meat or cleaning anything that has touched raw meat. I basically just need to suck this one up.

—I never plan much what I'm buying in advance, mostly because I look for what's available, and this definitely leads to impulse buying — so in the future, I should plan better.

—I'm not making use of coupons, or going farther to a different store to spend less. I'm considering going to the Dollar Tree, even though it's far, for some items.

—I use grocery delivery services a lot, because I have this rule where I only can use one if they have a coupon code that makes it as cheap as buying in-store. HOWEVER, I'm not checking this price against other stores. What I'm doing is making sure whatever percent or cash value I have off, it's equal to or higher than the delivery and extra fees I'm paying. But I'm beginning to suspect it's still more expensive than just going to the store, because the items themselves can be more expensive.

10.With everything else stripped away, I was also able to take a look at subscriptions I have that I pay monthly, as well as my utilities and that was super helpful.

Our utilities have gone WAY up since we first moved here, and while some utilities are inevitable (don't even get me started on the wild cost of heat in our apartment, even after I let my fingers turn white — I have Raynaud's — every day), others can probably get reduced by threatening to switch (I HATE this stuff, but it's worth doing — these expenses add up).

Also, I don't *need* every subscription (there are ones I even forgot I had), and there are ones my roommate and I can share. Mainly — why do I keep getting Billie razorheads delivered when I already have so many and I rarely even shave my legs in the winter??? These were only the ones I could FIND, too — I bet I have even more lying around. Buy Nothing, here I come.

11.Finally, I learned what I didn't miss spending money on, and what wasn't really a problem in the first place.

I realized I actually am more frugal than I realize when it comes to things like clothes and makeup. While these things feel like big expenses because they are individually expensive, I really rarely shop unless it's with credit at a secondhand store or for something I've run out of or really need. Yes, my makeup is expensive, but I wear it rarely enough that I'm not running out all that often. I also tend to buy large sizes, especially for shampoo and conditioner, which always hurts to spend the money on but does help me save long-term. This was a rare nice realization in a month where I was otherwise having to take a good hard look in the mirror about my spending.

Based on everything I learned, here are the goals I set for February — and not all of them were money-saving measures!

— Focus on curtailing my grocery spending, because as it turns out, it's consistently my biggest expense besides rent and restaurants/bars.

— Find hobbies and classes that increase my social time and creative horizons and reduce my time and money spent on restaurants and bars.

—I have a major instant gratification problem, and I should not buy things on a whim, like pizza on a night out, cute decor items, books, records, etc.

—There are consistent purchases I make, such as coffee, seltzer, and kitty litter, that really add up, and I could probably save a lot if I found a cheaper alternative, or invested in something (like a seltzer-maker) that reduces or eliminates my need to purchase things as often.

—Relatedly, since there is so much I inevitably spend money on — being a New Yorker, coffee/seltzer addict, a cat mom, and a Broadway fan — the new goal may have to be how to make my money work for me. AKA, getting points back on purchases and otherwise utilizing any discount or cashback system I can.

Now, you're probably wondering...did I actually complete No-Spend January? Well...unfortunately, no. I did break a lot of rules. I never pretended to be perfect!

Here's what I broke my rules for:

—Buying a birthday gift for my SIL and one of my best friends

—Purchasing wine for three separate dinner parties (I'm not gonna show up empty-handed!)

— Buying a flight to Miami to visit family

—Buying McDonald's, Dunkin, and Shake Shack on a long pre-planned road trip

—I had some money left over in Venmo, which I used for a ticket to the Mean Girls movie. But I didn't buy popcorn!!!

—And finally, I ended up using the cash I'd made from selling my bed to go to my roommate's bar trivia that she was running.

At the end of the day, while it wasn't easy, this was definitely a valuable experience that helped me learn some smart saving habits. All told, even with my few cheats, I was able to save $1,600, which is amazing and a great start on my New Year's resolutions!

Now I'm curious — have you ever tried a No-Buy month or year? Let me know in the comments!