‘Tremendous Outcome’: Yellow Gets Court Nod to Sell 130 Assets

A federal bankruptcy judge approved the sale of 130 of Yellow Corp.’s terminals Tuesday, a week after rival trucking players scooped up the service centers in a long-awaited bankruptcy auction.

But the auction process, which divested the terminals for a combined $1.88 billion, isn’t over. Yellow is still seeking buyers for its remaining 46 owned and 147 leased terminals.

More from Sourcing Journal

“Preliminarily based on what’s represented, this is obviously a tremendous outcome,” said Judge Craig Goldblatt during the Tuesday hearing. No one objected to the sale.

With the approval, the bankruptcy court has suspended the auction for the leased terminals until Dec. 18, when companies can resume bidding on the remaining 147 assets. The auction for the owned terminals is ongoing.

A court hearing on the leased properties sale is scheduled for Jan. 12.

The winning bids generated enough cash to pay off Yellow’s roughly $1.22 billion in pre-bankruptcy debt due next year, including $700 million owed on a controversial U.S. Treasury Department Paycheck Protection Program (PPP) loan.

Less-than-truckload (LTL) freight and logistics company XPO was the big winner in the deal, scoring 28 terminals for $870 million, adding to the 294 it already operates in the U.S. for 322 total. The deal includes sites in major urban areas including Brooklyn, N.Y.; Nashville, Tenn.; Atlanta; Houston; and Las Vegas.

According to Jason Miller, interim chairperson, department of supply chain management at Michigan State University’s Eli Broad College of Business, the deal doesn’t expand XPO’s market coverage but largely “represents a reallocation of establishments across firms.”

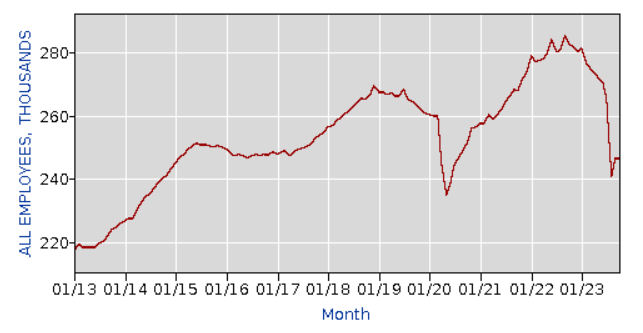

Miller told Sourcing Journal that he did not see many long-term ramifications on the trucking industry even as terminal ownership shifts to different LTL trucking firms. But he noted that industrywide employment has yet to claw back their pre-Yellow bankruptcy levels.

“Data from the Bureau of Labor Statistics shows LTL employment is showing no signs of recovering yet from Yellow’s demise, and has fallen back to where is was in late 2014 (and is a bit below the 2016 freight recession levels). I’m not sure the extent these carriers plan to rapidly add workers to these establishments, so we could see some rebound in the coming months.”

Estes Express Lines—which placed the final stalking-horse bid for all of Yellow’s terminals at $1.525 billion in September ahead of the auction—won 24 terminals for $248.7 million. Saia took on 17 properties for $235.7 million, while Knight-Swift won the rights to own 13 terminals with $51.3 million price tag.

Old Dominion was notably absent from the winners despite upping the ante with its own $1.5 billion stalking-horse bid on the terminals in August. FedEx Freight did not bid.

Miller noted that for shippers, the shakeout hasn’t impacted trucking freight rates so far, but that could change as LTLs including FedEx Freight, Old Dominion, ArcBest, Saia announced their 2024 general rate increases (GRIs).

“LTL prices are neutral year-over-year and up 26 percent from before Covid-19,” Miller said, citing BLS data. “I don’t expect to see prices declining as we move into 2024 given the announced GRIs.”

In total, 21 players purchased the Yellow properties at values that far exceed a prior combined appraised value of $1.1 billion. The transactions are expected to close by Feb. 6, with the allowance of a one-time 30-day extension.

More than 400 interested parties completed nondisclosure agreements in the auction process, with 70 qualified bidders participating in the auction that began Nov. 28.

Yellow also has yet to auction off its rolling stock of approximately 11,700 tractors and 34,800 trailers. The court previously approved the sale of the trucks through auction houses, but hasn’t set a date for the auction.

The bankrupt trucking company opted to break up its assets rather than keeping the firm intact for a single buyer, dashing the hopes of U.S. senators urging Yellow to save the 30,000 jobs lost in its insolvency.

The senators backed a late bid led by Sarah Riggs Amico, executive chair of auto hauler Jack Cooper Transport, which wanted to revive the full company and its Teamsters-represented employees under the entity Next Century Logistics.

In a letter to Next Century Logistics, Yellow’s lawyers contended that the bid was “not viable,” according to the New York Times. This mirrored the point of view of many industry experts skeptical of such a deal, who said shippers were unlikely to bring their freight back to a reconstituted Yellow.

Amico and co. are still in the mix for parts of Yellow, reportedly placing a second bid Thursday ahead of the approval on the remaining unsold terminals and rolling stock. According to a Reuters report, Amico wants to rehire 12,000 to 15,000 of the workers who lost their jobs when Yellow shut down.