Target Is Now Carding People to Buy Zero-Proof Drinks — What Does That Say About the Future of Nonalcoholic Retail?

Growing pains are to be expected as the nonalcoholic category graduates from specialty retail into big box stores.

Target / Sechey

It’s hard to find a stronger indication that nonalcoholic drinks have transcended from trend into the mainstream than permanent real estate at Target.

On Thursday, the Minneapolis-based big box retailer announced that it will be carrying a selection of booze-free beverages curated by Sèchey, a nonalcoholic beverage retailer headquartered in Charleston that also happens to produce zero-proof still and sparkling wines.

“The biggest piece of feedback we historically have received as to why someone may not be drinking De Soi, or a specialty nonalcoholic beverage in general, is availability,” says De Soi CEO Scout Brisson, whose nonalcoholic botanical spritzes are now available at Target locations nationwide. “[Target] has created a destination in stores that's meeting consumer demands. This creates more education in the space, resulting in a positive feedback loop and allowing the category to experience even more growth.”

But as national retailers and grocers start to take the nonalcoholic category seriously by investing precious shelf space, who gets left behind?

The first big casualty seems to be Boisson, a nonalcoholic specialty retailer with brick-and-mortar locations in Miami, San Francisco, and New York that ceased all retail operations just last week — looking to restructure its e-commerce and wholesale businesses.

Related: The 12 Best Nonalcoholic Spirits, According to Bartenders

“I am proud that we served more than 250,000 customers, of the deep and meaningful wholesale partners who embraced NA for their customers, and proud of the awareness and education we brought to consumers, introducing them to NA through partnerships we forged with brands and communities,” wrote Boisson founder and president Nick Bodkins in a LinkedIn post on Friday. “I am proud…of the awareness and education we brought to consumers, introducing them to NA through partnerships we forged with brands and communities.”

Andrea Hernandez, founder of Snaxshot, a community that focuses on innovation in the food and beverage industry, says that NA bottle shops like Boisson were instrumental in helping cement and lend validation to the category, to the point that it was able to grow out of niche retail into mainstream grocers like Target, Sprouts, and Walmart.

Related: Are Children Allowed to Drink Nonalcoholic Beer? It's Kind of Complicated

“The future of NA is actually alongside booze,” she says. “Why go to a specific niche store when you can grab your NA alongside everything else you have on your grocery list?”

Walmart, too, is carving out more shelf space for the nonalcoholic category. Earlier this week, it added Wine0’s sparkling rosé to its selection of zero-proof beverages, which already includes offerings from brands like Ritual, Freixenet, and Seedlip.

“Walmart plans to create a destination set for nonalcoholic drinks including beer, wine, and spirits, all merchandised together,” says Philip Brandes, founder of Wine0 and Bravus Brewing Company, a nonalcoholic craft distillery based in Anaheim, California. “I've seen this model work before, allowing customers to easily find and navigate the non-alc category in one section, versus hunting for products in their respective alcoholic sections spread across the store.”

Related: 17 Nonalcoholic Cocktails for Your Next Holiday Party

Brandes adds that by increasing their selection of alcohol-free wines retailers like Walmart are catering to a consumer that has “too often been ignored by winemakers and nonalcoholic producers,” especially as the wine industry is struggling to attract younger drinkers.

Whose nonalcoholic drink is it, anyway?

While partnering with Target is sure to become a massive driver of sales for Sèchey, CEO and founder Emily Heintz says she intends to continue operating her Charleston shop and sees customer education as the core purpose for maintaining a specialty retail space dedicated to nonalcoholic beverages.

“There is a need for education, and sometimes you need a smaller, dedicated environment for the consumer,” she says. “I do think there’s room for both [big box and specialty retail].”

She likens Sèchey to a small bottle shop, where customers can talk with a sommelier about what to buy and how to pair it with food, for example.

Related: How Did the Negroni Become the Most Popular Nonalcoholic Cocktail?

But while customers can now easily find nonalcoholic wine, beer, spritzes, and cocktails in the adult beverage aisle at nearly 700 Target locations nationwide, they might be surprised to find they’ll need to provide identification and proof of age at check-out.

At Sèchey’s brick-and-mortar shop, no identification is required to purchase nonalcoholic drinks. Similarly, customers can purchase any of the products in the Sèchey and Target collaboration online directly from the brands themselves, without needing to provide ID.

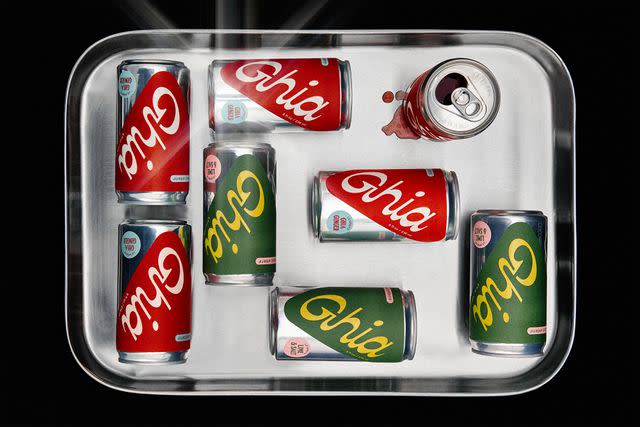

Ghia

Ghia's nonalcoholic spritz assortment, featuring lime and salt and ginger spritzes.A Target spokesperson responded to an inquiry about product placement, stating that the flavor profiles of nonalcohol products align more closely with full-alcohol items and are designed for experiences similar to, and also during, traditional full-alcohol occasions.

“Target faces the dilemma of distinguishing which of the nonalcoholic drinks on its shelves must be sold to 21+ and which can be sold to anyone. It's not an impossible problem, but there's a considerable degree of liability that follows even a single violation,” explains Nicholas Bradley, a business attorney based in New York City. “From the perspective of a big retail chain with multiple locations and hundreds of employees in New York City alone, the safest move is to be over-inclusive and to require ID for all ‘nonalcoholic’ beverages, even if that specific brand genuinely has no alcohol.”

Related: Why I'm So Into the Nonalcoholic Tea Cocktails at This New York City Korean Spot

While pulling out an ID to buy a four-pack of Ghia’s ginger spritzes is, for most of us, a minor and somewhat unexpected inconvenience, Target’s stance on who nonalcoholic beverages are for — and the intent with which they are typically purchased — reinforces a growing consensus that’s backed by data. In fact, Ghia founder Melanie Masarin says that 90% of her customers are alcohol drinkers seeking moderation.

“The [ID requirement] is not exclusive to Target, but an industry-wide challenge we are working together to overcome,” says Kin Euphorics founder and CEO Jen Batchelor. . “Kin ran into a similar issue when we launched at Sprouts but have since worked with our internal champions there to have this policy reviewed and solved for in a way that keeps them in compliance.”

Kin Euphorics

Batchelor adds that she’s happy to have Kin sit in the alcoholic beverage aisle for the time being — getting to attend the party is better than no invitation at all, after all — but sees customer pressure as one of the most powerful forces in moving products like hers to a dedicated space that doesn’t trigger pesky (and often unexpected) identification requirements for customers who aren’t imbibing.

“As we've seen firsthand, the right amount of customer pressure can drive a retailer to increase focus internally to change the POS categorization of their NA offerings so that their systems don't require cashiers to card,” Batchelor says. “In one case with a cherished Kin retailer, ‘customer pressure’ came in the form of nearly 20% of our stock being stolen by local high schoolers on a month-by-month basis, forcing the end of age-gating for all [nonalcoholic products] in the set!”

For more Food & Wine news, make sure to sign up for our newsletter!

Read the original article on Food & Wine.